The following is an overview of the 4th Quarter (October to December) FY12/2017.

For more details please refer to the following.

Results presentation materials (here)

(IR) Masatoshi Kumagai talks about GMO Internet Group Strategy

(IR) GMO Internet Group Strategy 2017 Q1 Summary (here)

(IR) GMO Internet Group Strategy 2017 Q2 Summary (here)

(IR) GMO Internet Group Strategy 2017 Q3 Summary (here )

=============================================

■Financial Overview

=============================================

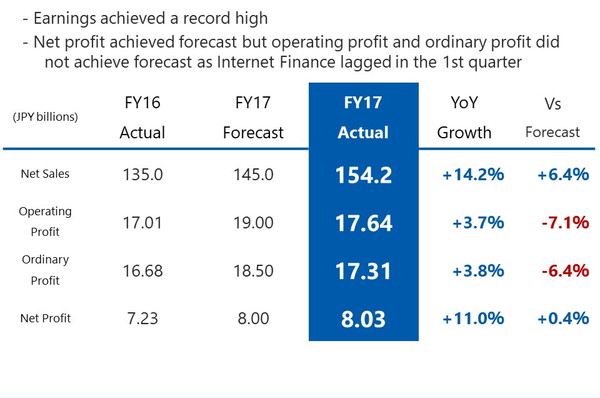

- Executive Summary: FY2017

- Earnings achieved a record high, and operating profit and ordinary profit did not achieve the forecasts as Internet Finance lagged in the 1st quarter, but net profit achieved the forecast of 8 billion yen.

【Financial Results for FY2017】

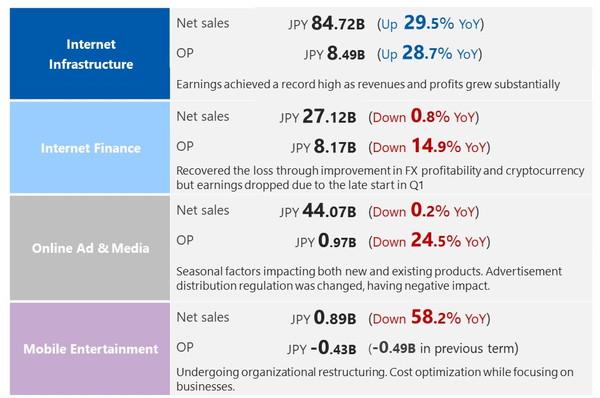

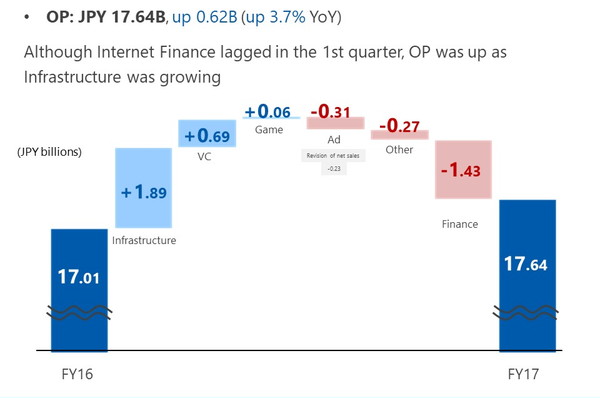

- This is an executive summary of operating profit covering January to December for each segment. Looking at each segment, while Infrastructure grew, profit decreased in Internet Finance due to the volatile market last year, so the consolidated operating profit increased by only 600 million yen year-on-year.

【Financial results (January-December) – analysis of operating profit】

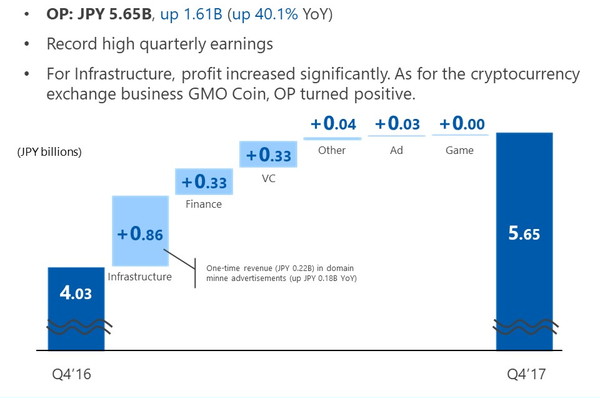

- This is an executive summary of operating profit covering January to December for each segment. Quarterly operating profit achieved a record high of 5.65 billion yen as Infrastructure saw record high earnings and the cryptocurrency exchange business GMO Coin achieved positive figures.

【Executive Summary: Q4 FY2017 (October-December)】

Next is the summary of each segment.

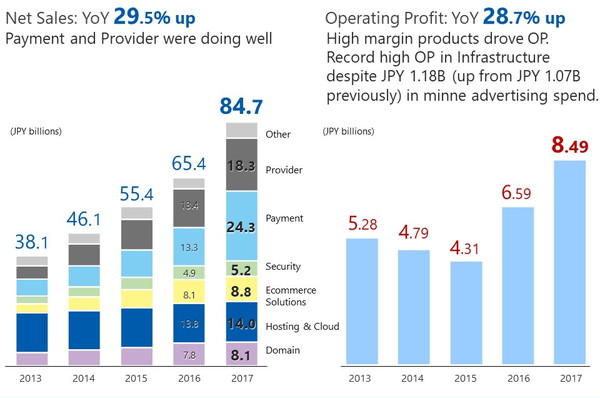

- Internet Infrastructure saw very steady growth as profit was up almost 30% year-on-year.

- Internet Finance on the other hand saw profit decrease by 15% from last year. Internet Finance recovered from its late start in Q1 through improvements in FX profitability and the expansion of the cryptocurrency exchange business. However, profit decreased due to the volatile market last year.

- In Online Advertising and Media, profit decreased by 25% and seasonal factors impacted both new and existing products. New ad technology products grew, but profit was down due to weak existing Media products and the change in ad network advertisement distribution regulations.

- In Mobile Entertainment, both revenue and profit decreased. We have completed organizational restructuring and are now able to focus on the business.

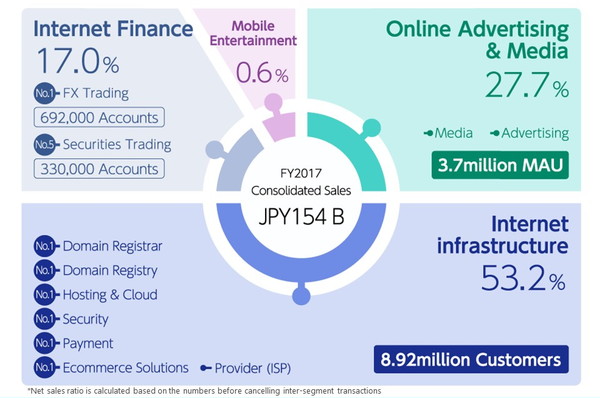

This diagram shows GMO Internet’s four segments. The segment sizes are based on the net sales ratio, which between Infrastructure, Media and Finance is approximately 5:3:2. Our customer base is expanding across all segments with growth in Infrastructure contracts and customer accounts in FX and Securities.

=============================================

■Internet Infrastructure

=============================================

【Internet Infrastructure – results trends】

============================================

============================================

■Internet Finance* segment.

=============================================

*Segment name changed from Internet Securities to Internet Finance in Q1 FY2017.

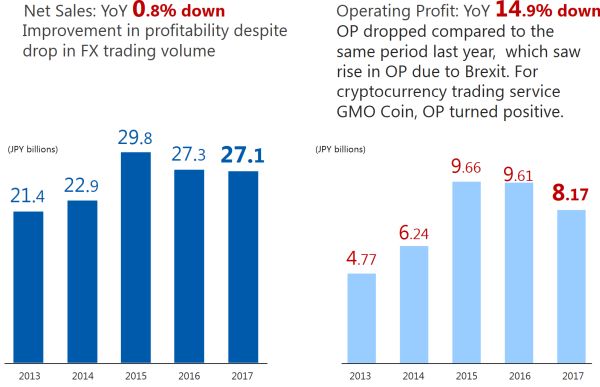

- Next two graphs show the transition of Internet Finance’s net sales and operating profit for the past five years.

- In 2017, the lack of market volatility compared to 2015 and 2016 led to a decrease in profit. Profitability declined temporarily in Q1 but recovered through an analysis of big-data, as shown on this slide. We launched our cryptocurrency exchange business GMO Coin in Q2, which achieved positive figures in Q4. Cryptocurrency is a business that could grow substantially as the market matures. Although profit still changes due to price fluctuations, we’ll apply our knowledge of FX to build up this new pillar of business.

【Internet Finance – results trends】

=============================================

■Online Advertising & Media segment.

=============================================

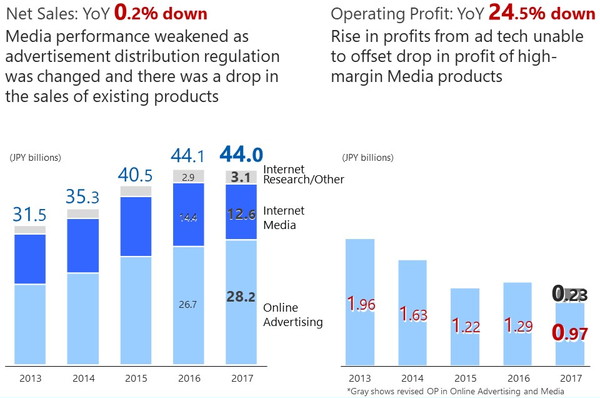

- The next two graphs show the growth of Online Advertising and Media’s net sales and operating profit over the past five years. Net sales and operating profit decreased by 0.2% and 24.5% year-on-year, respectively. Our in-house ad tech products grew, but the scale is still small, so they were unable to offset the drop in the sales of existing products in Online Media. Changes in ad network advertisement distribution regulations resulted in decreased revenue.

【Online Advertising & Media – results trends】

============================================

■Mobile entertainment segment and other businesses.

=============================================

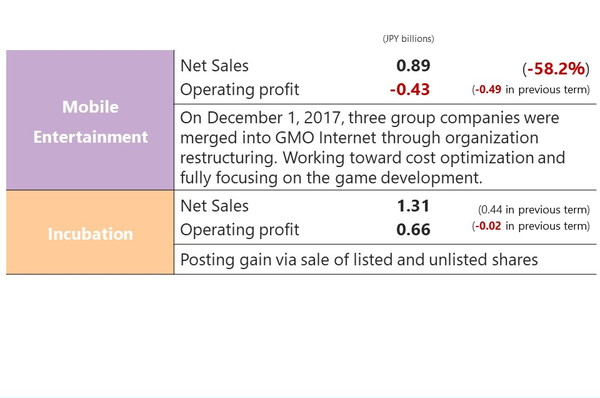

- Group companies at the core of the Mobile Entertainment segment were consolidated through organizational restructuring. The purpose is further cost optimization and to focus more on game development.

- In our incubation business, we posted a gain via sales of listed shares that went public in 2016.

【Mobile entertainment and other businesses – performance by quarter】

Please refer to “Masatoshi Kumagai talks about the GMO Internet Group strategy” for the 2017 Overview of the group’s current position and an outline of our strategy going forward, particularly for cryptocurrency and Internet banking businesses and other major themes.

We appreciate your ongoing support of the GMO Internet Group.

Internet for Everyone

Results presentation materials (here)

(IR) Masatoshi Kumagai talks about GMO Internet Group Strategy

(IR) GMO Internet Group Strategy 2017 Q1 Summary (here)

(IR) GMO Internet Group Strategy 2017 Q2 Summary (here)

(IR) GMO Internet Group Strategy 2017 Q3 Summary (here )