The following is an overview of the 1st Quarter (January to March) FY12/2018.

For more details please refer to the following.

Results presentation materials (here)

(IR) Masatoshi Kumagai talks about GMO Internet Group Strategy

=============================================

■Financial Overview

=============================================

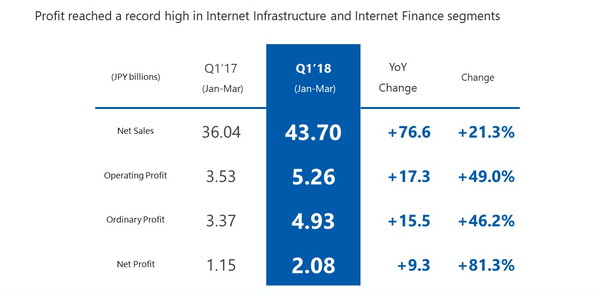

- Financial summary for Q1 (January-March) of 2018.

- Infrastructure saw record high earnings and the Internet Finance segment is doing well, making for a good start.

【Executive Summary: Q1 FY2018 (January-March)】

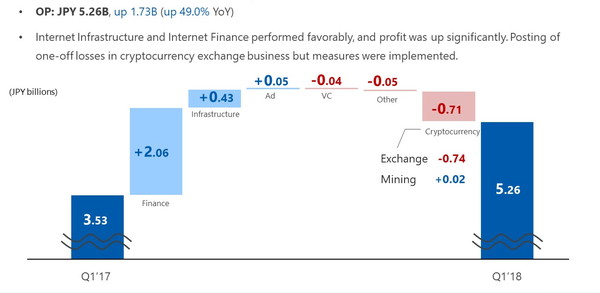

- This is an executive summary of operating profit covering January to March. Operating profit increased by 1.73 billion yen to 5.26 billion yen compared to this time last year. Looking at each segment, Internet Infrastructure saw steady growth in each business area and profit increased by 430 million yen. Of particular notice is the 2.06 billion yen increase in profit in the Internet Finance segment due to improvement in profitability.

- However, profit in the Cryptocurrency segment decreased by 710 million yen year-on-year. Profit in the cryptocurrency exchange business decreased by 740 million yen due to one-off loss on valuation of proprietary position as we were unable to respond to the rapid market fluctuations, though the profit in the cryptocurrency mining business was 20 million yen, achieving positive figures. However, we implemented measures to control our position, and the figures turned positive in March.

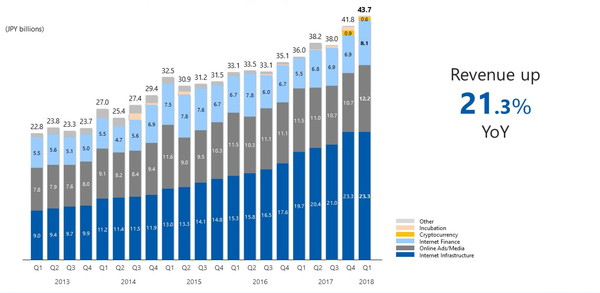

- Shown here are each segment’s revenue trends by quarter over the past 5 years. Revenue in Infrastructure exceeded 40 billion yen. Revenue in Infrastructure drove the Group’s net sales, which doubled over the past 5 years.

【Net sales by segment】

=============================================

■Internet Infrastructure

=============================================

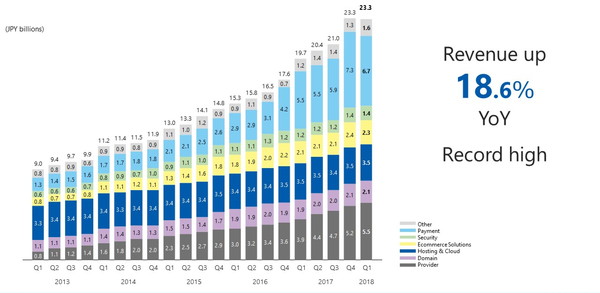

- This is net sales in Internet Infrastructure and its breakdown. Recurring revenue continues to see an upward trend, and the net sales increased 2.5-fold over the past 5 years. Revenue in provider services was 5.5 billion yen, and is again growing into core-products.

【Internet Infrastructure – net sales by sub-segment】

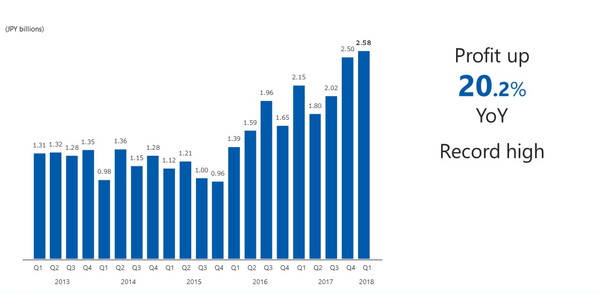

- Shown here are Internet Infrastructure segment’s profit trends by quarter over the past 5 years. High-margin products such as payment and SSL performed favorably, and operating profit achieved a record high.

【Internet Infrastructure – operating profit】

=============================================

■Online Advertising & Media segment.

=============================================

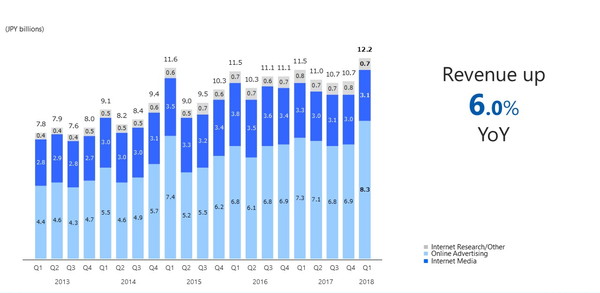

- This is net sales in Online Advertising and Media and its breakdown. Net sales reached a record high. For Online Advertising shown in light blue at the bottom, our in-house ad technology products and the ad agency have performed favorably, resulting in two-digit growth in their net sales. As for Media shown in dark blue, changes in ad network advertisement distribution regulations resulted in YoY losses.

【Online Advertising & Media – net sales】

- Shown here are Online Advertising and Media segment’s profit trends by quarter over the past 5 years. While operating profit increased year-on-year, we are struggling to improve the profitability. We will continue to strengthen our in-house products.

【Online Advertising & Media – operating profit】

============================================

■Internet Finance segment.

=============================================

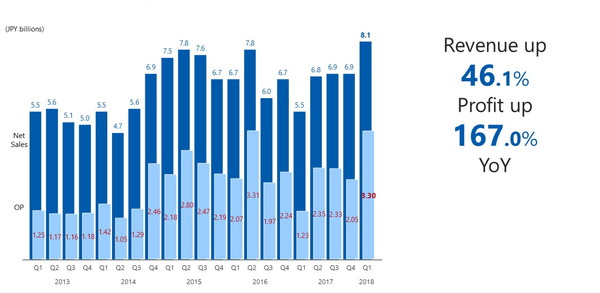

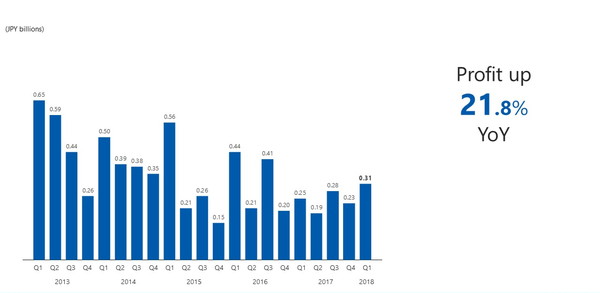

- This slide shows performance trends by quarter. Earnings declined temporarily in Q1 last year but increased steadily through an analysis of big-data, and both revenue and profit were up in Q1 of this year, as shown on this slide.

【Internet Finance – results trends】

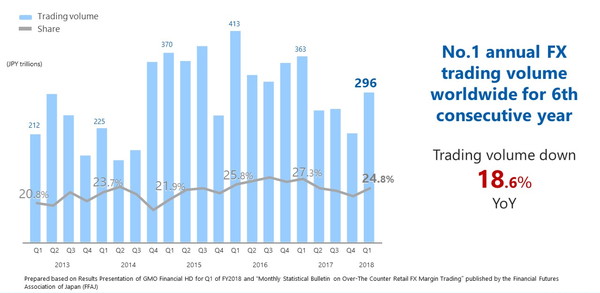

- Shown here are FX trading volume trends by quarter. We’ve achieved the highest trading volume globally for six consecutive years. We were losing share to other competitors temporarily but it recovered and is now growing again.

=============================================

■Cryptocurrency segment.

=============================================

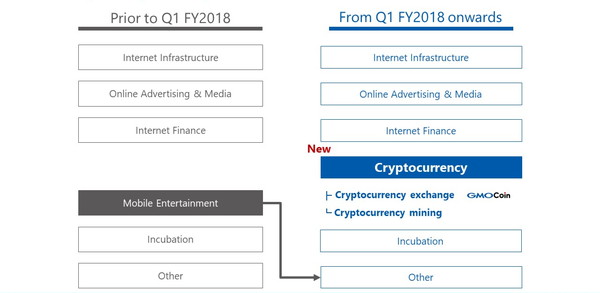

- We added Cryptocurrency segment as a new segment. Cryptocurrency segment has two sub-segments. One is cryptocurrency exchange business, which offers services under the GMO Coin. The other is cryptocurrency mining business, which offers services under GMO Internet and the group company in Europe.

====================================================

■Cryptocurrency segment | Cryptocurrency exchange business

====================================================

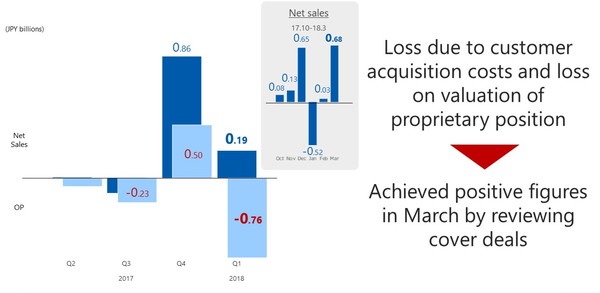

- GMO Coin, which is a consolidated subsidiary of GMO Financial Holdings, is at the core of this subsegment. Revenue and profit were affected by Bitcoin price fluctuations and dropped compared to the previous quarter but are now recovering.

- We posted a valuation loss due to a selloff in January but recovered through various strategies, such as the management of proprietary position and optimization of cover deals. This business achieved positive figures in March, and the revenue is growing.

【Cryptocurrency exchange – result trends】

==================================================

■Cryptocurrency segment | Cryptocurrency mining business

==================================================

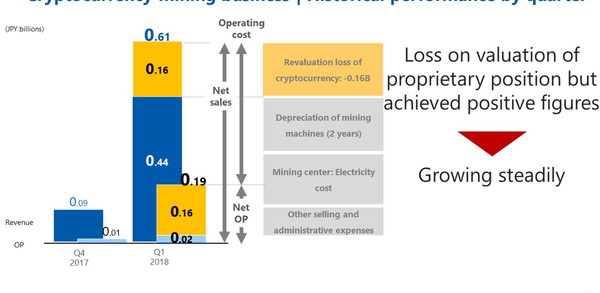

- GMO Internet has launched on December 20, 2017, a cryptocurrency mining business, which has made a good start and achieved positive figures in just 10 days.

- We are establishing more mining facilities and have obtained a favorable outcome. Initially we still held a position in cryptocurrencies which was sold off before accounting standards had been established. We deducted 160 million yen loss on valuation of our Bitcoin inventory from revenue and profit as the cryptocurrency price has declined since the beginning of the year, so net sales and net profit were 600 million yen and 190 million yen respectively.

- The cost is made up of mainly electricity cost and the depreciation of mining machines as shown on this slide. I have previously founded many businesses. As explained in advance, we are running a profitable business, and making for a good start.

【Cryptocurrency mining – result trends】

Please refer to “Masatoshi Kumagai talks about the GMO Internet Group strategy” for the 2017 Overview of the group’s current position and an outline of our strategy going forward, particularly for cryptocurrency and Internet banking businesses and other major themes.

We appreciate your ongoing support of the GMO Internet Group.

Internet for Everyone

Results presentation materials (here)

(IR) Masatoshi Kumagai talks about GMO Internet Group Strategy