We have announced the 4th quarter financial results for the year ended December 31, 2018.

Results presentation materials (here)

(IR) Masatoshi Kumagai talks about GMO Internet Group Strategy (here)

(IR) GMO Internet Group Strategy 2018 Q1 Summary (here)

(IR) GMO Internet Group Strategy 2018 Q2 Summary (here)

(IR) GMO Internet Group Strategy 2018 Q3 Summary (here)

Older business results (here)

=========================================

■Financial Overview

=========================================

This is a highlight of the full year in 2018.

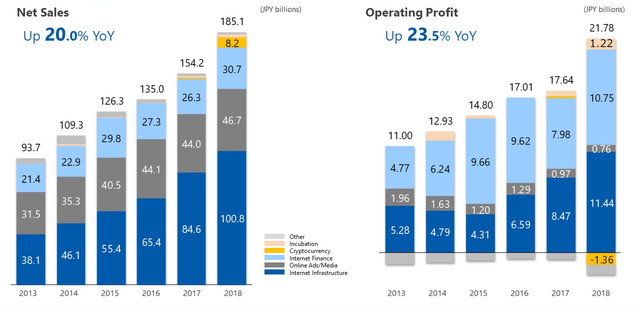

The full year in 2018 we exceeded 20% of both revenue and operating profit and broke the highest record.

The both revenue and operating profit and broke the highest record on both the Internet Infrastructure and Internet Finance exceeded 10 billion yen in operating profit marking the highest record.

Solid revenue base is formed from our Internet Infrastructure and Internet Finance exceeded 10 million contracts.

Although we recorded an extraordinary loss of JPY 35.3 billion related to the cryptocurrency mining business restructuring, we were able to eliminate the downside risk and strengthen the balance sheet due to the sale of shares in subsidiaries.

Shareholder return is plus 6.5 yen year-on-year resulting in 29.5 yen annually.We have already decided to exercise a share buyback up to 3.11 billion yen scale.

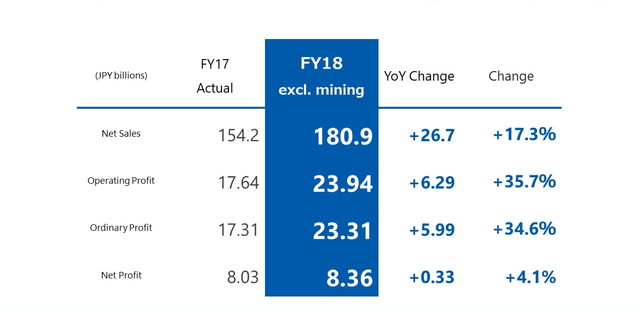

The full year in 2018, we have achieved a record high from net sales all the way to ordinary profit went up over 20% growth. Net profit was -20.7 billion yen resulting in the extraordinary loss from reestablishment in the mining business.

I’ll explain the restructuring of the cryptocurrency mining business later. You can see our existing businesses (excluding the cryptocurrency mining business) achieved over 30% growth in operating profit and ordinary profit year-on-year.

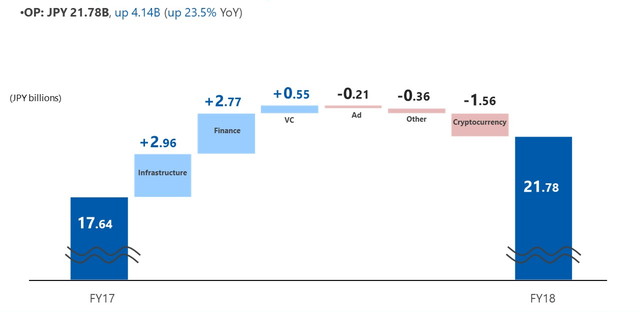

This is an executive summary of operating profit covering January to December. Operating profit increased by 4.14 billion yen to 21.78 billion yen compared to this time last year.

Looking at each segment, profit in the Internet Infrastructure segment increased by 2.96 billion yen, the Internet Finance segment by 2.77 billion yen, and the incubation business by 550 million yen due to the posting of gain on sale of stocks in investees that have achieved IPOs.

Online Advertising and Media’s operating profit decreased by 210 million yen, affected by ad fraud issues and the decrease in profitability.

The operating profit in the cryptocurrency exchange business increased year-on-year, but this could not offset the extraordinary loss in the cryptocurrency mining business, so the operating profit in the Cryptocurrency segment as a whole decreased by 1.56 billion yen year-on-year.

If you look at these figures, you’ll notice that the Internet services are shifting to the cloud, the security services are drawing attention, and the cashless payments are increasingly spreading, which have contributed to our strong growth in both revenue and profit over the past 6 years.

Financial segment faced challenges on liquidity in 2017, we set strong efforts on big data analysis to realize more efficient cover deals to further enhance our profitability in 2018. Although we urgently built our cryptocurrency business and decisions were made to reestablish the business at the end of last year, we marked the highest record driven by our existing business now.

=============================================

Internet Infrastructure

=============================================

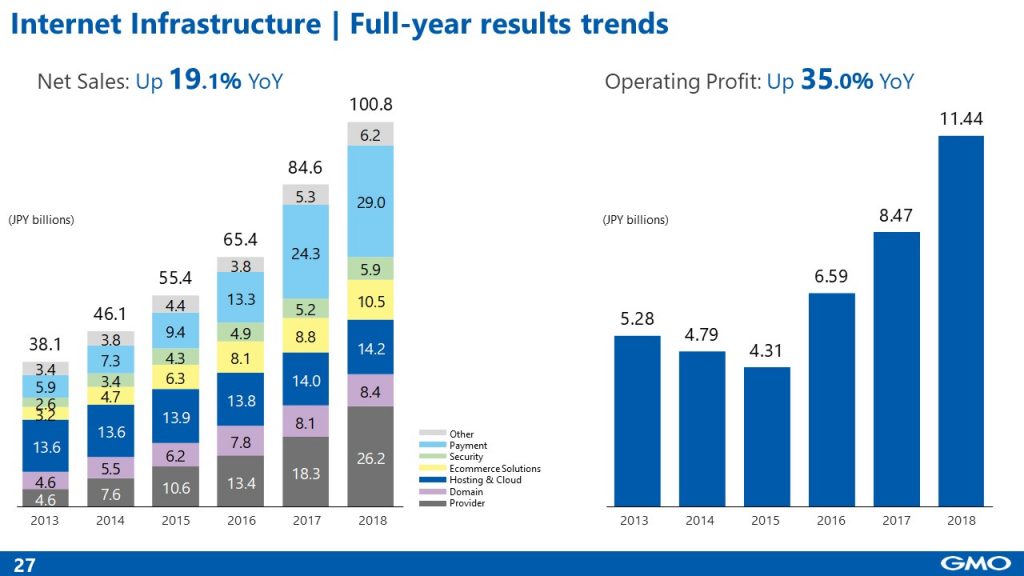

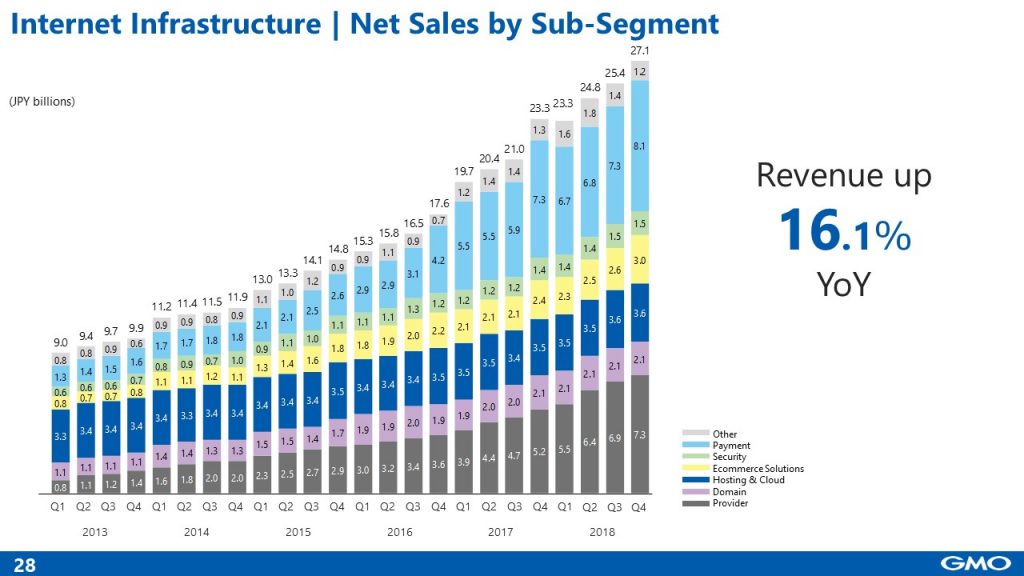

This is a financial result trend in 6 full year performance of the infrastructure business.

This year we have hit the 100 billion yen mark of net sales and 10 billion yen mark of operating profit through our activities of expanding the customer base recurring revenue and solid revenue as well as diversification of transaction type. Our revenue model is generating a robust increase in both revenue and profit. We expect this trend will keep going in the future.

This is net sales in Internet Infrastructure and its breakdown. The net sales from October to December is up 16% year-on-year. The increase in net sales is not obvious due to the absence of the previous year’s one-off factor, as the newly incorporated overseas subsidiary has a different fiscal year-end than the parent, so the organic growth rate is about 20%.

=============================================

■Online Advertising & Media

=============================================

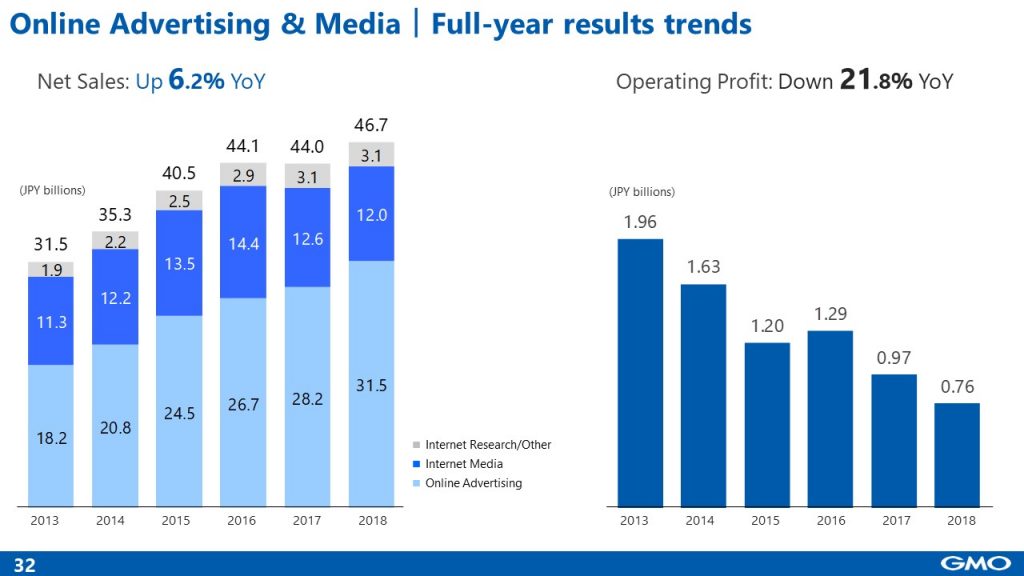

This is a transition of the online advertising and media business for six years. Net sales increased while profit decreased from the previous year we see a trend of decrease in profit for several years.

Advertising agency market demand is shifting to overseas media such as Google, Amazon, Facebook, and Apple (GAFA). Although the net sales continue to grow at the same rate, the profitability remains low in the mid-term. Aiming at V-shaped recovery this year (FY2019), we have begun initiatives in subsidiaries of this segment.

=============================================

■Internet Finance

=============================================

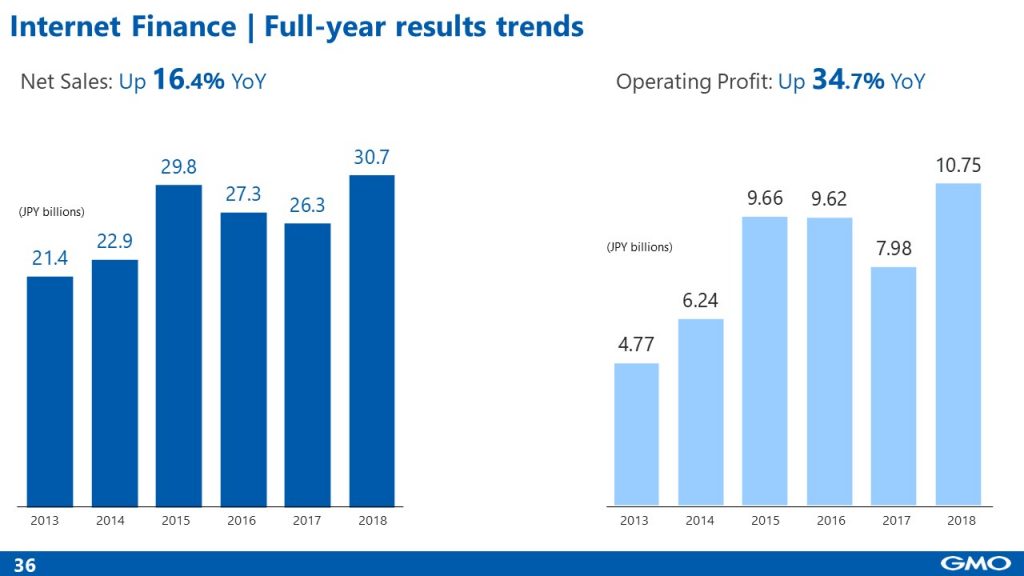

Although FX transaction volume has been relatively stable from 2017 onwards, our operating profit marked all-time high exceeding 10 billion yen in 2018 due to our improved mechanism of cover transaction and a high technical capability.

Despite the fact that transaction volume has decreased from the end of last year, we increased the profit in quarterly business results due to our profit control.

Based on improvement of profitability in FX utilizing AI and big data analysis, we will build more stable management basis that is not easy to fluctuate the market environment through offering products reflecting customer needs such as CFD.

=============================================

■Cryptocurrency business

=============================================

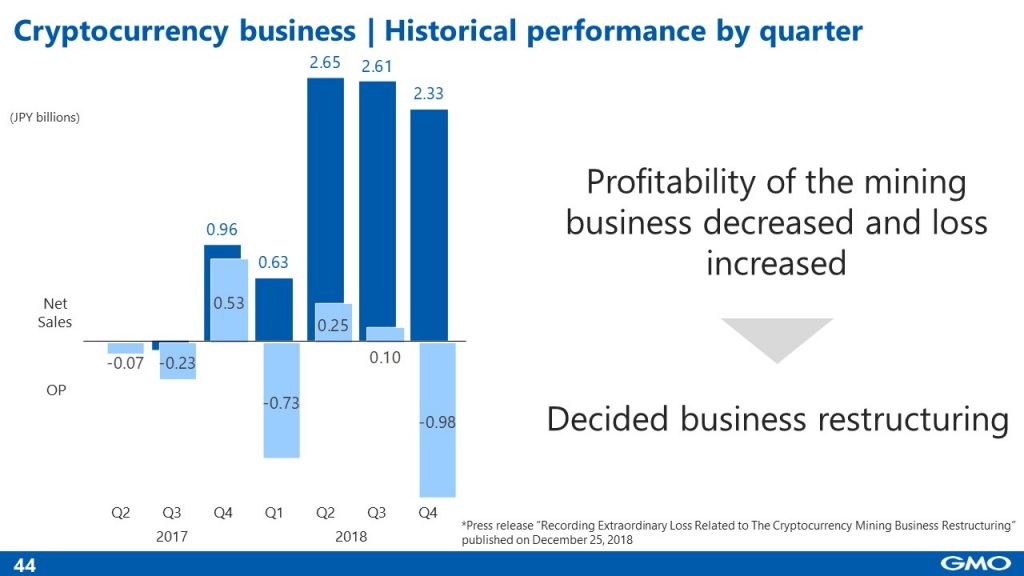

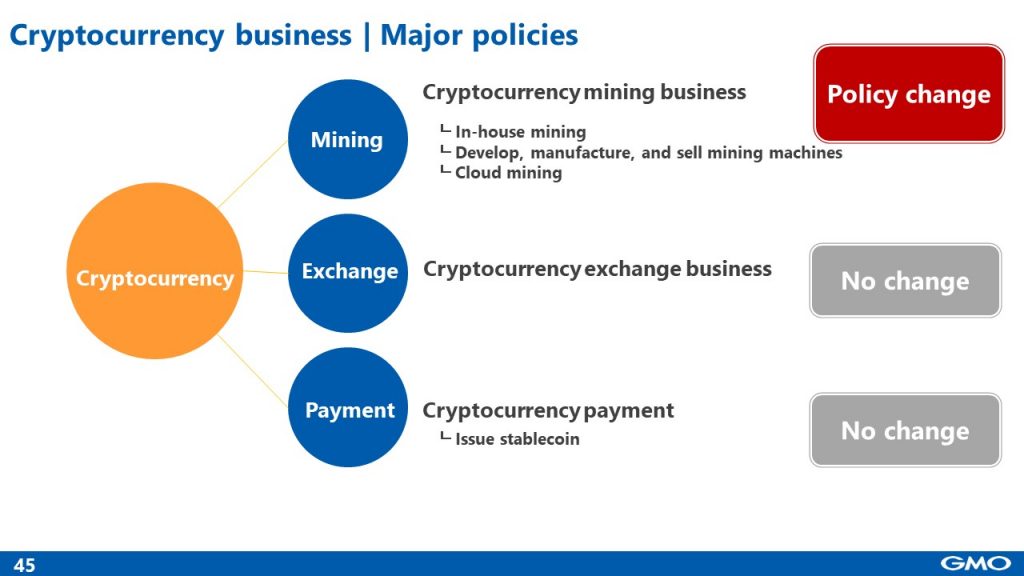

Due to our worsened profitability of the mining business in Q4 the loss has expanded upon posting of extraordinary loss. As announced on December 25th last year we will undertake a restructuring of mining business.

=============================================

■Cryptocurrency business|Cryptocurrency exchange business

=============================================

Although cryptocurrency price has stayed at low level in Q4, we made profit in business results while facing challenges on liquidity.

=============================================

■Cryptocurrency business |Cryptocurrency mining business

=============================================

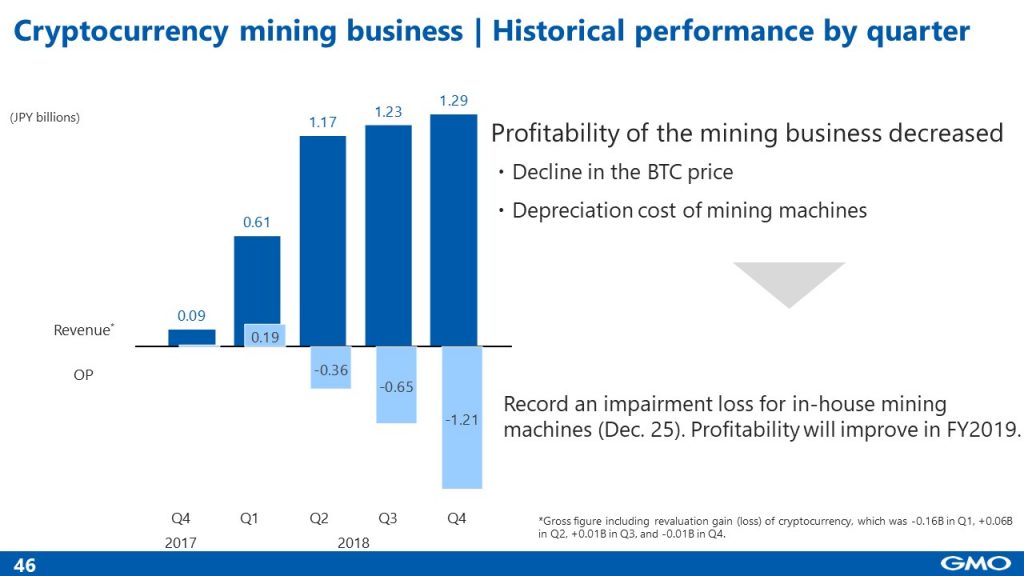

On the other hand, our profit has decreased caused by the following reasons.

1) In external environment, global hash-rate has exceeded 50 thousand PH (our share in hash rate has decreased)

2) Bitcoin price had stayed weakened.

3) Depreciation cost of mining machines had made profit decrease.

As shown in summary, we had exercised judgment to restructure in-house mining business also discontinued in-house mining machine development and manufacture.

GMO Internet will review the revenue structure of its in-house mining business, and have decided to record an impairment loss of all of our mining machines worth 11.6 billion yen to eliminate potential valuation risk of the risk asset.

In addition, the two biggest costs of cryptocurrency mining business are as follows.

1) Depreciation cost of mining machines

2) Electricity cost

We will relocate the mining center to an area of lower utility expense and restructure the business in order to improve our profitability. For restructuring of mining, we will depreciate the all cost related to mining machine development, manufacture, and sales worth 23.6 billion yen while removing risk as our depreciation expense of owned mining not incur anymore and continuing in-house mining. Also, we will withdraw mining machine development, manufacture, and sales going forward.

We thank deeply all the internal and external stakeholders, who allow us to achieve sustainable growth. We will never give up, and continue to challenge ourselves in new ways to create new values by learning from failures.

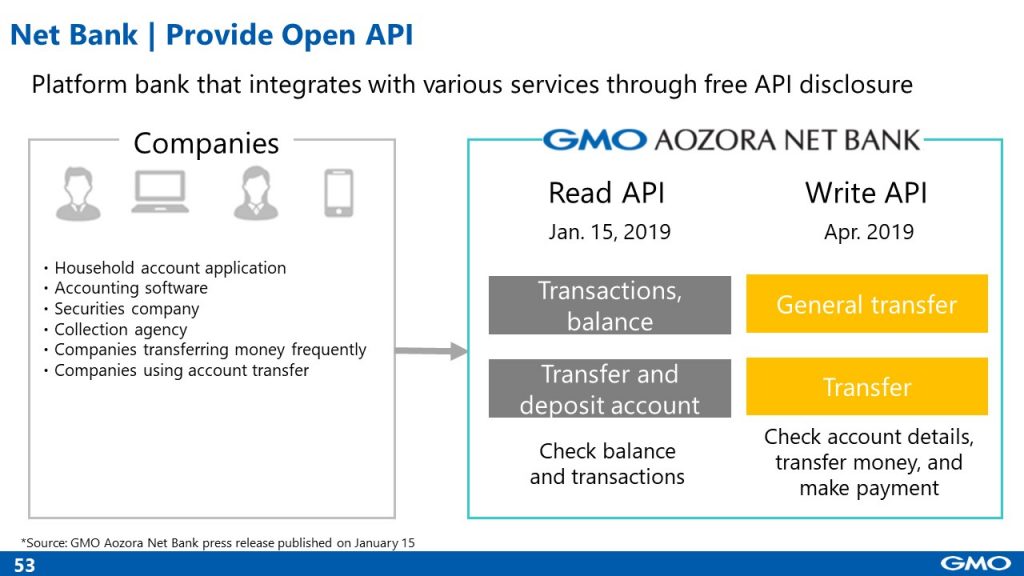

Finally, GMO Aozora Net bank that has launched their services for over half a year has begun linking to accounts in GMO Click Securities also has published API (January 15th)

For Initiative of publishing API, we will aim at platform bank collaborating with various third parties such as household accounts apps and accounting software.

We will endeavor not only to provide a good development environment to engineers and offer basic functions of banking services but also to provide convenient services that combine various existing services and banking services.

We would like to ask for your continued support in our endeavors.

Internet for Everyone

Results presentation materials (here)

(IR) Masatoshi Kumagai talks about GMO Internet Group Strategy (here)

(IR) GMO Internet Group Strategy 2018 Q1 Summary (here)

(IR) GMO Internet Group Strategy 2018 Q2 Summary (here)

(IR) GMO Internet Group Strategy 2018 Q3 Summary (here)

Older business results (here)