Financial summary for 2019 Q2

The following is an overview of the 2nd Quarter (April to June) FY12/2019.

==========================

■Financial Overview

==========================

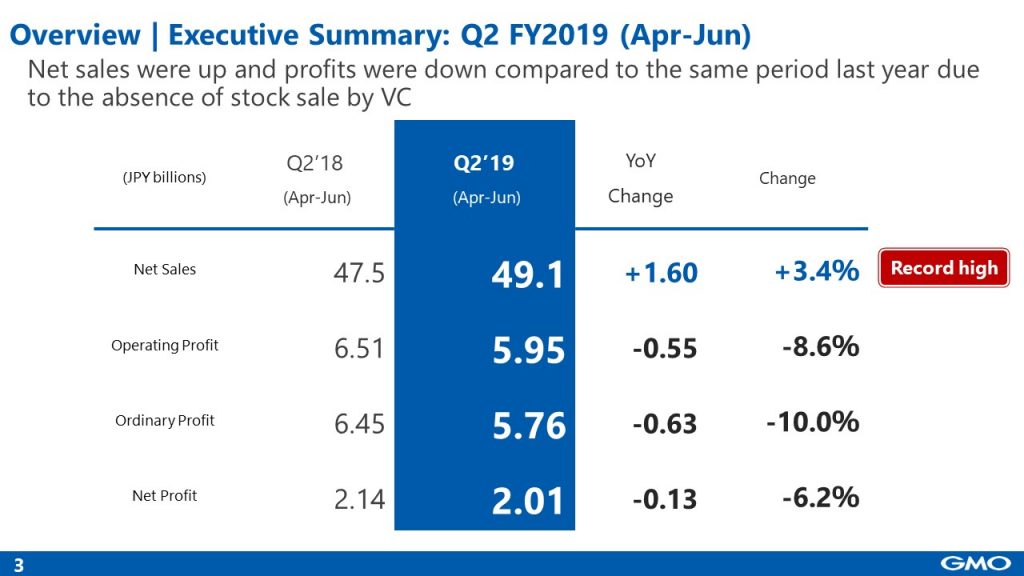

Here you can see an overview of Q2 FY2019 from April 1, 2019, to June 30, 2019.

Consolidated earnings achieved a record high in the same period last year due to sales of stocks in our VC/incubation business.

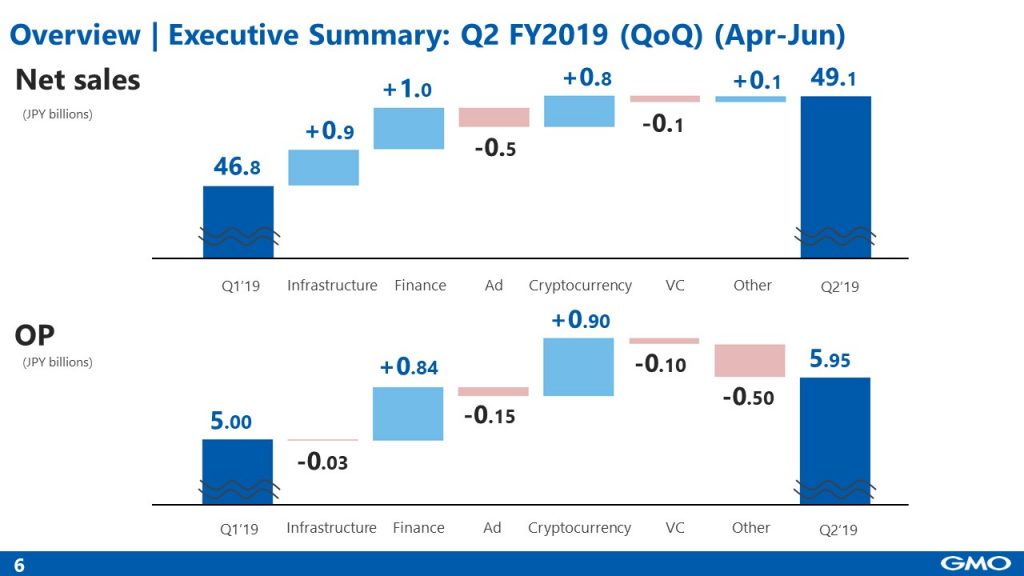

This is an executive summary of net sales and operating profit covering April to June. The consolidated net sales and consolidated profits were up. You can see that Internet Finance and Cryptocurrency businesses have done significantly better than the previous quarter. The Internet Finance segment experienced a decline in earnings due to a sudden fluctuation in exchange rates in the foreign exchange market early this year but recovered. In the Cryptocurrency segment, the cryptocurrency mining business and the cryptocurrency exchange business achieved positive figures.

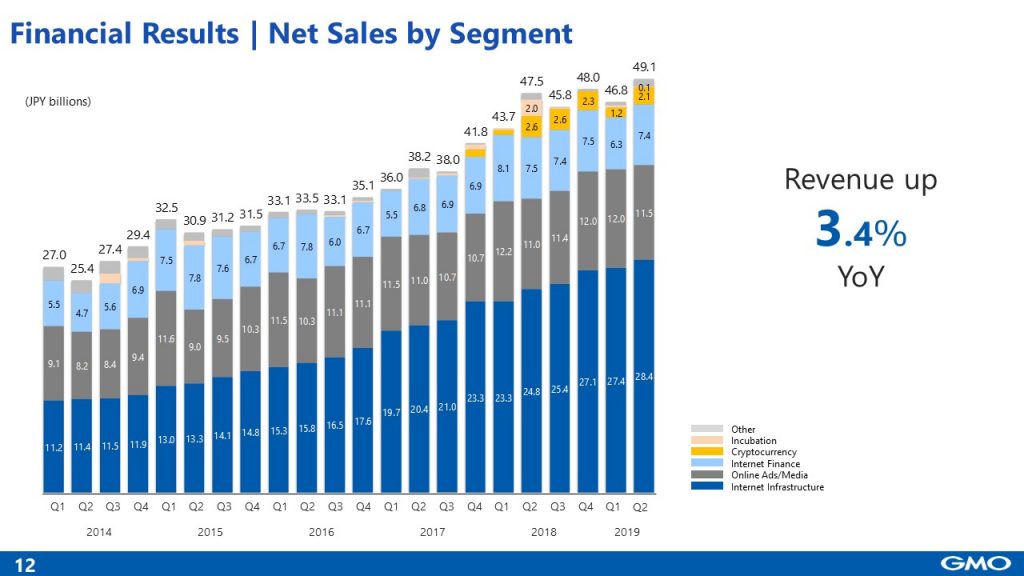

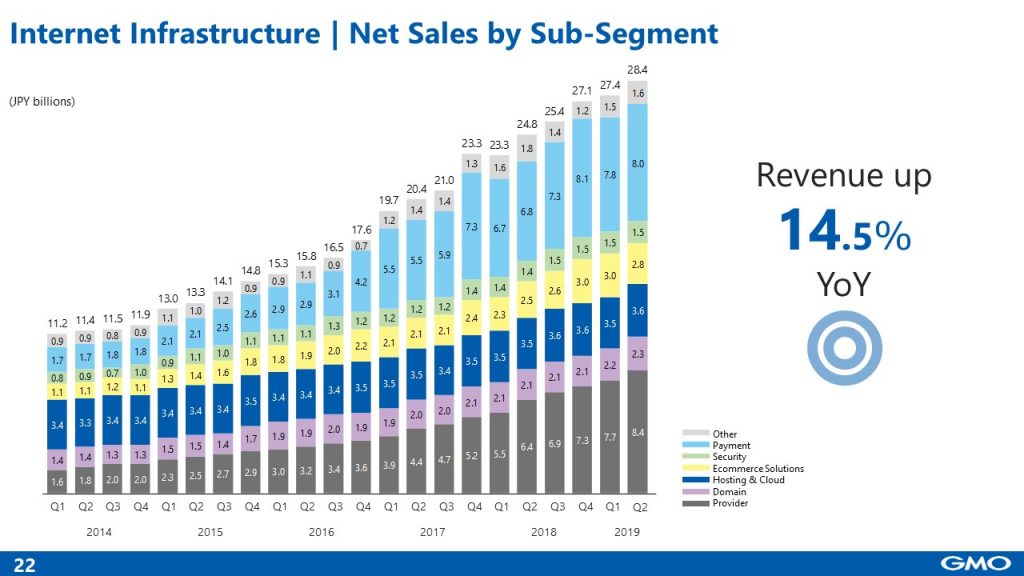

Shown here are each segment’s revenue trends by quarter over the past 6 years.

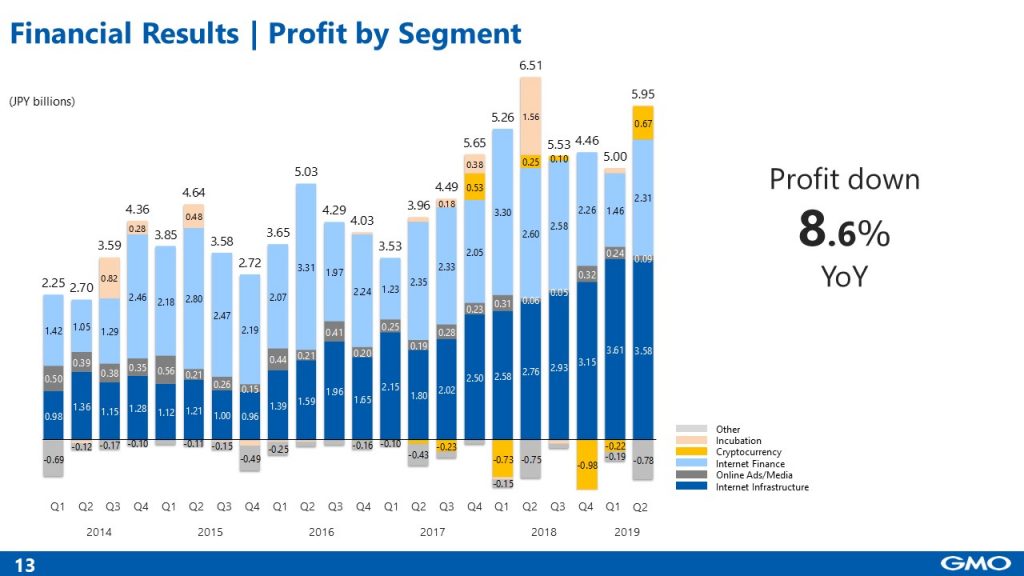

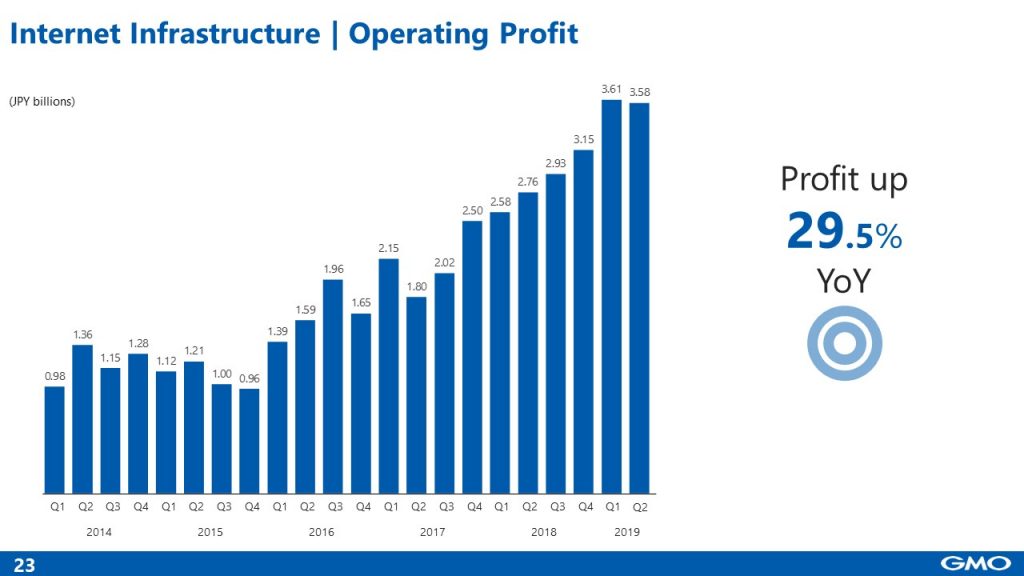

The net sales are up 3.4% year on year. Q2 seems weak temporarily, affected by VC and due to the decreased net sales of the cryptocurrency mining business. Regarding the year-on-year and quarter-and-quarter growth in operating profit, you can see the profit in Internet Infrastructure is continuing to expand in the long term.

==========================

■Internet Infrastructure

==========================

Internet Infrastructure is possible to achieve strong growth as the services – especially payment and provider – each hold top share in their respective markets in Japan.

Shown here are the Internet Infrastructure segment’s profit trends by quarter over the past 6 years. Operating profit increased by 29.5% to JPY 3.58B YoY as the net sales of payment and provider increased and also due to marketing cost fluctuations but did not reach a record high for the 7th consecutive quarter. Therefore, the self-assessment concerning the Infrastructure segment is ◎.

============================

■Online Advertising & Media

============================

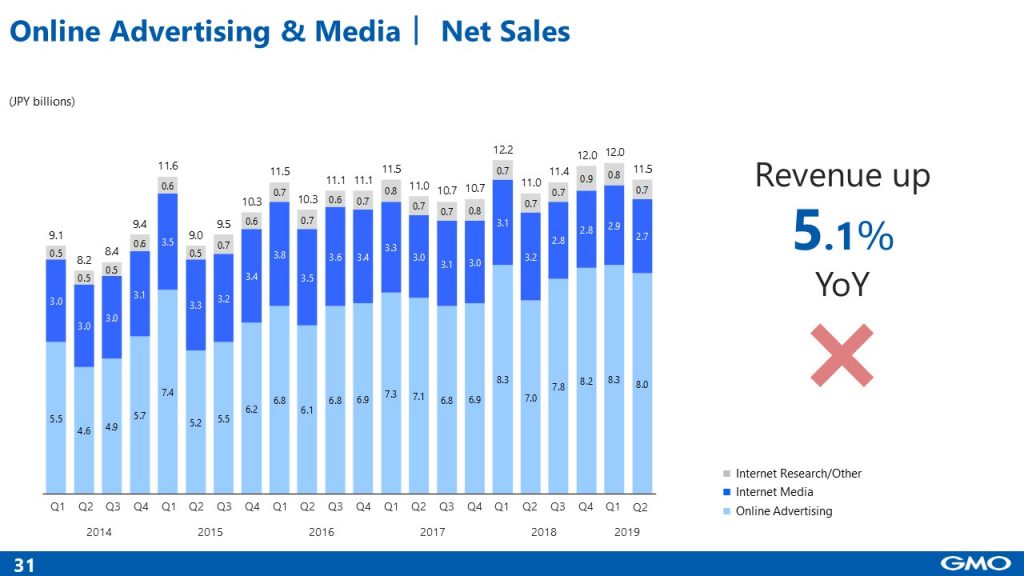

This is net sales in Online Advertising and Media and its breakdown.

The net sales of Online Advertising and Media are up 5.1 percent year on year. The net sales of online advertising increased by 14.3% to JPY 8B YoY. In addition to expanding the existing customers’ budget, new, major customer acquisition progressed, so the ad agency saw steady growth. The advertisement distribution amount has decreased as placement standards of ad tech products have been tightened but we are bouncing back and, as of today, recovering our trend. The net sales of media have decreased 15.1% to JPY 2.7B YoY, and the harsh environment continues. E-commerce media was affected by the weak growth of media for teenage girls, and the end of the sale of existing products for the small businesses in the previous quarter.

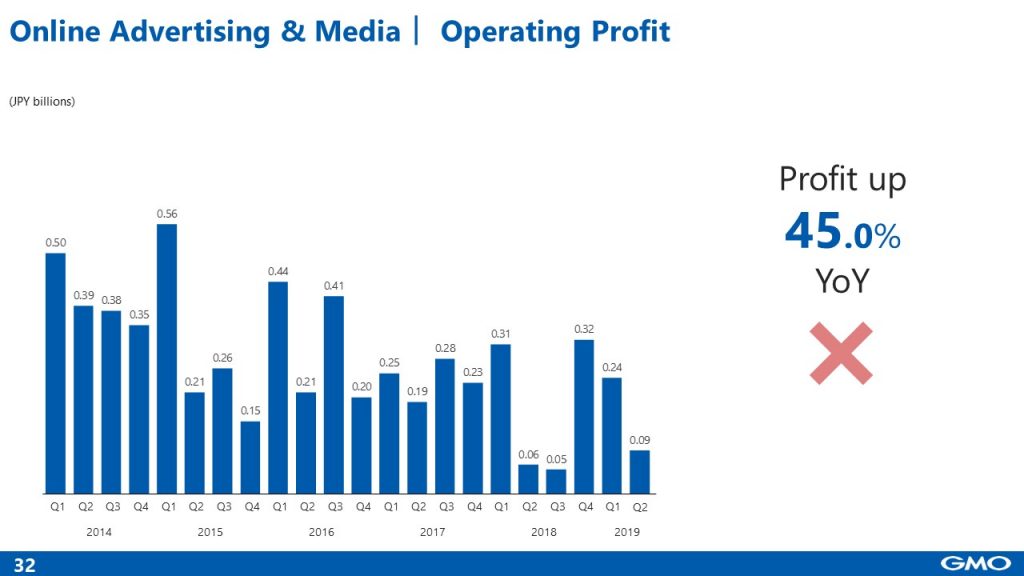

Shown here are Online Advertising & Media segment’s profit trends by quarter over the past 6 years. New in-house products grew but couldn’t cover the downward trend in existing in-house products. Although the profits are up compared to the previous year, profits are still low, and it is hard to say that the segment is recovering. Although we believe the measures implemented are not wrong, they have not produced good results, so the self-assessment concerning the Online Advertising & Media segment is △×.

==============================

■Internet Finance

==============================

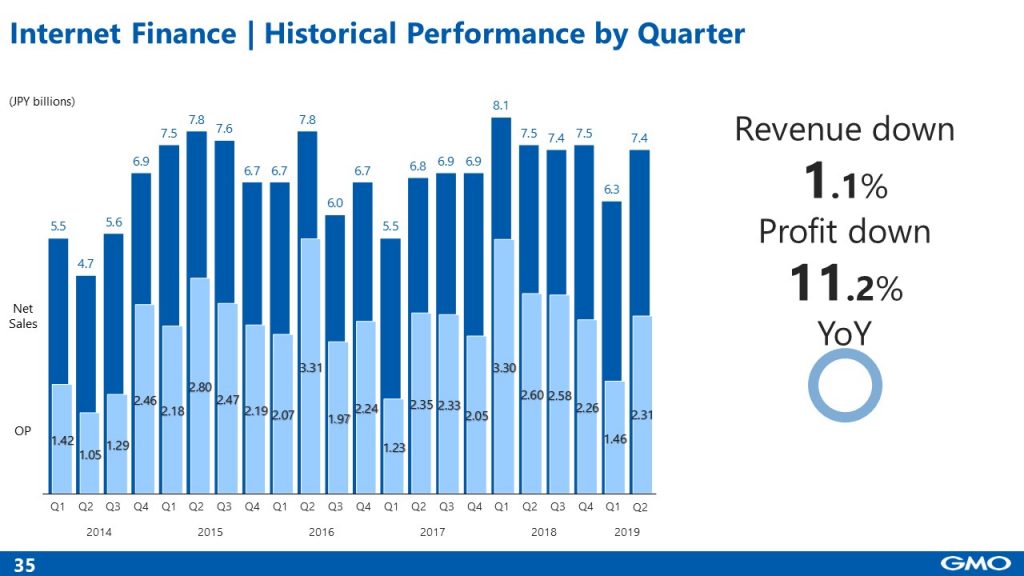

This is a transition of quarterly performance. Revenue and profit dropped YoY due to the weak growth of the trading volume but profitability reached a record high as a result of the profitability improvement measures such as big data analysis, so the net sales and profits were up QoQ and Internet Finance recovered. Earnings are recovering QoQ and we have been able to show certain figures despite the harsh market environment, so the self-assessment concerning the Internet Finance segment is ○.

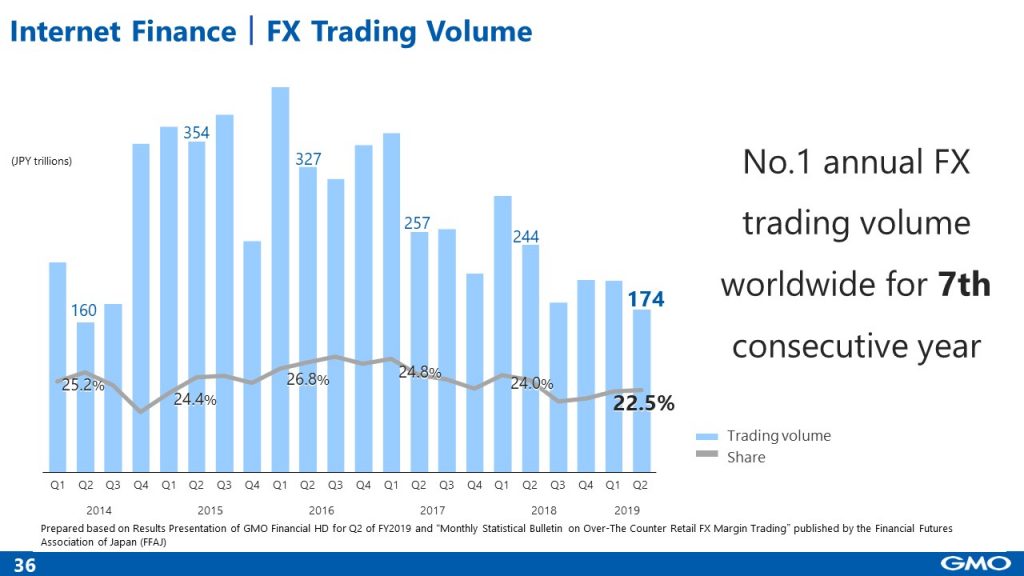

This is a transition of FX trading volume. While trading volume’s growth was sluggish due to a decline in volatility, market share increased by 0.4 pt to 22.5% QoQ.

============================

■Cryptocurrency segment

============================

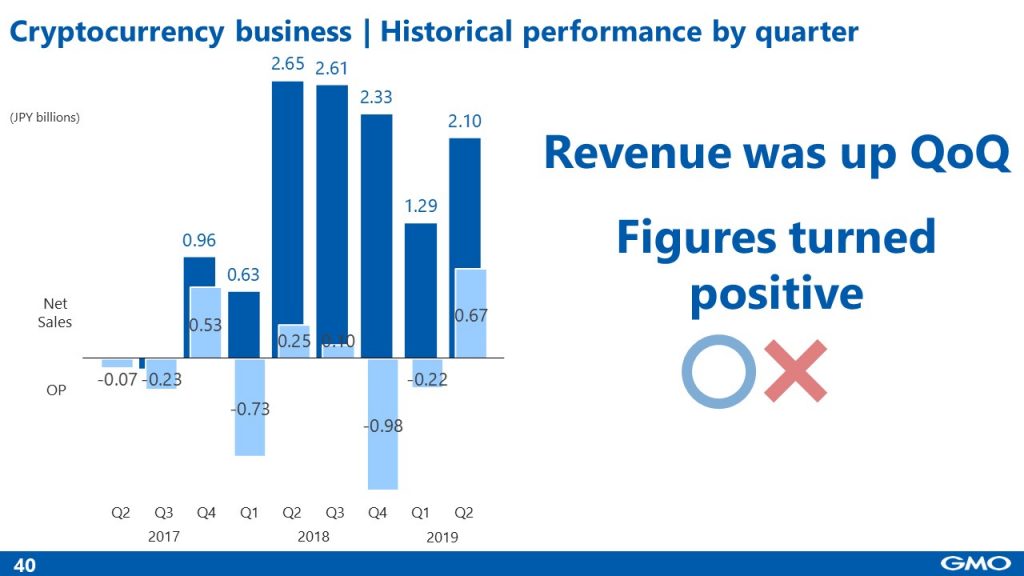

This is a transition of quarterly performance in the Cryptocurrency segment. The Cryptocurrency segment’s revenue was up QoQ and it recorded a profit. I’ll explain the cryptocurrency mining business and the cryptocurrency exchange business.

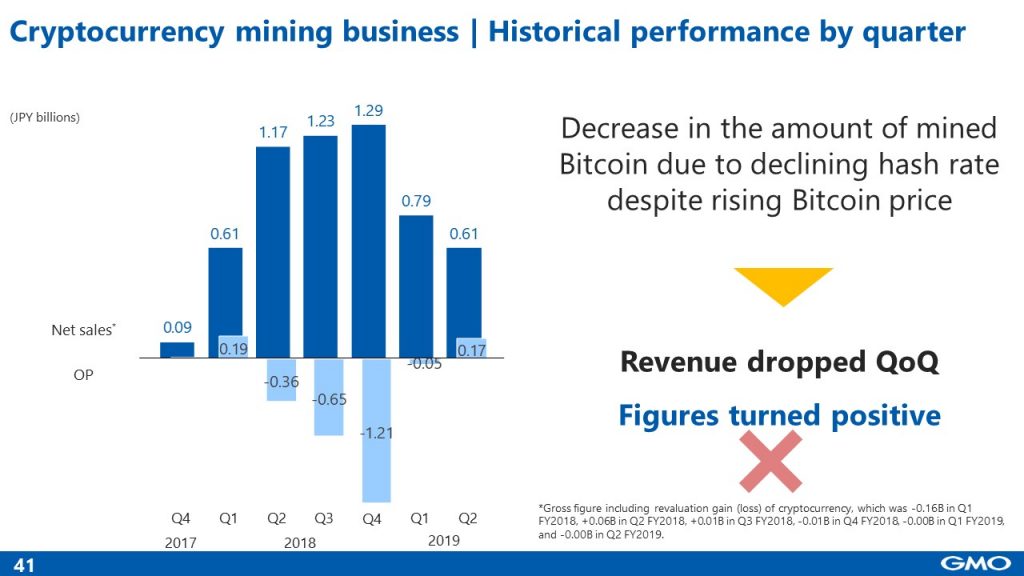

■ Cryptocurrency mining business

Net sales of the cryptocurrency mining business decreased QoQ but the business recorded a profit. Net sales depend on the unit price and the amount of mined Bitcoin. Unit price increased as the cryptocurrency market rose but the delay of a plan to relocate mining centers led to the dropping hash rate of GMO Internet, so the amount of mined Bitcoin decreased. On the other hand, cost decreased because of the decline in the electricity cost (variable cost) due to the dropping hash rate and also because the depreciation cost (fixed cost) of mining machines became zero due to recording an impairment loss in 2018. While the cryptocurrency mining business achieved positive figures, the delay of a plan to relocate mining centers had an opportunity cost, so the self-assessment concerning the cryptocurrency mining business was ×.

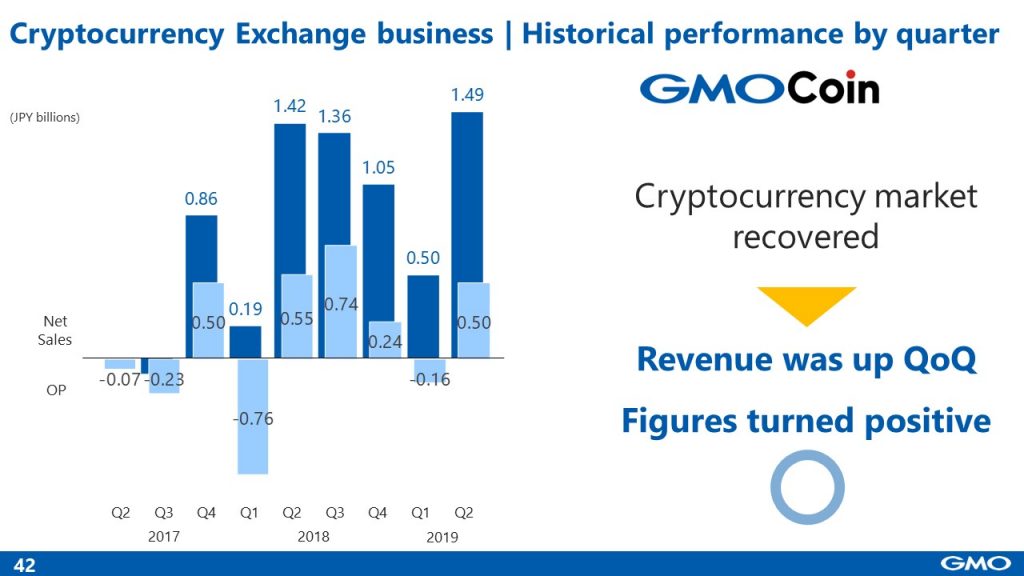

■ Cryptocurrency exchange business

The revenue of the cryptocurrency exchange business was up QoQ and the business recorded profit because of increasing volumes due to the volatile cryptocurrency market, so the self-assessment concerning the cryptocurrency exchange business was ○.

==========================

■ Global operations

==========================

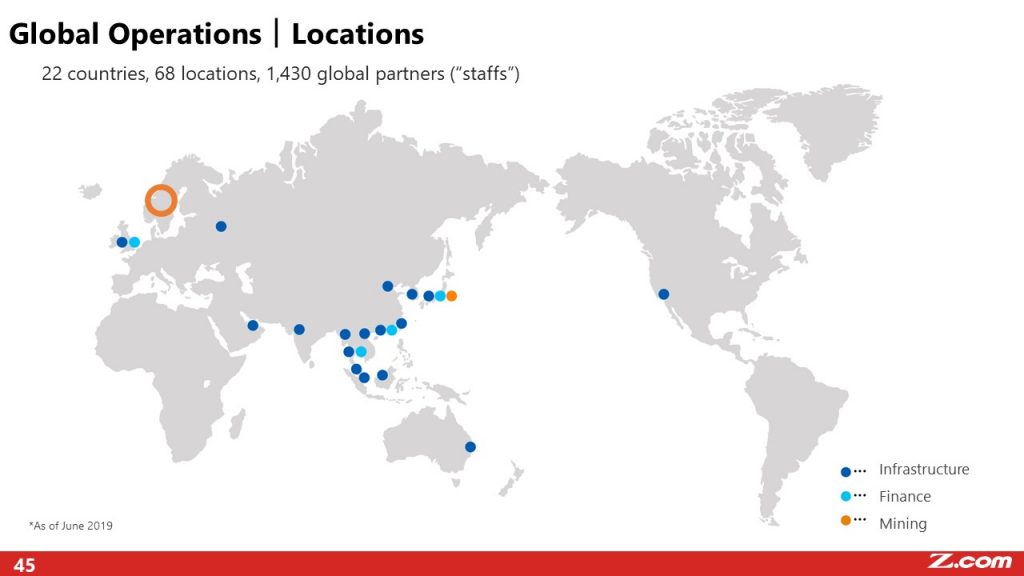

GMO Internet Group has already expanded to 68 locations in 22 countries and includes 1,430 partners.

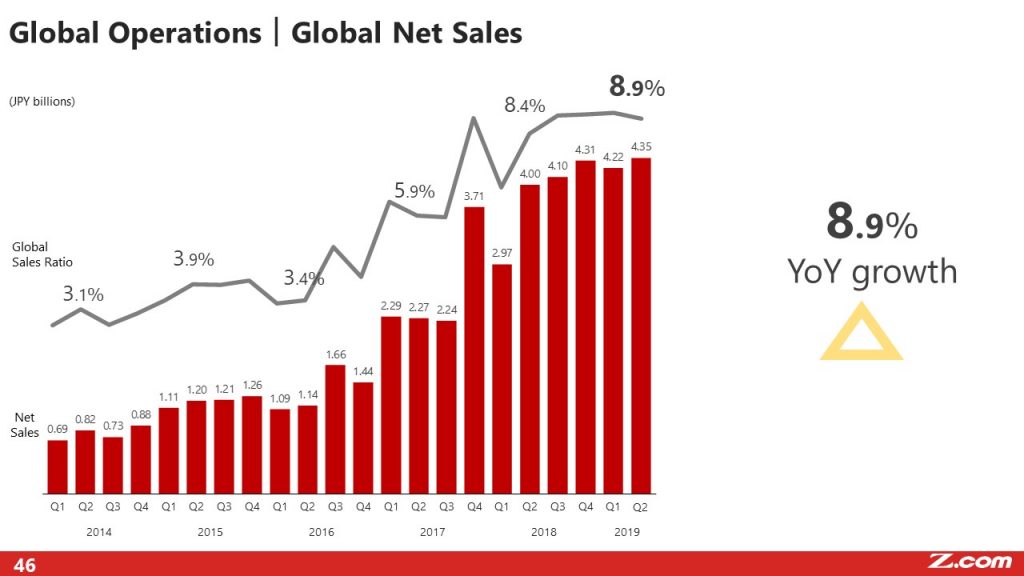

Overseas sales consist of the Internet Infrastructure business in South East Asia, which offers services under the Z.com brand, Internet Finance business, and cryptocurrency mining business. Overseas research business is added retroactively to Q1 FY2019. The overseas sales increased by 8.9% to JPY 4.3B YoY and the overseas sales ratio was 8.9% mainly due to the growth in the Internet Infrastructure segment. While we are investing in new businesses, which have achieved positive figures in a single month, we have not yet achieved the overseas sales ratio of 50%, so the self-assessment concerning the global operations is △.

==========================

■ Internet bank

==========================

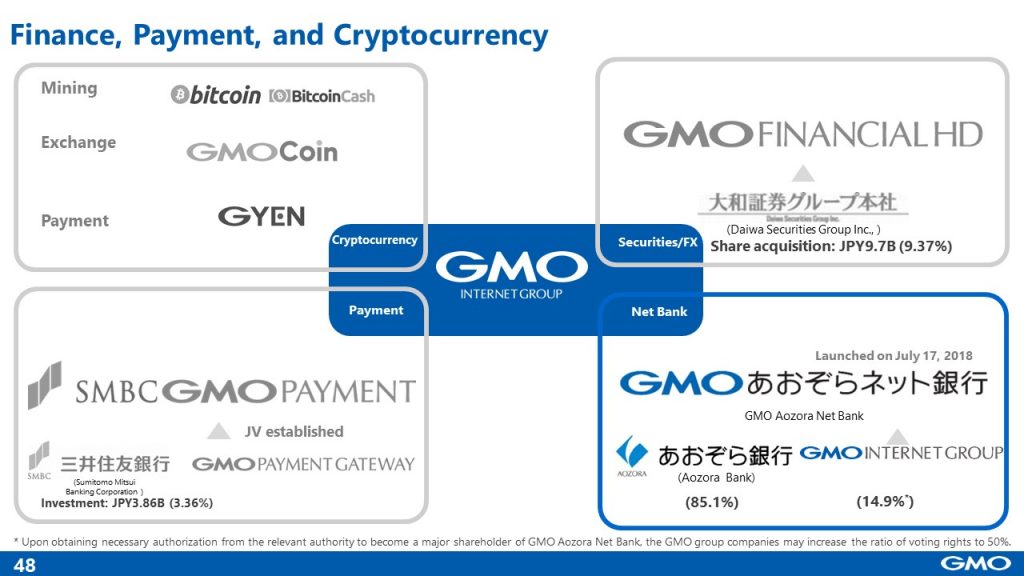

This slide shows the summary of GMO Internet’s financial and payment businesses. Cryptocurrency trading business and cryptocurrency mining business comprise the cryptocurrency business.

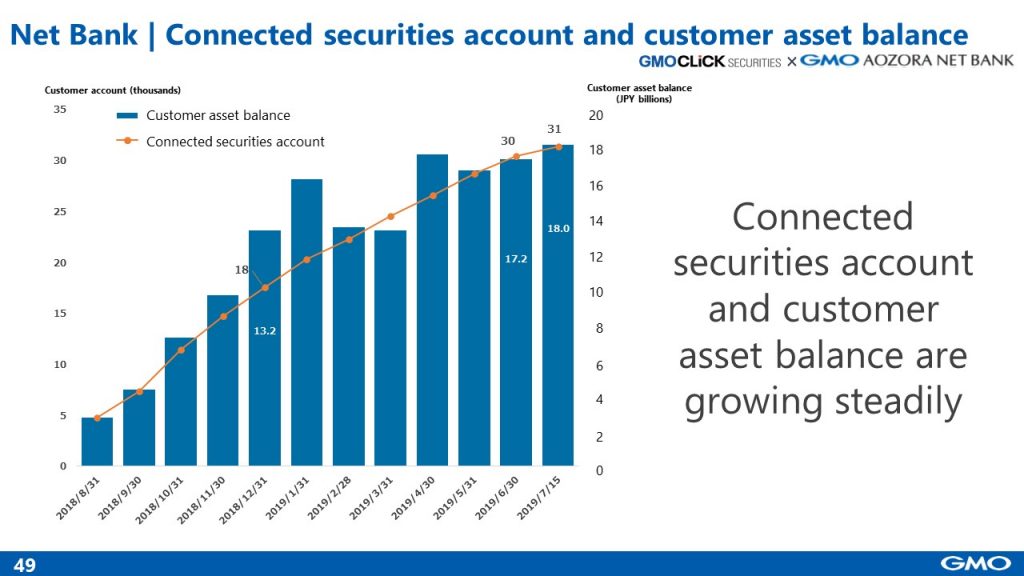

We promote opening securities-connected accounts with GMO CLICK Securities at the same time, and the number of accounts and the balance have been growing.

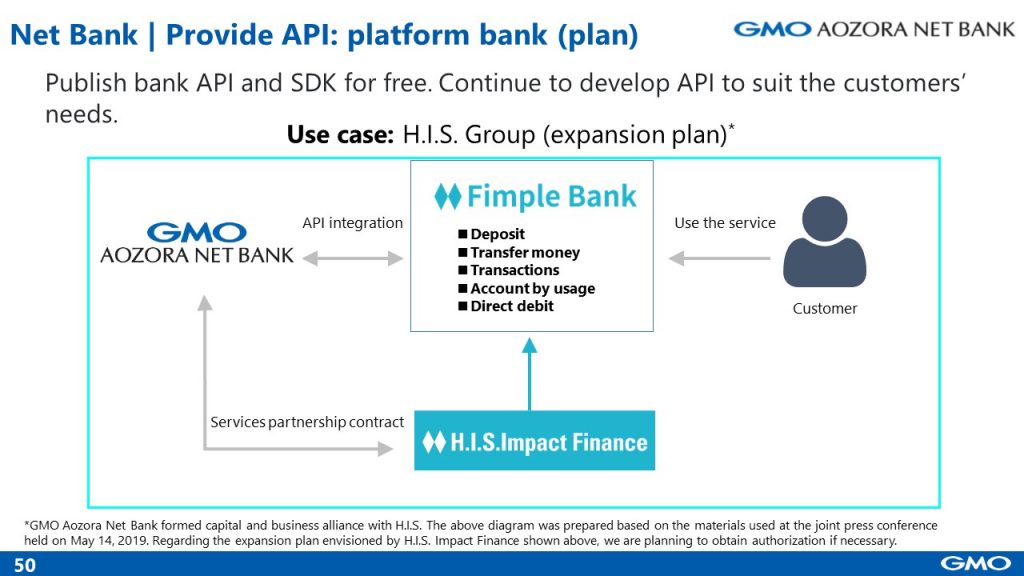

GMO Aozora Net Bank’s goal is to provide the platform bank. More APIs will be disclosed and more connections will be available in the future. It will integrate a business-to-business payment service that guarantees the receivables offered by H.I.S. Impact Finance of H.I.S. Group with banking feature to provide new financial service utilizing new write APIs disclosed. GMO Aozora Net Bank, as a white label banking service, will meet the needs of companies by offering financial infrastructure APIs and will ensure that it will lead to acquiring new customers.

==========================

■ Summary

==========================

The performance of this year was comparable to that of 2018. Profit was up (excluding the sales of stocks in our VC in 2018) but the delay in the restructuring of the cryptocurrency mining business had an opportunity cost.

GMO Internet will continue to pursue the added value by developing its No. 1 services, which is the strength of GMO Internet, and through group-wide synergies and will ensure that it will lead to further growth.

Internet for Everyone