The following is an overview of the 1st Quarter (January to March) FY12/2017.

For more details please refer to the following.

Results presentation materials (here)

(IR) Masatoshi Kumagai talks about GMO Internet Group Strategy 2017 Summary(here)

=============================================

■Financial Overview

=============================================

●Financial summary for Q1 (January-March) of 2017.

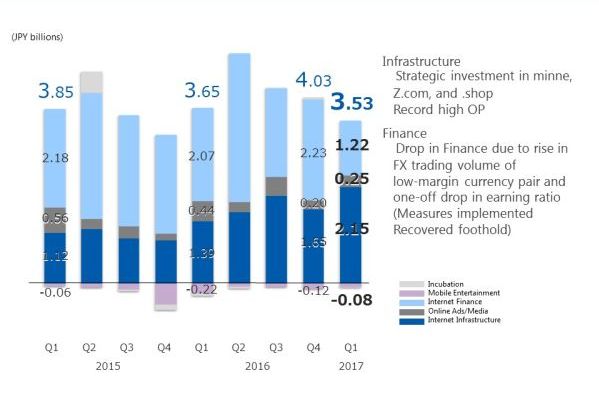

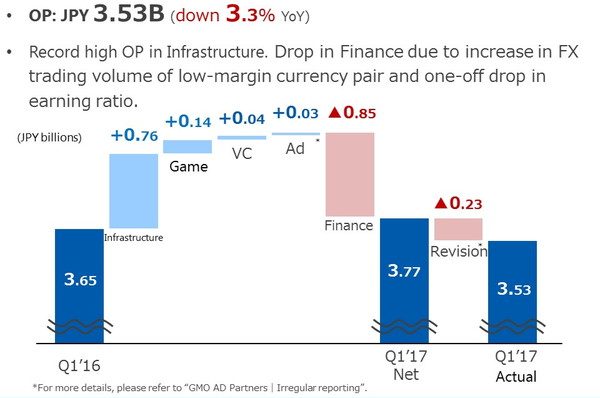

While the operating profit is JPY 3.53B – down 3.3% YoY – and Infrastructure is growing with operating profit reaching record high, we are starting with YoY losses due to two factors. One is market fluctuation, which has had one-off effect on FX business of the Finance segment. The other is the result of incorporating revision to GMO AD Partners’ net sales for FY 2016 into GMO Internet’s consolidated statement of Q1 FY2017.

【The first quarter financial results (January-March) – analysis of operating profit】

Next two graphs show the transition of quarterly performance. Net sales has increased by 8.6% to JPY 36.0 billion YoY. Operating profit is down 3.3% to JPY 3.53 billion YoY. Net sales is up and profit is down. Because of the recurring revenue in Infrastructure, we have had strong results. In current business environment, this trend is expected to continue, and profit is increasingly stable.

【Net sales by segment】

=============================================

■Internet Infrastructure

=============================================

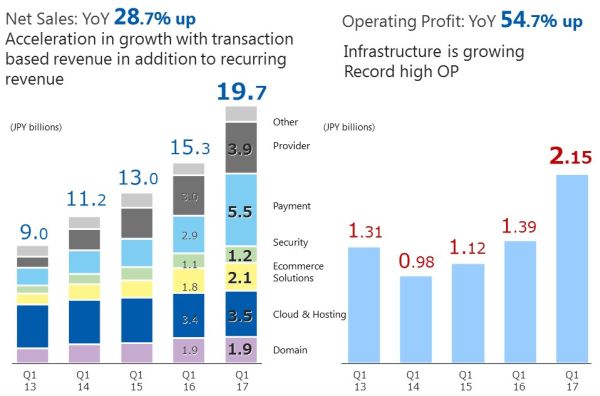

●Next two graphs show net sales, by sub-segment, and operating profit of the first quarter for the past 5 years.

With recurring revenue and transaction revenue from payment services and minne, the growth rate is accelerating. Provider expanded further. As for profit, profit margin for payment services and SSL also greatly increased despite investing in next generation products.

【Internet Infrastructure – results trends】

=============================================

■Internet Finance* segment.

=============================================

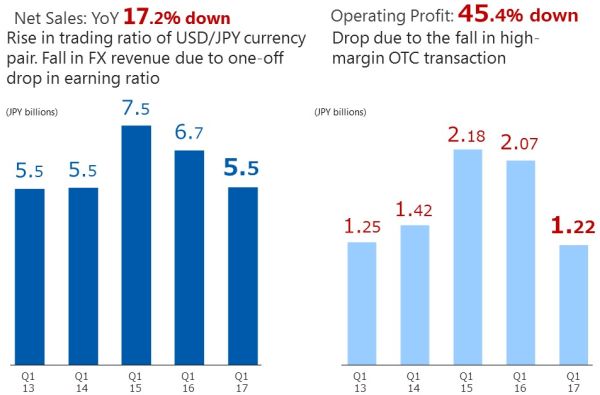

*Segment name changed from Internet Securities to Internet Finance in Q1 FY2017.

- Next two graphs show the transition of Internet Finance’s net sales and operating profit of the first quarter for the past five years. Net sales has decreased by 17.2% to JPY 5.5 billion YoY. Operating profit is down 45.4% to JPY 1.22 billion YoY. Although the market was booming in FY2015 and FY2016, Finance dropped in FY2017 due to rise in trading ratio of low-margin USD/JPY currency pair and one-off drop in earnings ratio due to rise in cover cost.

【Internet Finance – results trends】

- Annual FX trading volume was No.1 worldwide for the 5th consecutive year since 2012. As a result of the planning, development, maintenance, and management of our own systems, we believe we were able to attract support from many customers. We will unite and strive to offer innovative services.

=============================================

■Online Advertising & Media segment.

=============================================

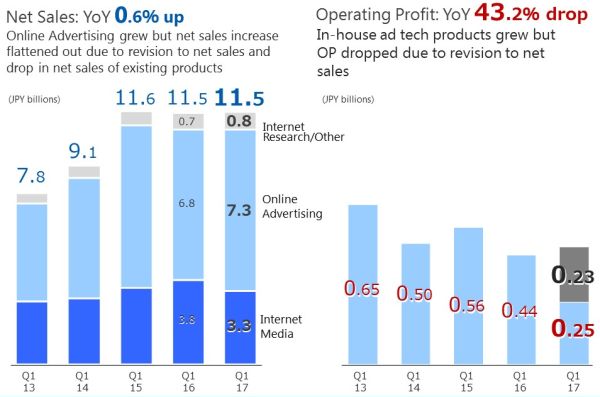

●Next two graphs show the transition of Online Advertising & Media’s net sales and operating profit of the first quarter for the past five years.

Net sales has increased by 0.6% to JPY 11.5 billion YoY. Operating profit is down 43.2% to JPY 250 million YoY. Despite ad technology shift in Online Advertising and drop in net sales of Media’s existing products since the fourth quarter of FY2016, we believe we were able to restore business momentum. As for profit, new products are growing despite downward trend in existing products but operating profit dropped due to revision to net sales (JPY 230 million).

【Online Advertising & Media – results trends】

============================================

■Mobile entertainment segment.

=============================================

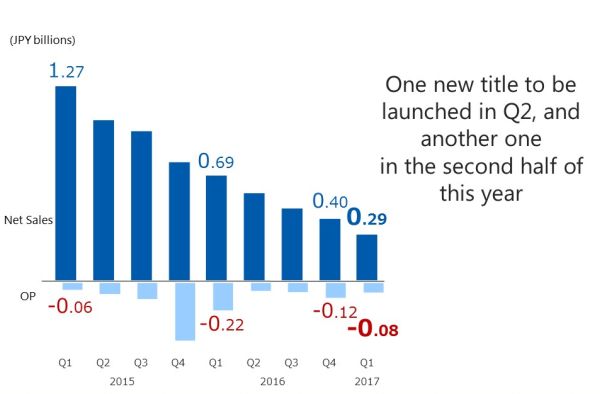

●We have been reorganizing internally and working on getting costs under control. As a result, negative figure is under control. Regarding the situation of pipeline, one new title will be launched in second quarter, and another one in the second half of this year.

【Mobile Entertainment – historical performance by quarter】

Please refer to “Masatoshi Kumagai talks about the GMO Internet Group strategy” for the 2017 Overview of the group’s current position and an outline of our strategy going forward, particularly for “.shop,” finance – virtual currency business and Internet banking – and other major themes.

We appreciate your ongoing support of the GMO Internet Group.

Internet for Everyone

Results presentation materials (here)

(IR) Masatoshi Kumagai talks about GMO Internet Group Strategy (here)