The following is an overview of the 3rd Quarter (July to September) FY12/2020.

=============================================

■Financial Overview

=============================================

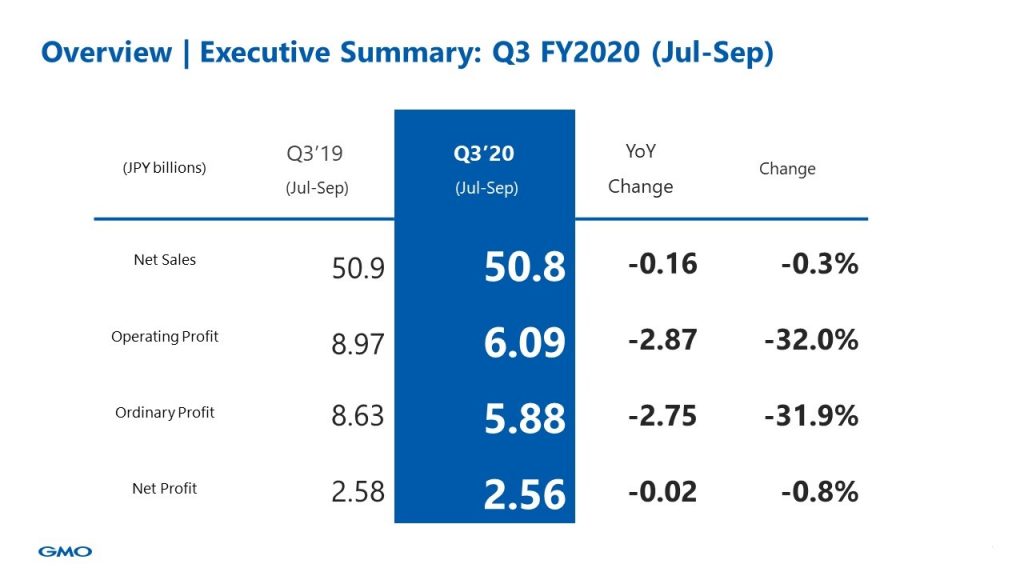

Here you can see an overview of Q3 FY2020 from July 1, 2020, to September 30, 2020.

Net sales and profits were down compared to the same period last year as the venture capital (VC) posted gain via the sale of listed and unlisted shares in FY2019 and Internet Finance saw a profit decrease in FY2020.

=============================================

■Internet Infrastructure

=============================================

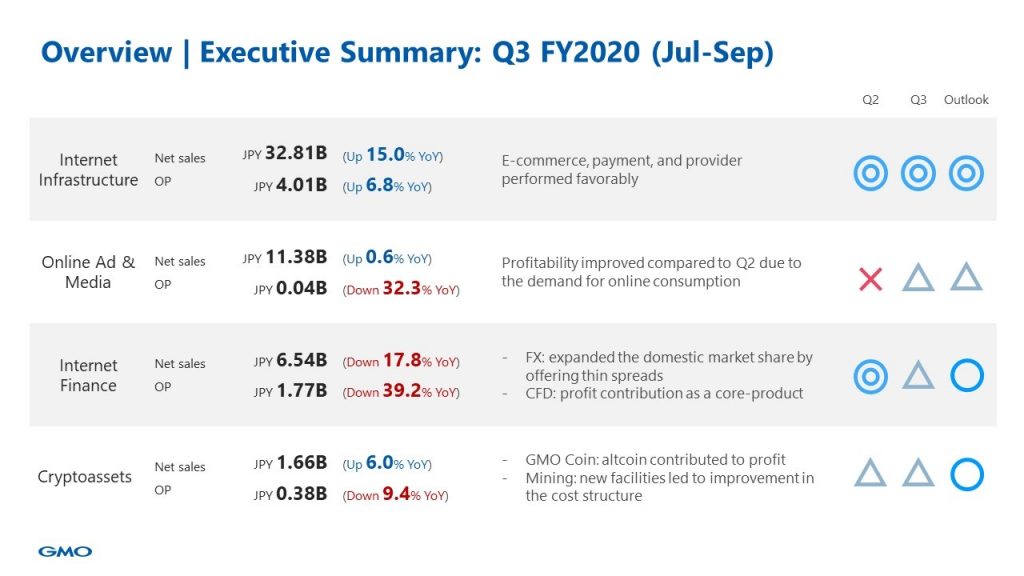

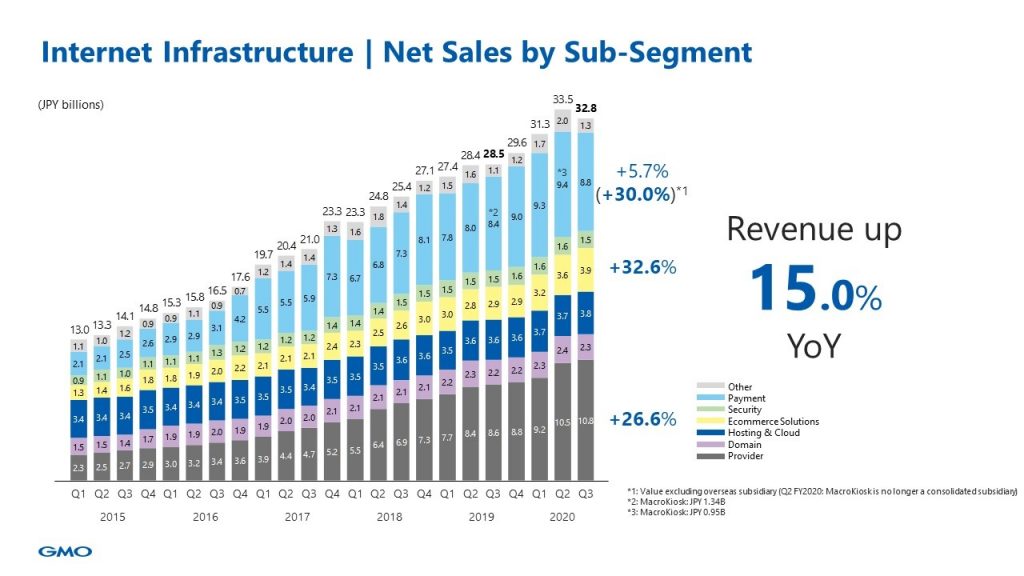

This is net sales in the Internet Infrastructure segment and its breakdown. The segment’s net sales increased by 15.0%. Because the consumption increased due to stay-at-home orders and because of the increased demand for teleworking, net sales in Provider, Ecommerce Solutions, and Payment increased by 26.6%, 32.6%, and 30% (excluding the impact of the overseas subsidiary), respectively, so the Infrastructure segment performed well.

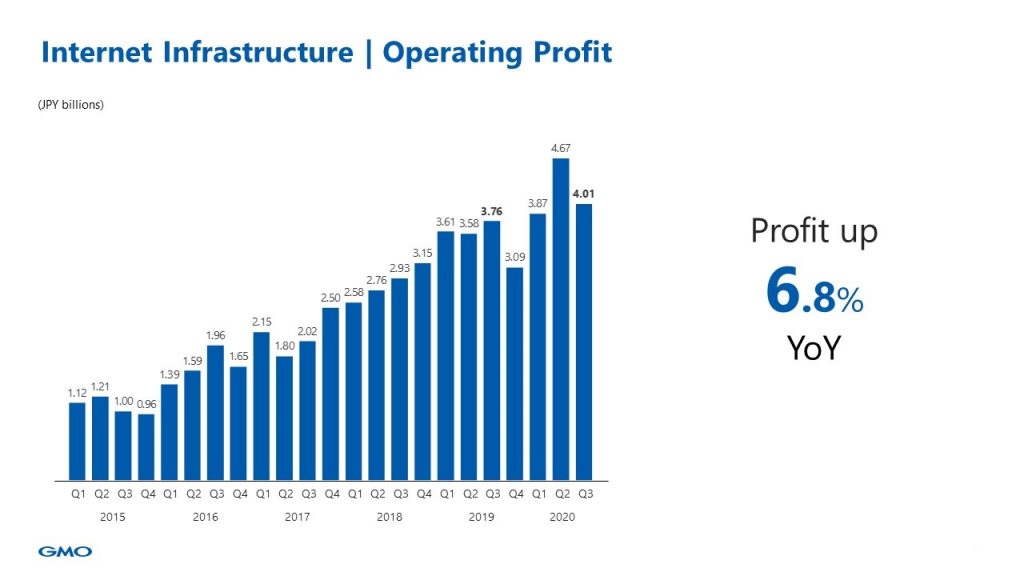

Shown here are the Internet Infrastructure segment’s profit trends by quarter over the past 5 years. Operating profit was JPY 4.01 billion mainly due to the growth in the Ecommerce Solutions and the Provider.

=============================================

■Online Advertising & Media

===========================================

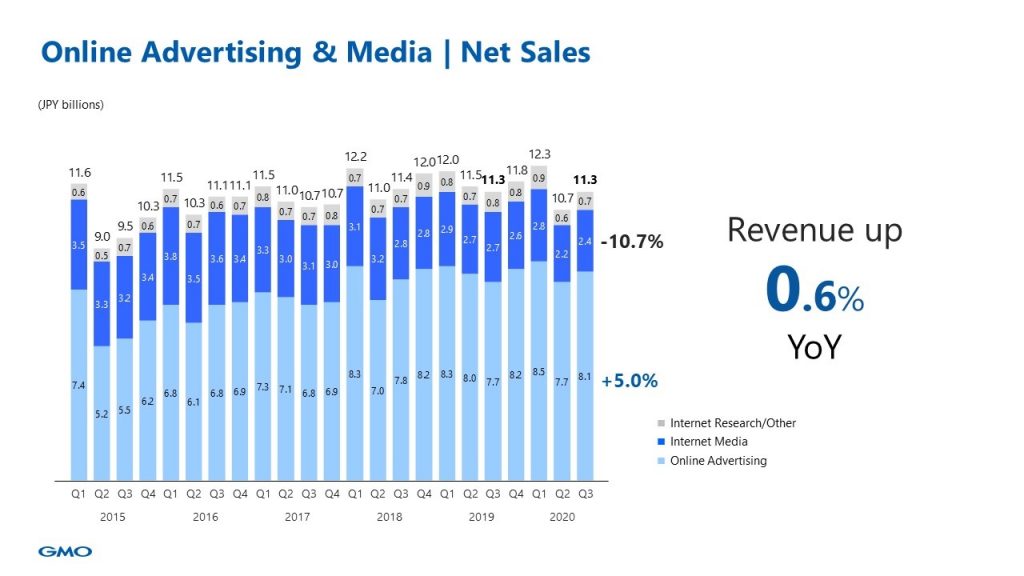

This is net sales in Online Advertising and Media and its breakdown. Net sales have increased by 0.6% YoY. Net sales in Online Advertising, which is indicated in light blue, has increased by 5.0% to JPY 8.1 billion YoY. Due to the strong demand for online consumption, the advertising agency recorded solid performance although the performance depended on the industry. Net sales in Media, which is indicated in dark blue, has decreased by 10.7% to JPY 2.4 billion YoY. Although the ad’s unit price has increased, the impact of the decline in ad placements by the financial industry is observed in this subsegment.

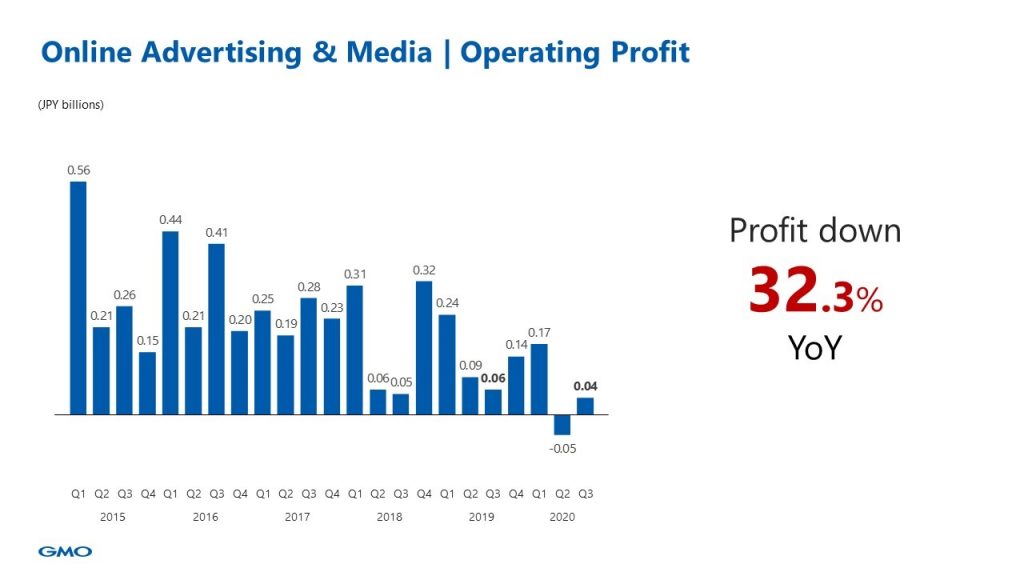

Shown here are Online Advertising & Media segment’s profit trends by quarter over the past 5 years. Profit dropped from last year due to the promotion costs of the new businesses in Media.

=============================================

■Internet Finance

=============================================

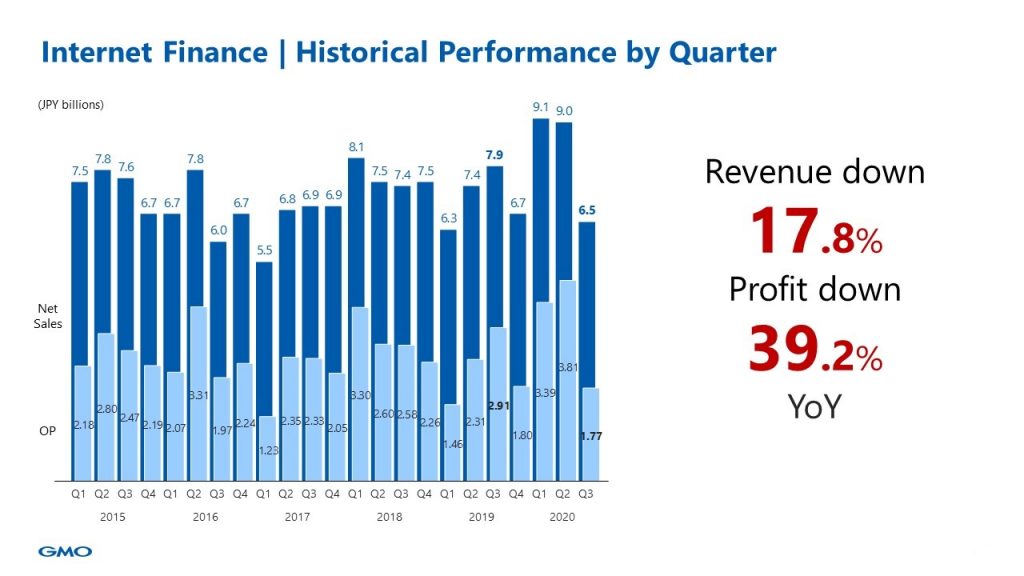

This slide shows performance trends by quarter. CFD performed favorably but FX aimed at expanding the domestic market share by offering thin spreads, so Finance dropped compared to the same period last year.

=============================================

■Cryptoassets segment

=============================================

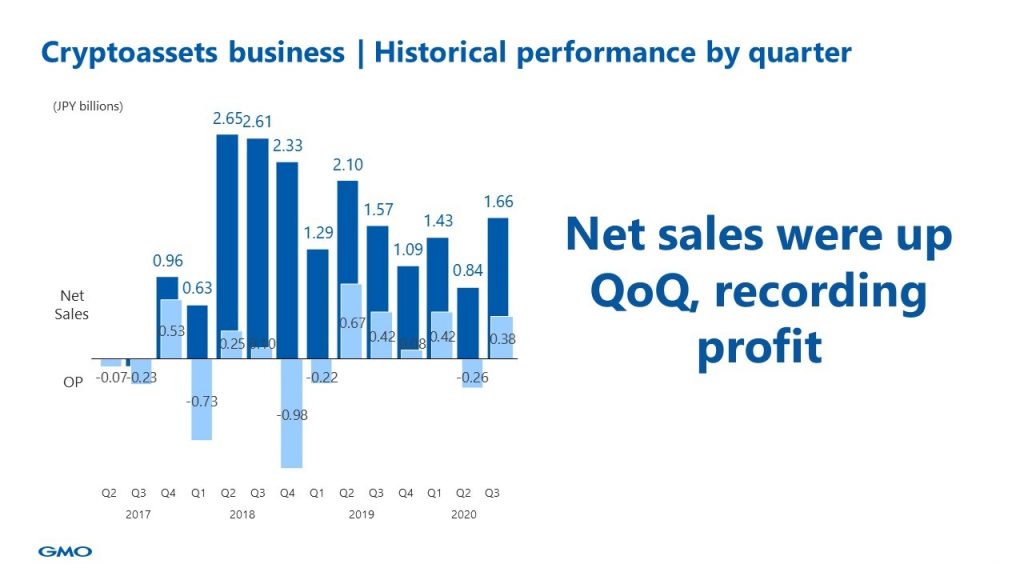

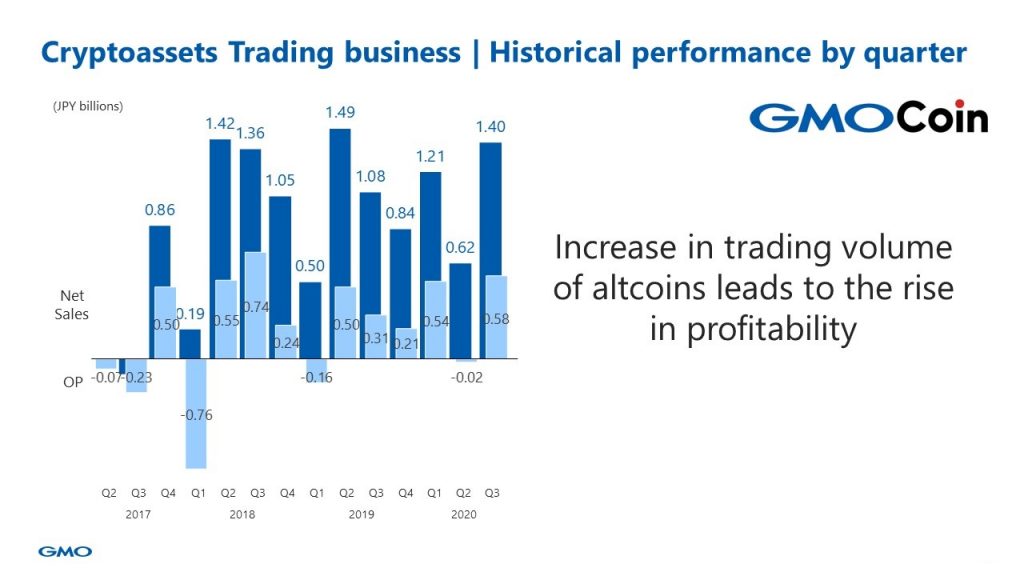

This is a transition of quarterly performance in the Cryptoassets segment. The Cryptoassets segment’s net sales have been increasing since Q2 and the segment has recorded a profit.

================================================

■Cryptoassets segment: Cryptoassets exchange business

================================================

Regarding cryptoassets exchange business, both revenue and profit were up QoQ and YoY. Improvement in profitability was due to the increase in the newly added altcoin trading volume but trading value’s growth was sluggish.

================================================

■Cryptoassets segment: Cryptoassets mining business

================================================

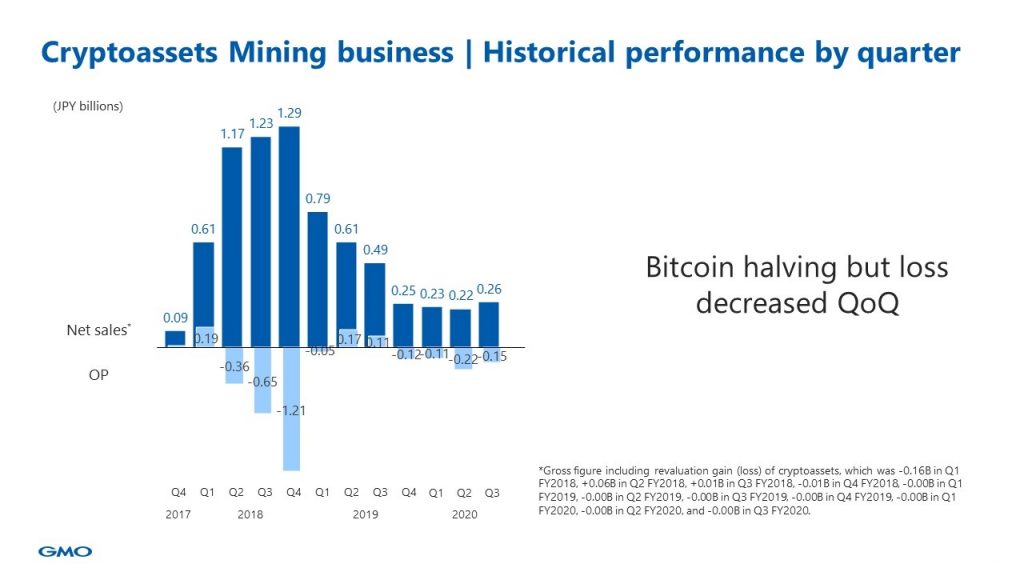

In the cryptoassets mining business, revenue increased and loss decreased quarter-on-quarter. Old mining facilities have been closed on June 30, 2020, and we have been operating only at new mining facilities since July 2020. Although our computational power expanded, new mining facilities did not operate stably at first because the power supply stopped temporarily. Bitcoin halving that came in mid-May led to a drop in mining profitability and a slight increase in the amount of mined Bitcoin.

We ask for your cooperation.

Internet for Everyone

▽back to presentation materials (here)

▽back to historical summery (here)