The following is an overview of the 3rd Quarter (July to September) FY12/2021.

=============================================

■Financial Overview

=============================================

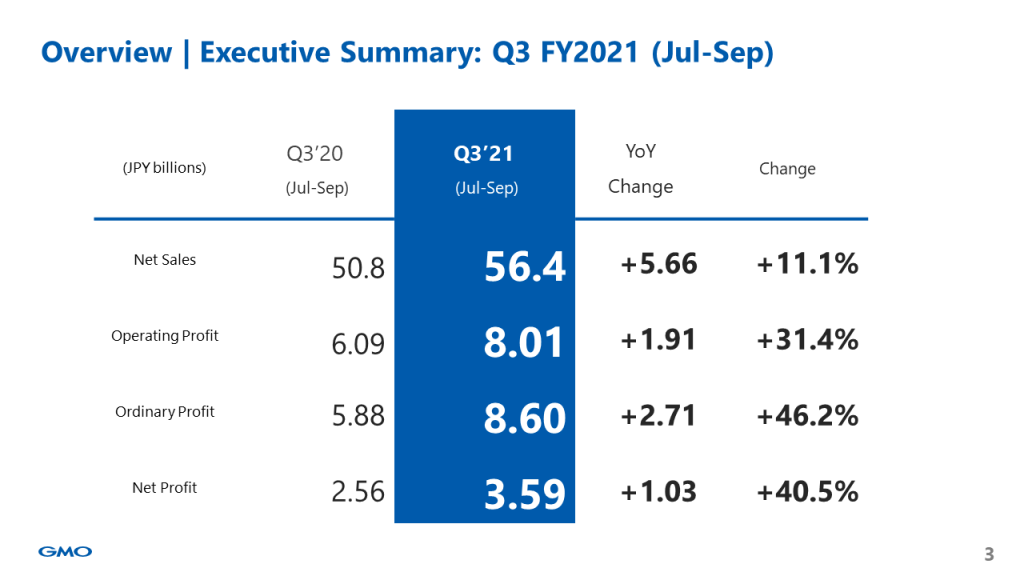

Here you can see an overview of Q3 FY2021 from July 1, 2021, to September 30, 2021.

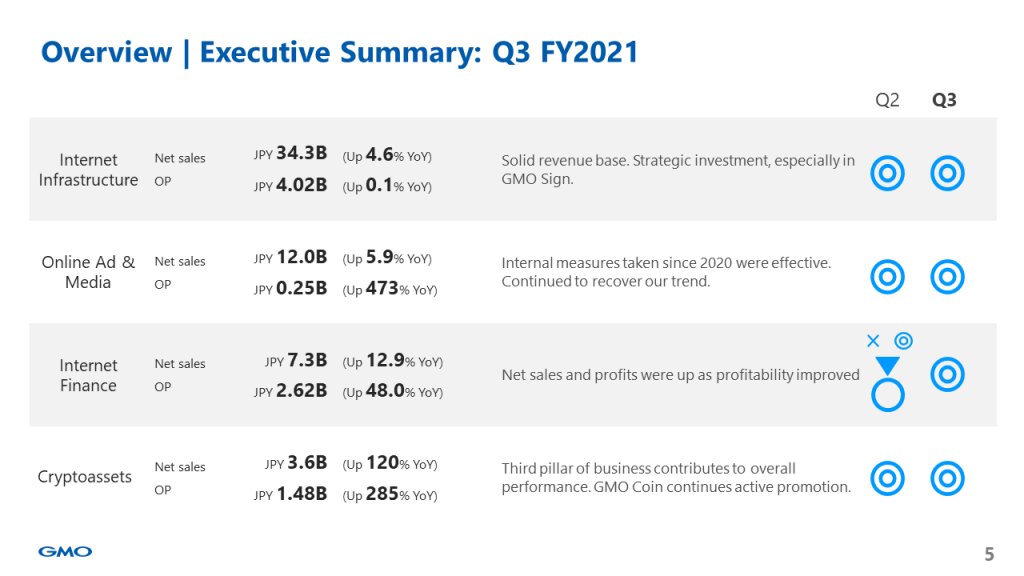

Both revenue and profit were up compared to the same period last year. Internet Finance and Online Advertisement & Media have improved and Cryptoassets business – as the third pillar of business – continues contributing to overall performance, based on the steady growth in the Internet Infrastructure segment.

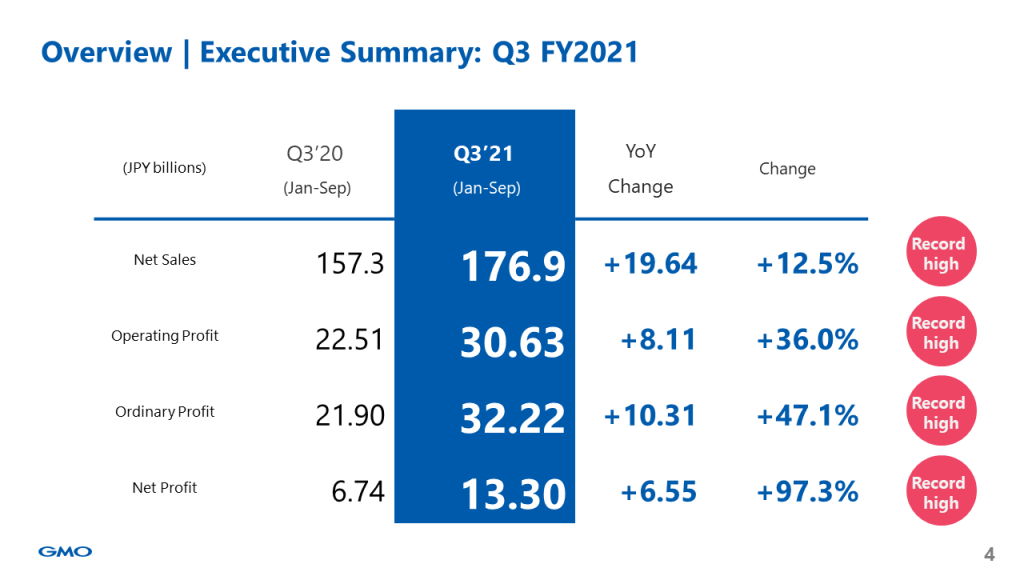

This is a financial summary for January to September. Net sales, operating profit, ordinary profit, and net profit achieved a record high. In Q3, operating profit, ordinary profit, and net profit exceeded the figures in 2021.

In a current business environment, although the number of group companies exceeded 100 – out of which 10 were listed subsidiaries – there was significant progress in terms of the motivation within the Group, creating various mechanisms, and the status of each business. In the third quarter, we felt more confident that we could continue to drive high growth rates over the next 3, 5, and 10 years.

The consolidated net sales and the consolidated operating profit increased by 5.6 billion yen and 1.9 billion yen year-on-year, respectively. We recorded impressive year-on-year growth as the overall performance of Cryptoassets – the third pillar of business – expanded and the profitability of Internet Finance increased compared to the previous year.

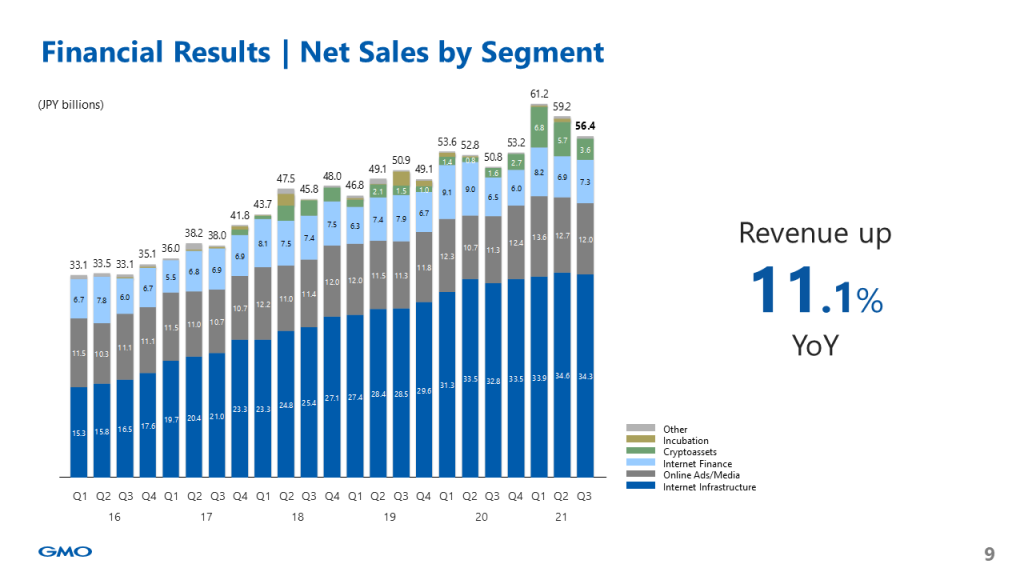

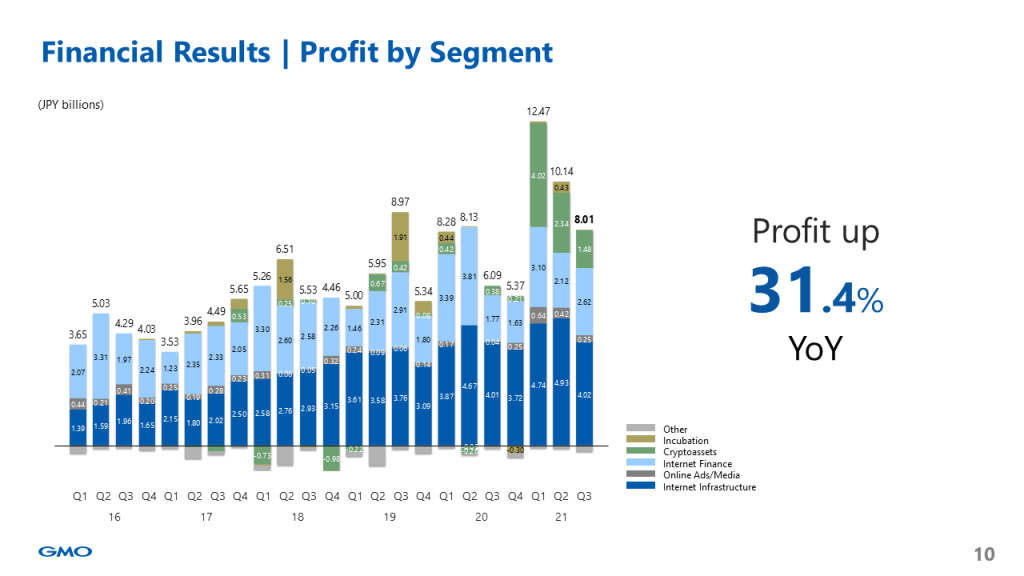

These are each segment’s quarterly net sales trends. This graph shows the sustainable trend growth of the recurring revenue base of the Infrastructure segment and the impressive contribution made by the Cryptoassets segment.

These are each segment’s quarterly operating profit trends. We continue to pursue high operating profit. However, the trading volume has decreased in the Cryptoassets business compared to the first half of 2021.

=============================================

■Internet Infrastructure

=============================================

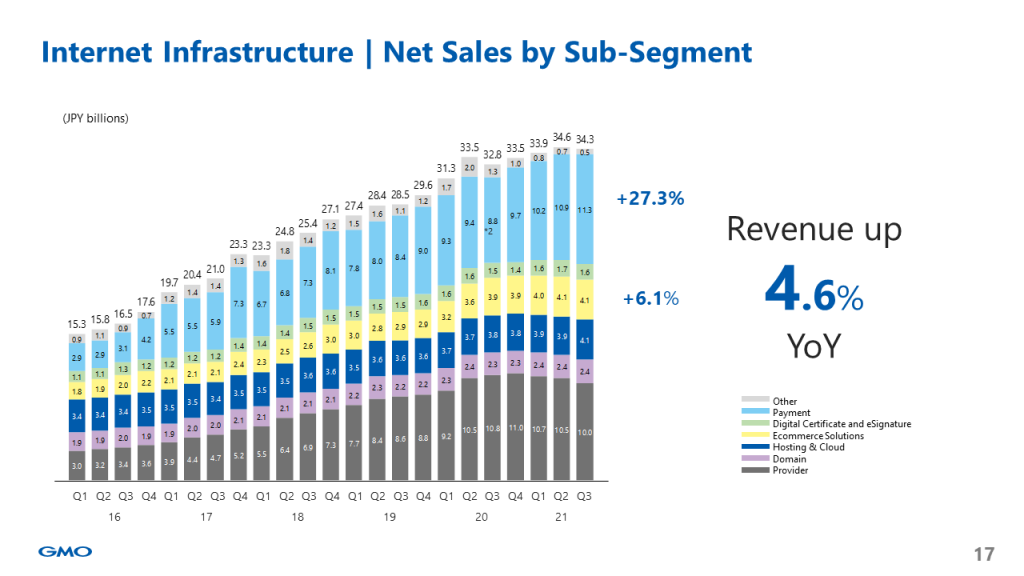

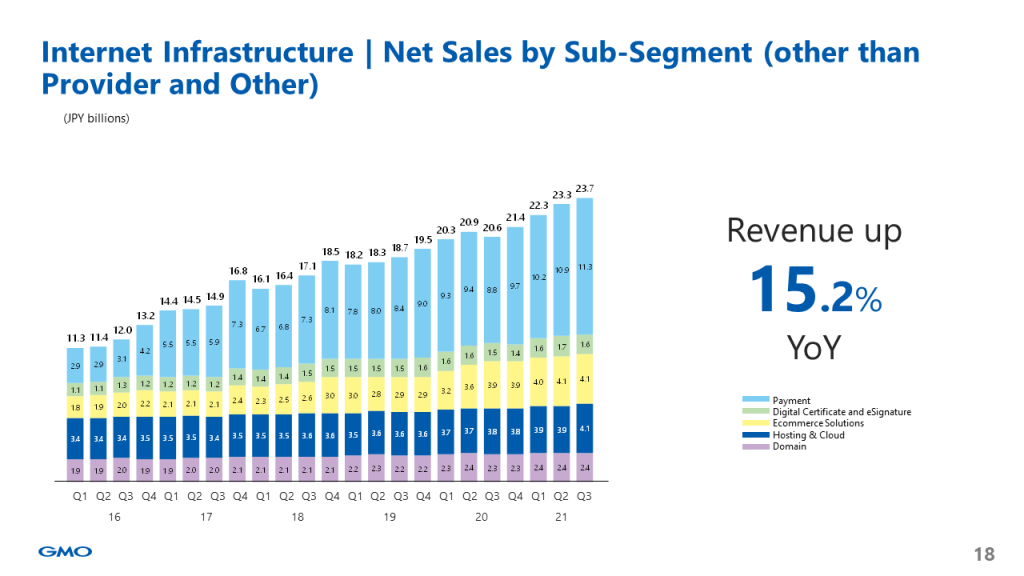

This is net sales in the Internet Infrastructure segment and its breakdown. The Internet Infrastructure segment has been growing on an ongoing basis since Q2 FY2020 as online consumption has remained high due to stay-at-home orders and as the segment utilizes the strengths of the No. 1 services. In the payment business, sales of the terminal of stera, the next-generation payment platform offered by GMO Financial Gate, Inc., have increased. We expect that stera will generate a significant amount of transaction revenue in the future.

In addition, a change in the sales mix in the Provider business with a high sales composition ratio affected the trend of sales increase. Excluding the Provider and other Provider-related sales, the Internet Infrastructure segment experienced stable and continuous growth.

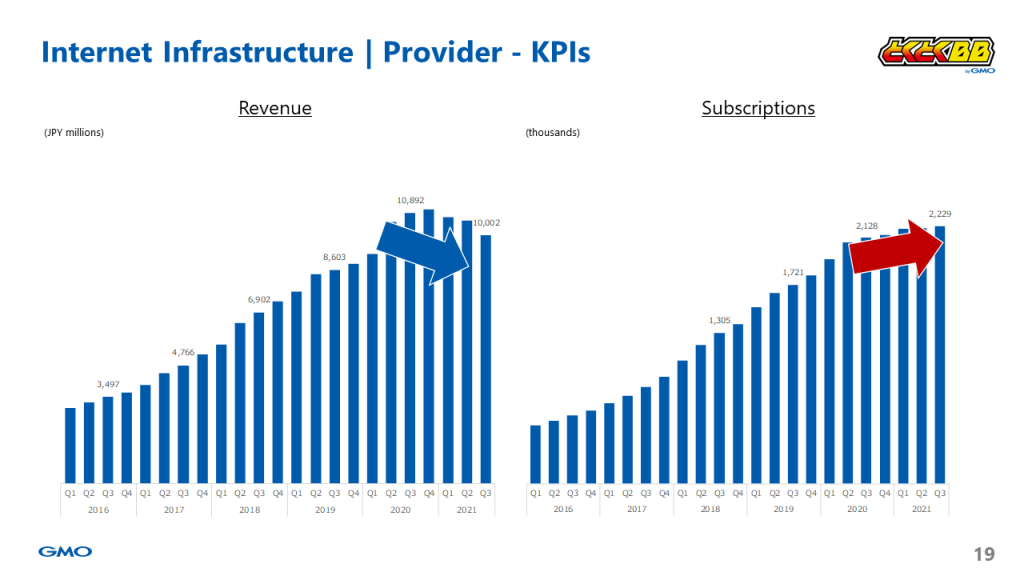

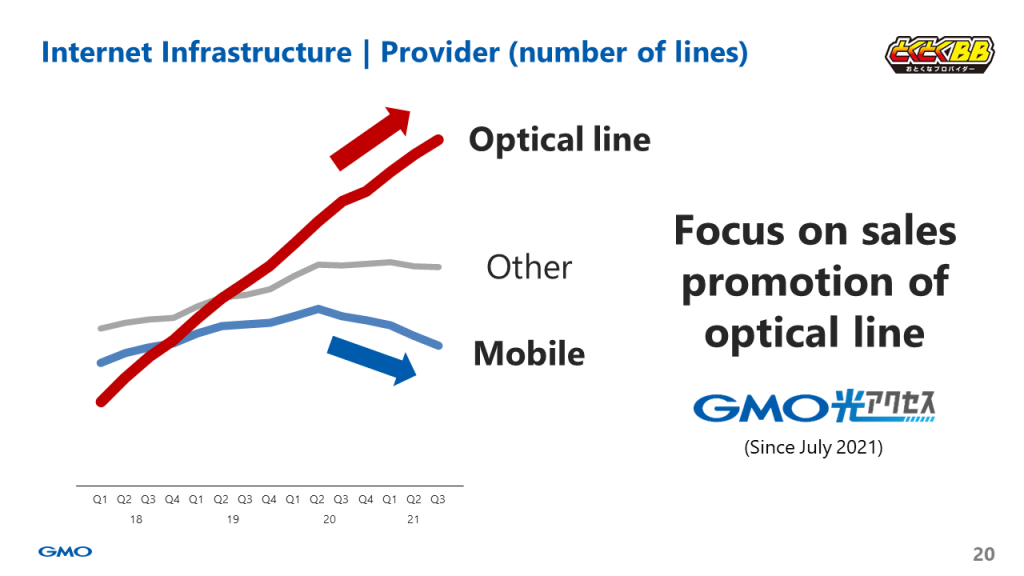

Next is the transition of KPIs, sales, and the number of lines in the Provider business. Although the number of lines continues to grow, sales are on a gradual downward trend. We will explain the breakdown of the number of lines and the changes in the sales mix.

The graph shows the number of lines categorized into optical lines, mobile lines, and others. The optical lines shown in red are performing well for the remote business. This is mainly recurring revenue. On the other hand, the blue line shows a net decline in mobile lines since Q2 last year due to line quality problems and the low-priced plans by major carriers. Since the total revenue is comprised of the initial fee plus recurring revenue, the initial unit price will be high. The Provider business is weak as these mobile lines are weak. The impact of the weak mobile lines is expected to remain until the first half of 2023.

On the other hand, as for the profit impact, the recurring profit of optical lines will accumulate in the future, so the impact on segment profit will gradually improve. Please be expectant about this increase in the number of lines in the future. Going forward, we will focus not only on the optical lines of other companies such as docomo Hikari but also on the promotion of our own brand GMO Hikari Access, which is selling well.

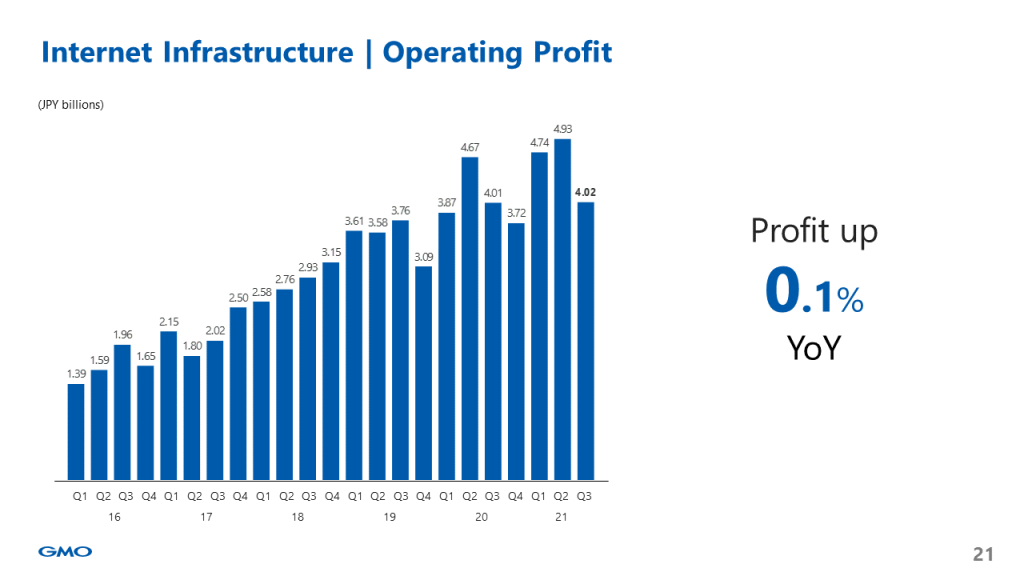

The growth trend of quarterly operating profit also continues but it has increased only slightly due to the impact of investment in GMO Sign and the start of amortization of goodwill.

=============================================

■Online Advertising & Media

=============================================

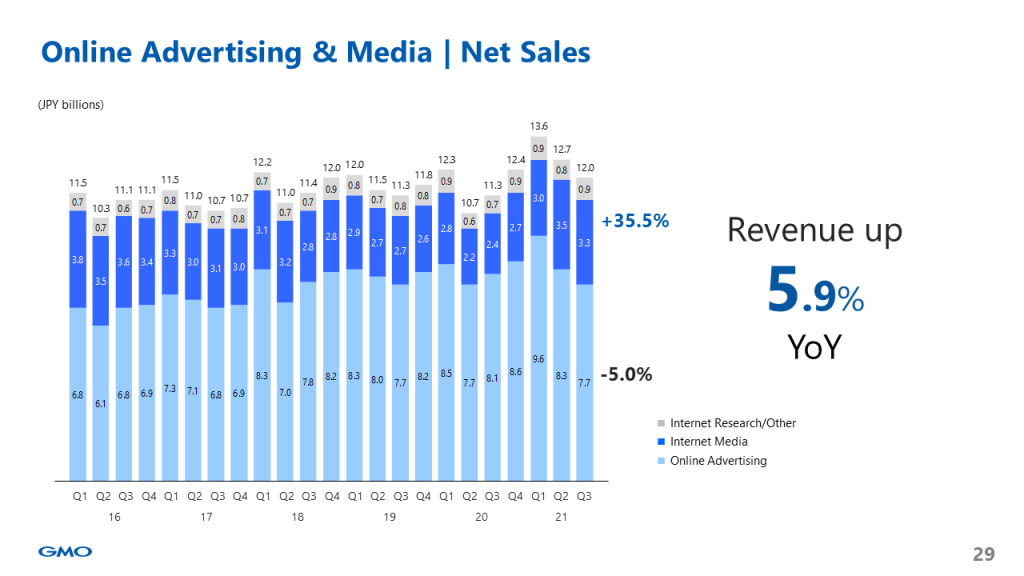

This is net sales in Online Advertising & Media and its breakdown. The net sales of internet advertising and media are up 5.9 percent year on year. For Online Advertising, while affiliate advertising grew, net sales were down compared to the same period last year when the demand of some customers increased due to stay-at-home orders, and standards of ad network advertisement distribution assessment were tightened, which also resulted in YoY losses. On the other hand, the net sales of Media have increased as the ad’s unit price is recovering its trend as opposed to the same period last year when Media has suffered due to the COVID-19.

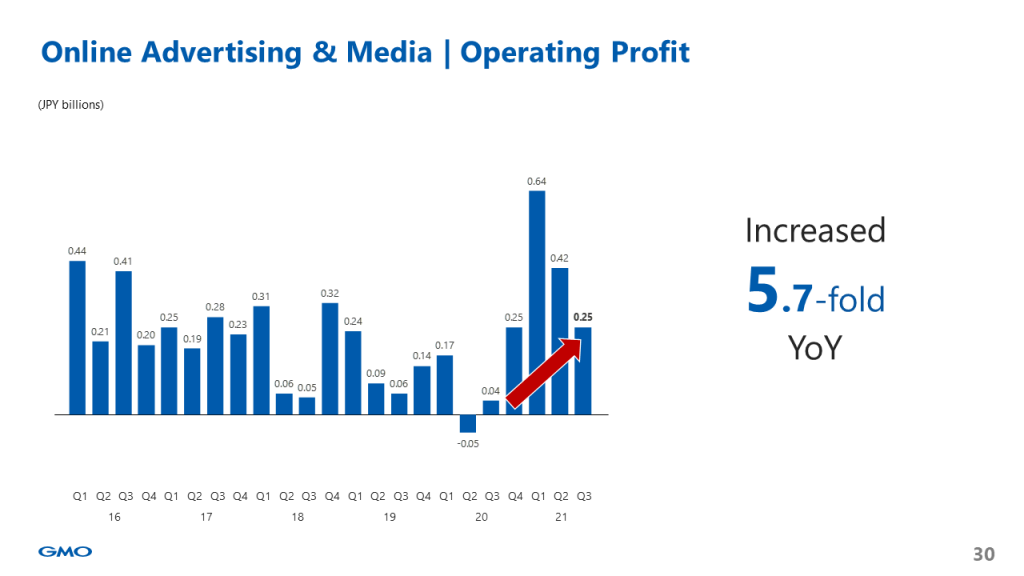

Shown here are Online Advertising & Media segment’s profit trends by quarter over the past 6 years. Profit has bottomed out last year and is now recovering. We have been expanding our Online Advertising & Media business by replacing products, through the overhaul of the business processes, and by reducing costs, which are delivering good results. In Q3, business conditions were good as a whole although there were temporary factors as explained earlier. We will enhance the investment in Q4, mainly in media, as planned at the beginning of the period.

=============================================

■Internet Finance

=============================================

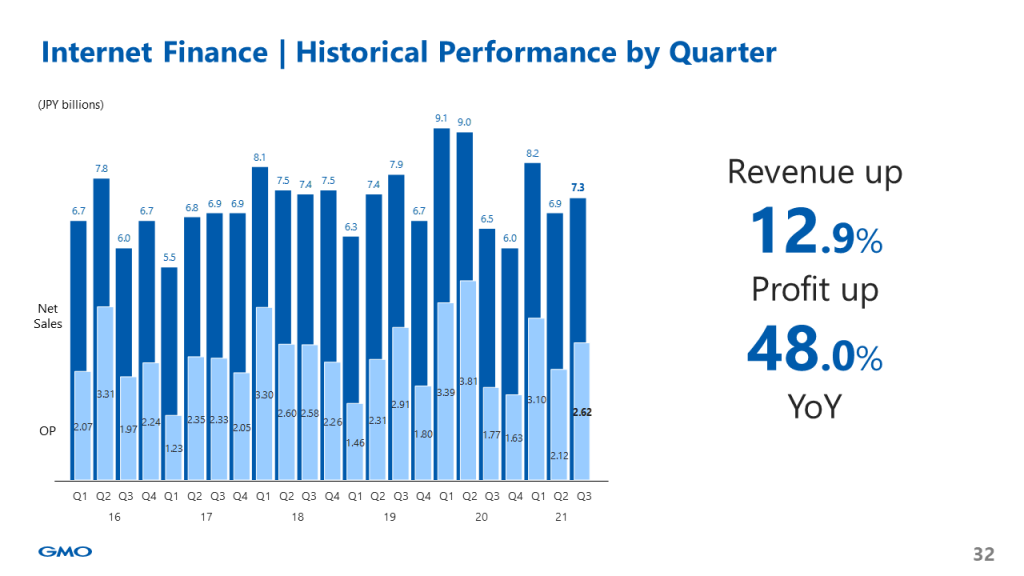

This is a transition of quarterly performance. For the FX, the profitability had worsened in the same period last year as the competition to offer thin spreads increased but there were no such competitions in 2021 and the profitability improved. The CFDs grew steadily, and both revenue and profit were up QoQ and YoY.

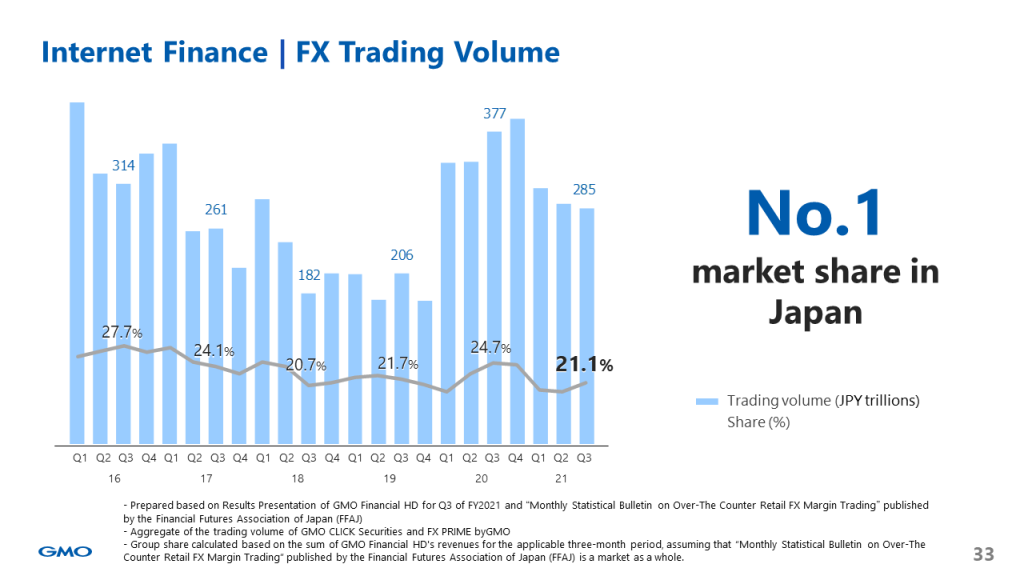

The lack of market volatility led to a decrease in FX trading volume. On the other hand, the market share of FX continues to be No. 1.

Although there isn’t much fluctuation in the FX trading volume as compared to the volatile market during the pandemic in 2020, it has remained high. The domestic market share of FX continues to be No. 1. Gaika ex byGMO, Inc. that has joined the Group will be consolidated beginning in Q4, and we expect the domestic market share will be 30%. We will strengthen synergies to remain No. 1.

=============================================

■Cryptoassets segment

=============================================

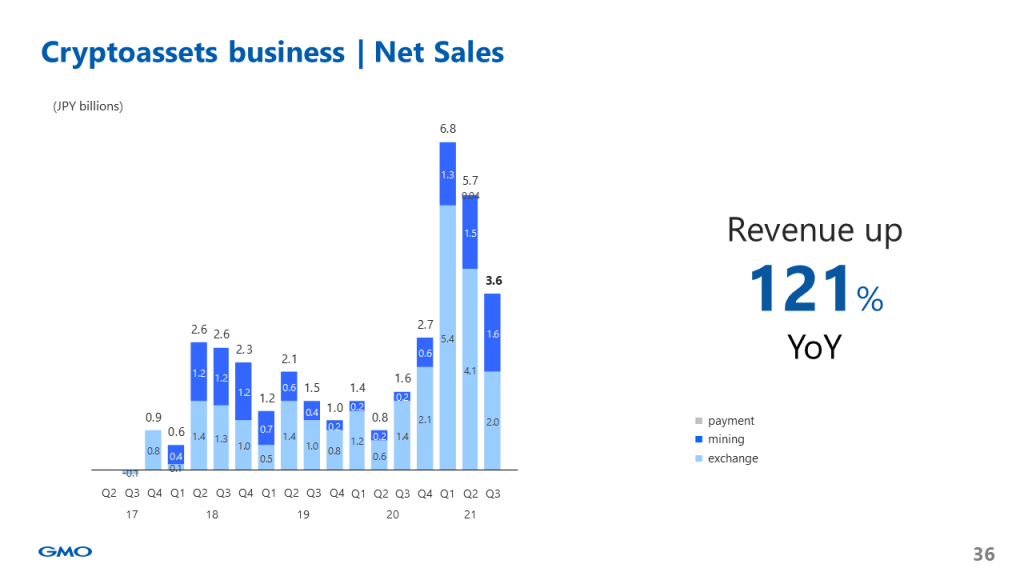

This is net sales in the Cryptoassets segment and its breakdown. The trading volume and revenue in the cryptoassets exchange business have been down compared to the volatile cryptoassets market in the first half of 2021. On the other hand, revenue in the mining business has remained stable despite changes in the external environment, such as cryptoasset price and the global hash rate.

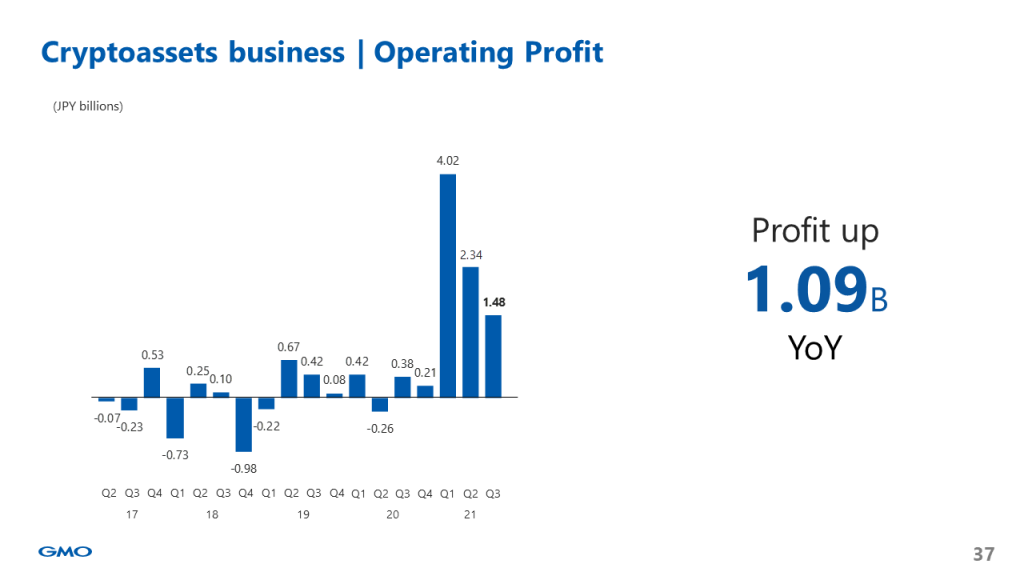

Shown here are the Cryptoassets segment’s profit trends by quarter over the past 5 years. Operating profit increased by 1.09 billion yen year-on-year, and the third pillar of business contributed to overall performance. Under such circumstances, GMO Coin is enhancing the marketing investment. It ran TV commercials mainly in the Kanto area in Q2, which received good reactions, and we confirmed that they were effective in terms of improving the visibility and the awareness of the group. It has started running TV commercials in a wider area in the fourth quarter, which is the 2nd phase of the company’s marketing plan. We believe that further improving the awareness of the group will lead to an increase in the number of accounts. The mining will continue business development.

==============================

■TOPICS

==============================

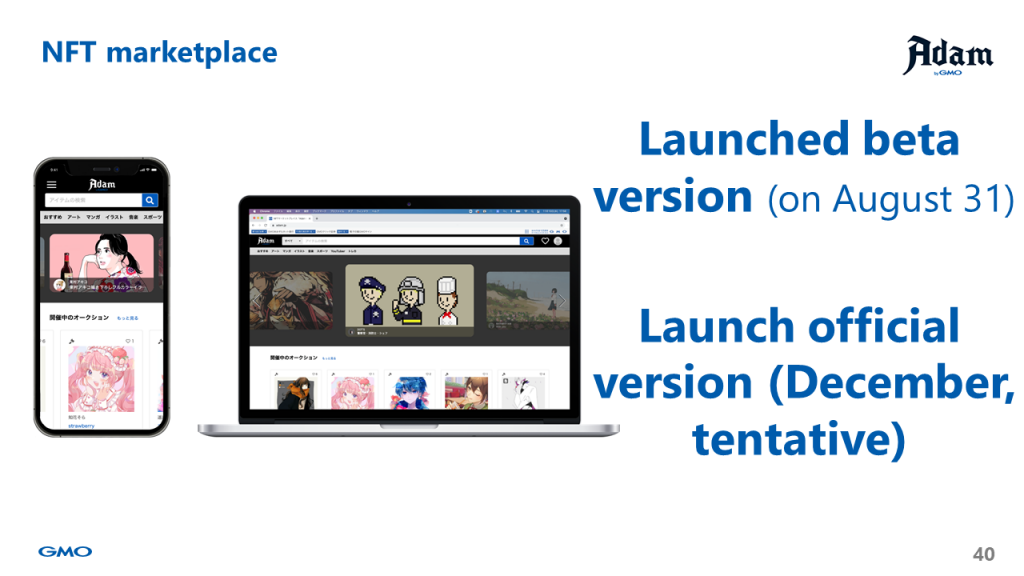

Regarding the NFT marketplace Adam byGMO, the beta version has been available since August 31, 2021, and the official version is scheduled to be released in December. In order to make it the No. 1 NFT marketplace that is easy for anyone to use, we are expanding the product lineup, developing a system such as a seller management screen that allows various people to sell, and supporting multiple languages. Please look forward to it.

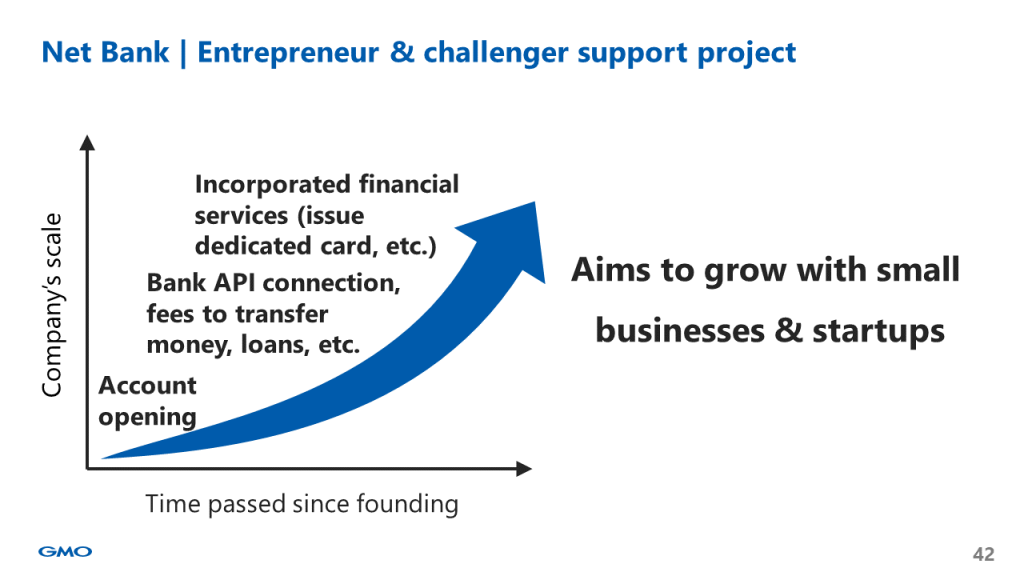

Next is GMO Aozora Net Bank, which will provide high-quality, low-priced services according to the growth phase of customers as an online bank that meets the needs of small and start-up companies, e.g. from a business account that is easy to open for small and start-up companies to bank API integration, the lowest fees to transfer money in the industry, loan provision, integration with built-in type financial services, and the issuance of a special card if a given company grows into a unicorn company.

By naming these initiatives “GMO Aozora Net Bank’s Entrepreneur & Challenger Support Project” and promoting them, we aim to grow together with small and start-up companies.

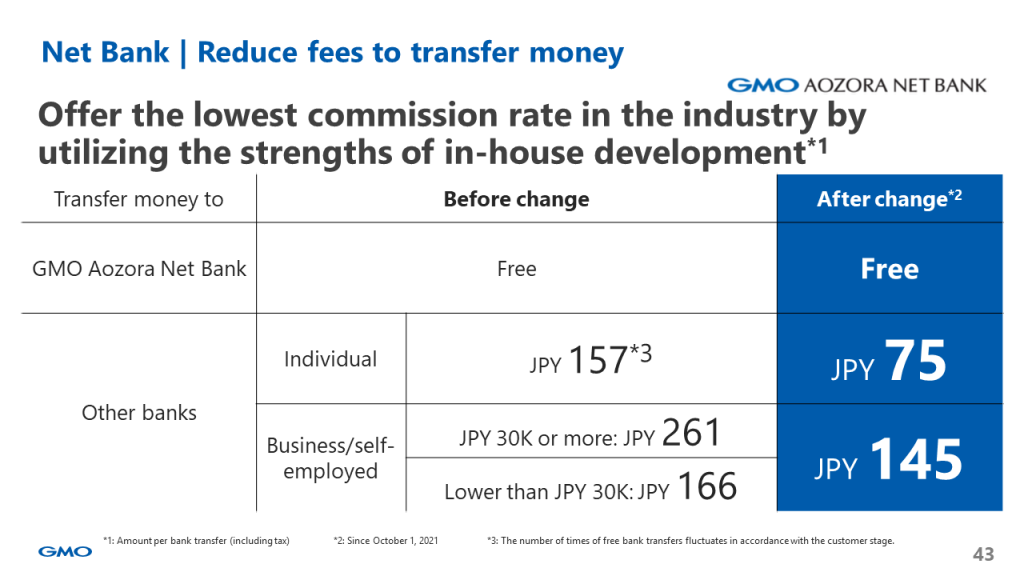

Providing cheap services is essential for the active use of accounts. Our fees to transfer money is the lowest in the industry. Regarding this fee change, the reduction of interbank fees by the Zengin Network has been the trigger. The other banks announced the price reduction on September 30, 2021, the day before October 1 when the change took place. We immediately decided to reduce the price to remain No. 1. Normally, it takes at least a month for other banks to place an order with a vendor in order to reduce the fee. We were able to immediately reduce the fee because of the in-house development of the system.

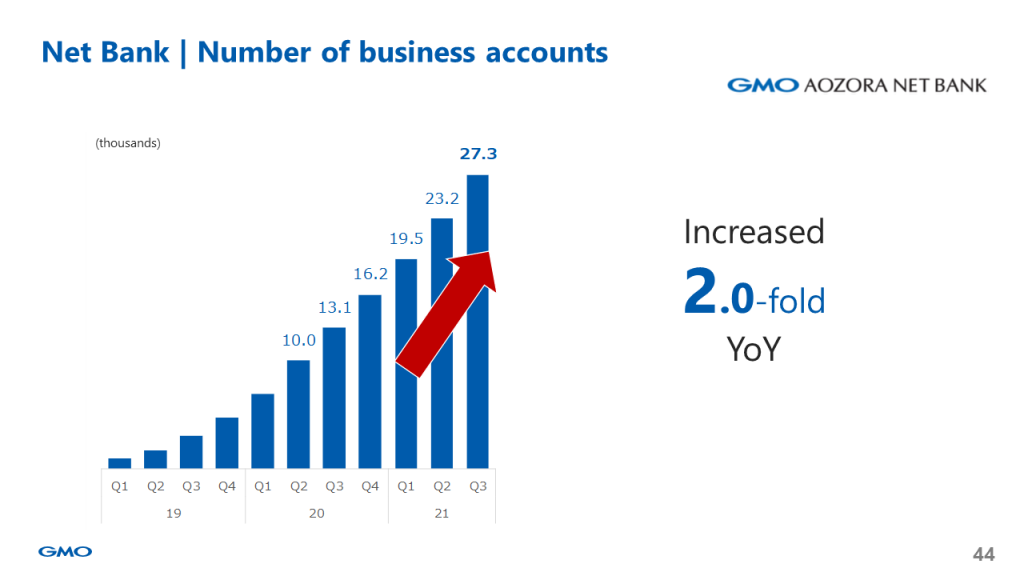

The number of business accounts is steadily increasing.

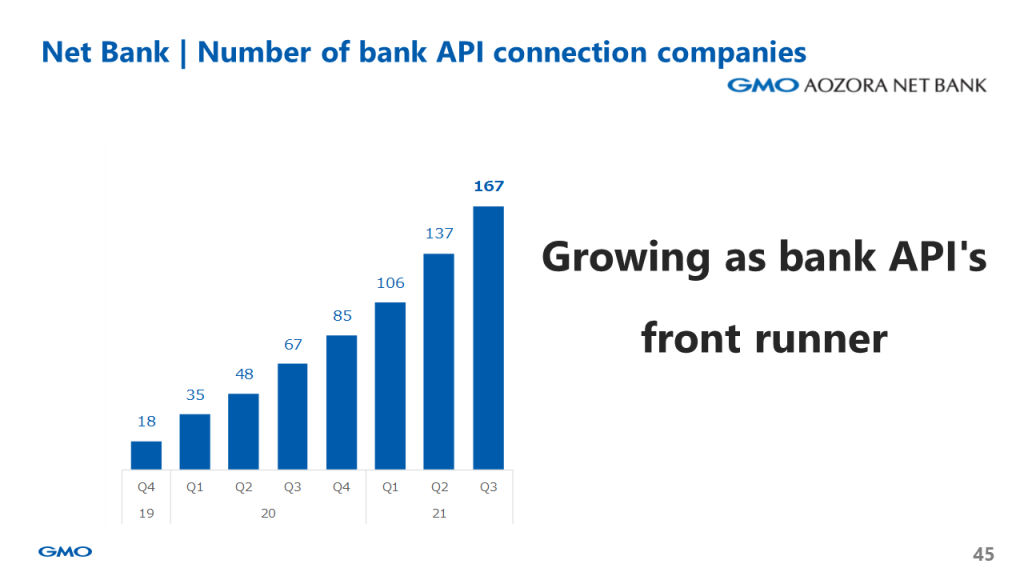

This slide shows the number of bank API connection companies. The bank API is a mechanism/specification for an external party to access banking functions such as balance inquiry and transfer. We provide this bank API free of charge but we regard it as an important KPI that will lead to future transfers. An operating company can incorporate the banking function into its services, contributing to the acceleration of DX. We will continue to grow as bank API’s front runner.

Last is our efforts in the next-generation air mobility area. Next-generation air mobility, flying cars, and drones have been booming recently. HONDA announced a policy to work on the electric vertical take-off and landing aircraft Honda eVTOL, and Marubeni announced that it would purchase 200 eVTOLs.

Why is the GMO Internet Group entering the next-generation air mobility space? That is because air is a market with the potential to be called the “final frontier of the businesses.” The market size of “flying cars” is predicted to reach 160 trillion yen in 2040. Flying cars similar to those that appeared in Back to the Future will become a reality in the not too distant future. Kumagai, the Group CEO, holds helicopter and airplane licenses and is most familiar with air among the owners of IT companies.

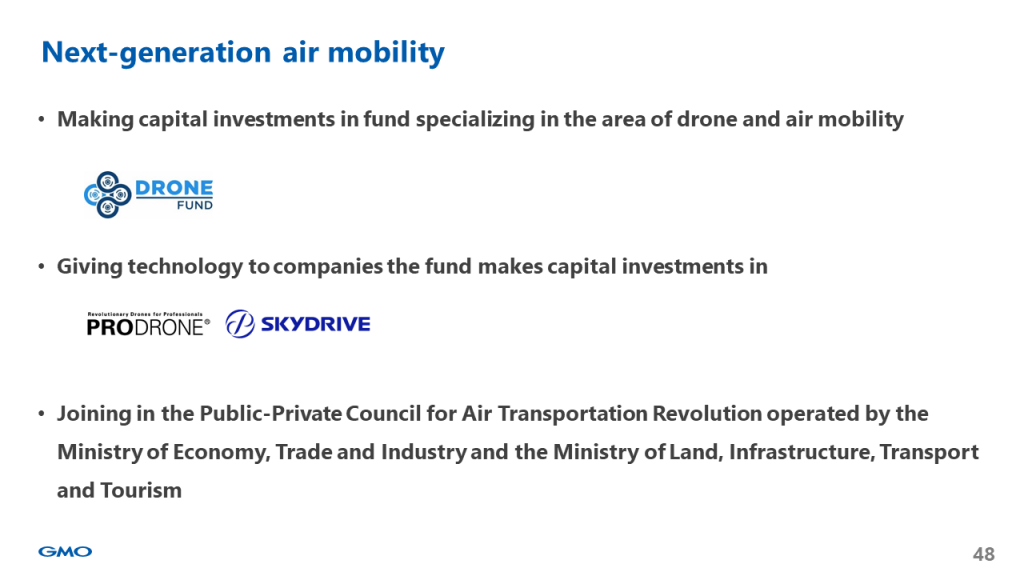

In the next-generation air mobility area, which is expected to be further developed in the future, we are working on the following three points.

(1) Making investments in drone fund, a fund specializing in the area of drone and air mobility

We have been investing in this fund – since 2019 – that aims to realize a “drone-based society” and an “air mobility society.”

(2) Giving technology to companies the fund makes investments in

GMO GlobalSign has been giving technology related to the security of communications and control of the drone to Prodrone Co., Ltd. and SkyDrive Inc. (DRONE FUND makes investments in Prodrone and SkyDrive).

(3) Joining in the Public-Private Council for Air Transportation Revolution operated by the Ministry of Economy, Trade and Industry and the Ministry of Land, Infrastructure, Transport and Tourism

Since May 2021, we have been participating in the “Public-Private Council for Air Transportation Revolution” operated by the Ministry of Economy, Trade and Industry and the Ministry of Land, Infrastructure, Transport and Tourism. We are also participating in a study group to launch the “flying car” into society in Expo 2025, Osaka, Kansai, Japan.

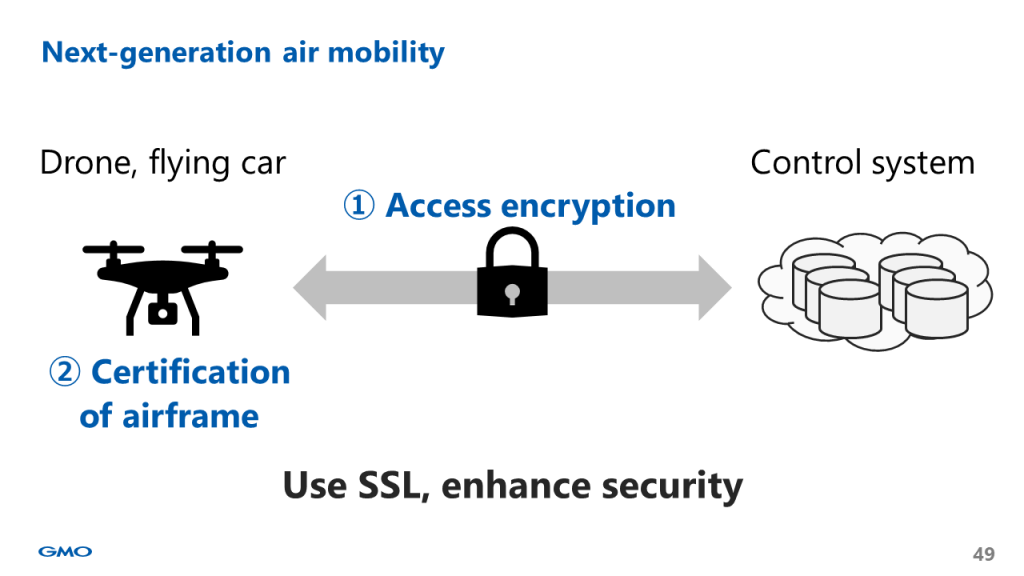

We give technology related to security to companies as the operation of drones and flying cars requires taking countermeasures against the issues of security risks, such as “takeover” of aircraft and operation systems and “fraud” and “eavesdropping” of communication data. We will contribute to the aspect of security by utilizing SSL of GMO GlobalSign, encrypting communication, and authenticating the aircraft. In the area of IoT where everything is connected to the Internet, the use of SSL will continue to increase. Please look forward to future developments.

▽back to presentation materials (here)

▽back to historical summery (here)