The following is an overview of FY12/2021.

=============================================

■Financial Overview

=============================================

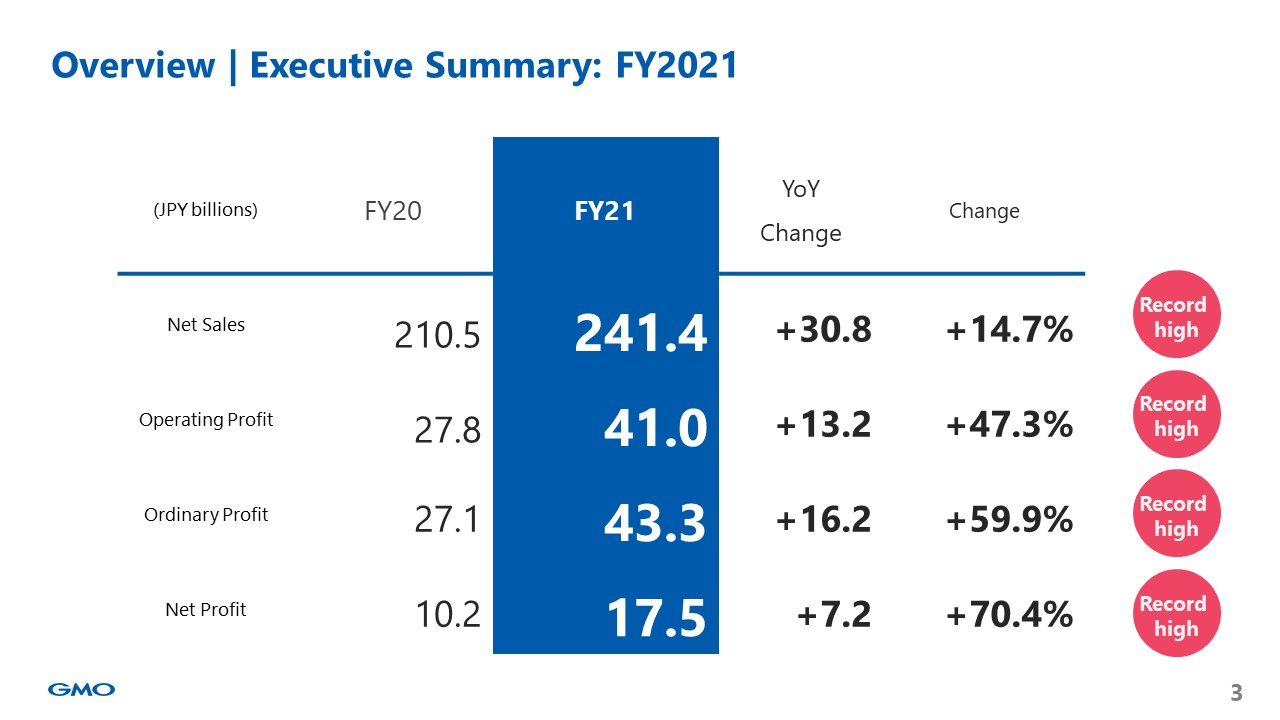

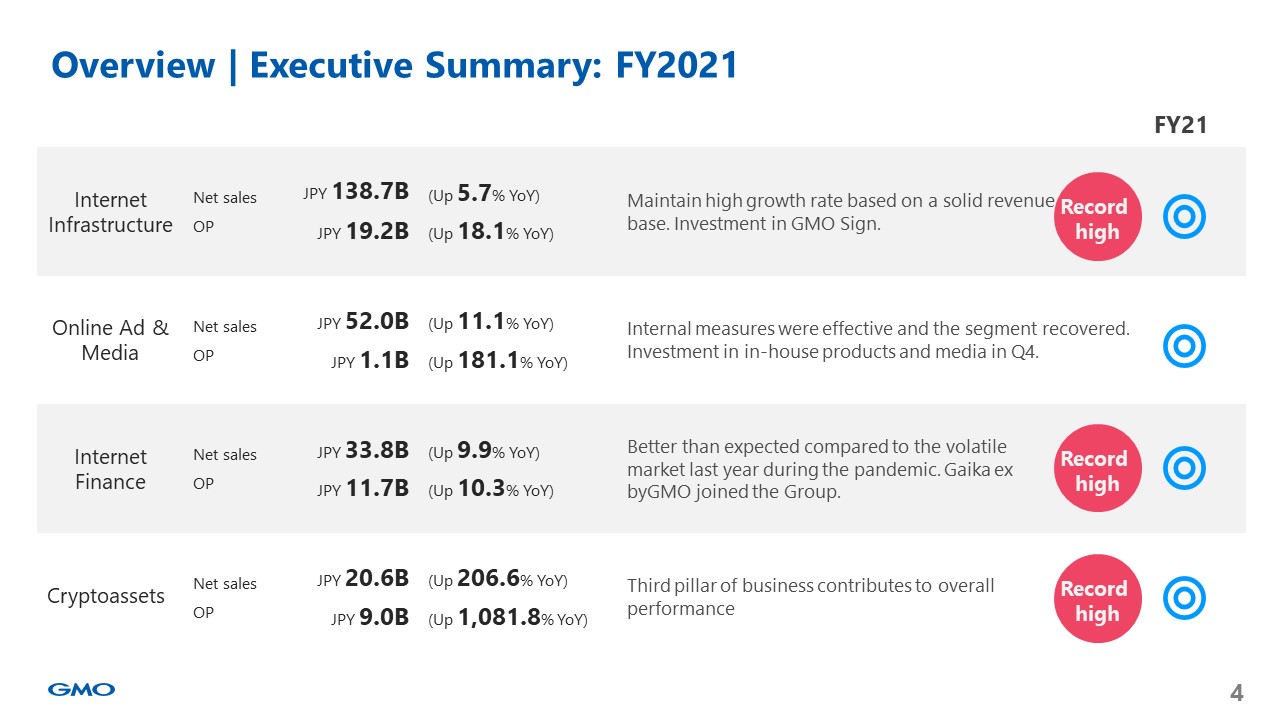

Both revenue and profit were up, reaching record highs.

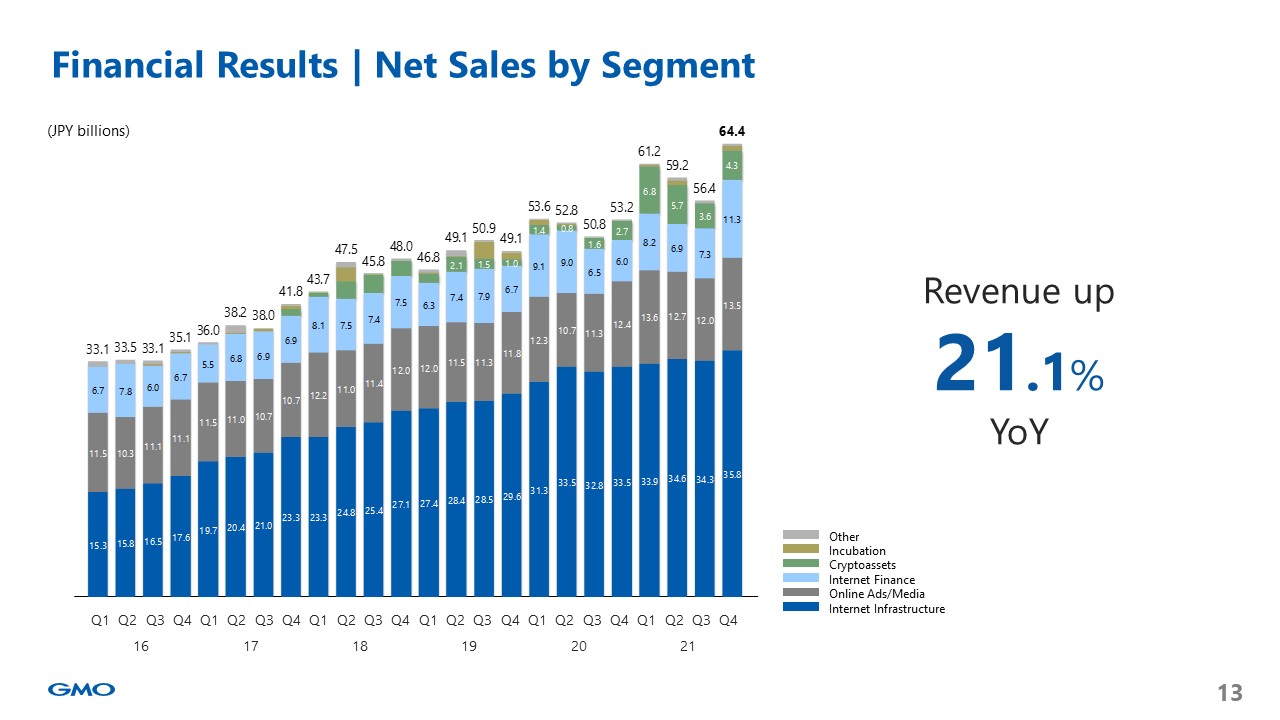

These are each segment’s quarterly net sales trends. This graph shows the sustainable trend growth of the recurring revenue base of the Infrastructure segment and the impressive contribution made by the Cryptoassets segment.

These are each segment’s quarterly operating profit trends. Internet Infrastructure and Internet Finance segments achieved growth, and the Cryptoassets segment contributed significantly to an increase in operating profit. This profit contribution showed that the cryptoassets business became the third pillar of business.

=============================================

■Internet Infrastructure

=============================================

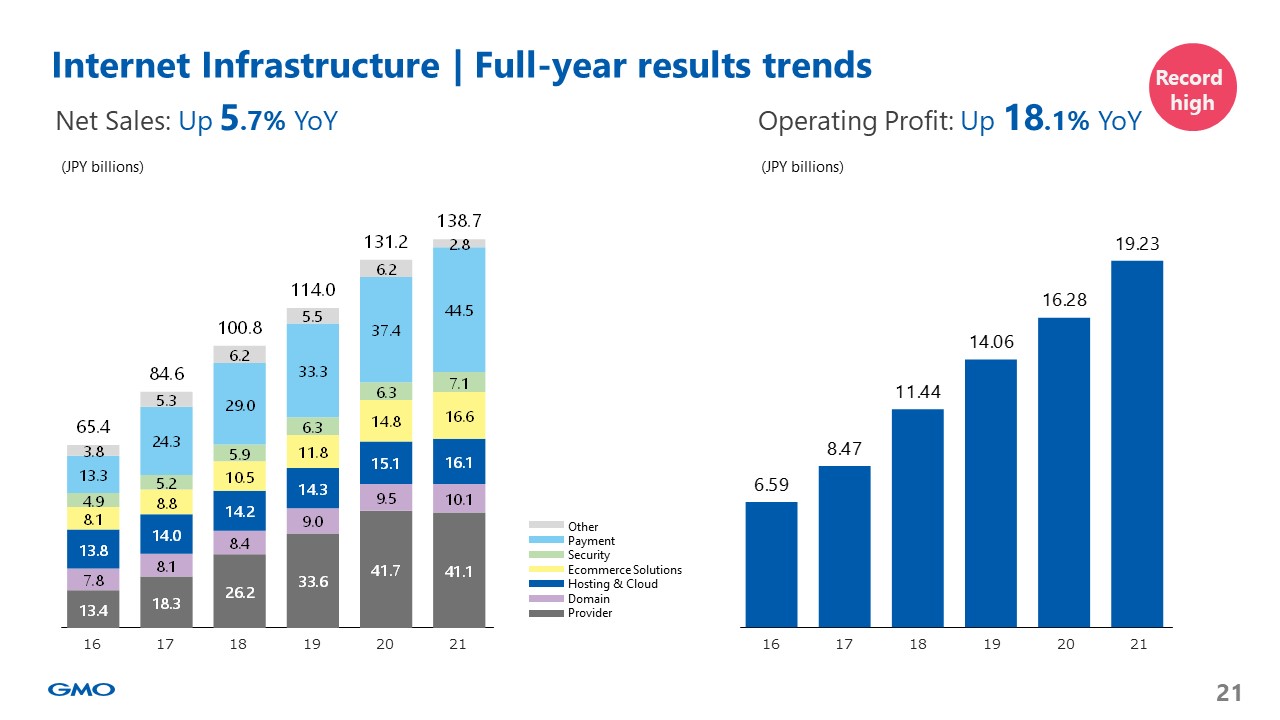

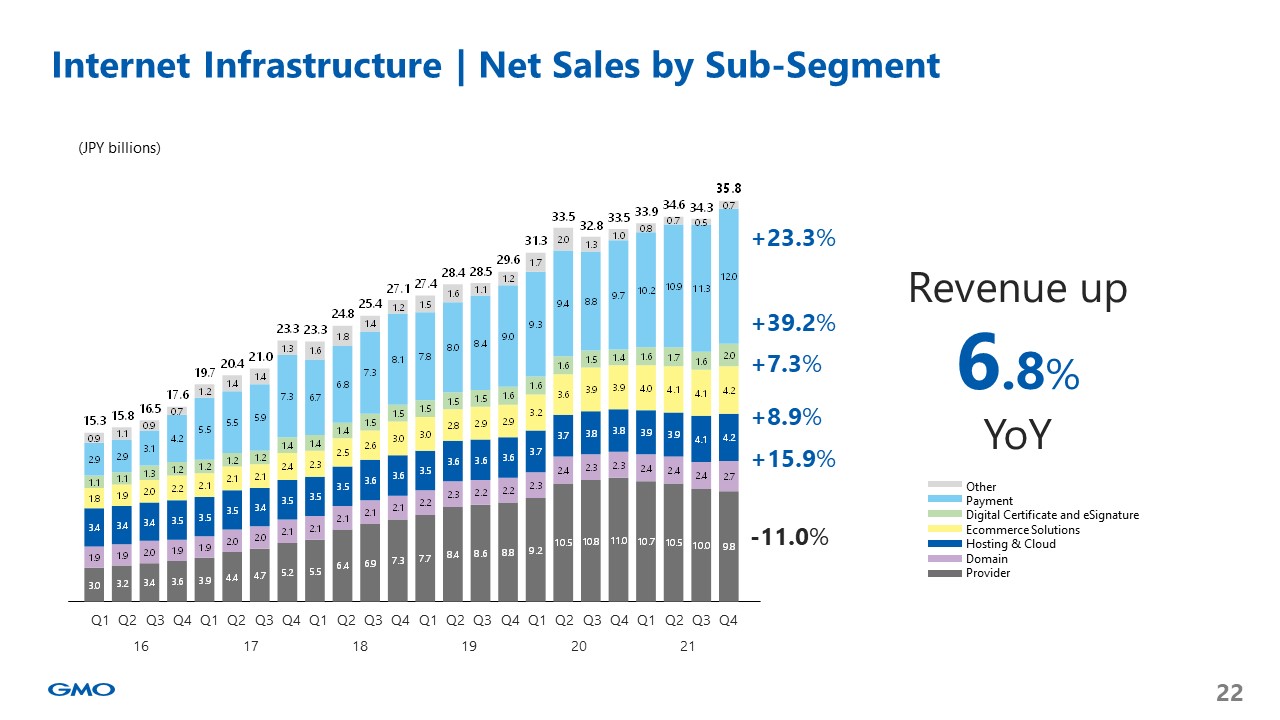

This is net sales in the Internet Infrastructure segment and its breakdown. The Internet Infrastructure segment has been growing on an ongoing basis since Q2 FY2020 as online consumption has remained high due to stay-at-home orders and as the segment utilizes the strengths of the No. 1 services. In the payment business, sales of the terminal of stera, the next-generation payment platform offered by GMO Financial Gate, Inc. that plays important role in offline payment, continue to increase. We expect that stera will generate a significant amount of transaction revenue in the future.

Effect due to change in the SSL expiration date was temporary and Digital certificate and eSignature recovered in Q4 and is now growing again. In addition, a change in the sales mix in the Provider business with a high sales composition ratio affected the trend of sales increase. As discussed in the last results presentation, we expect sales to increase again in the mid-term.

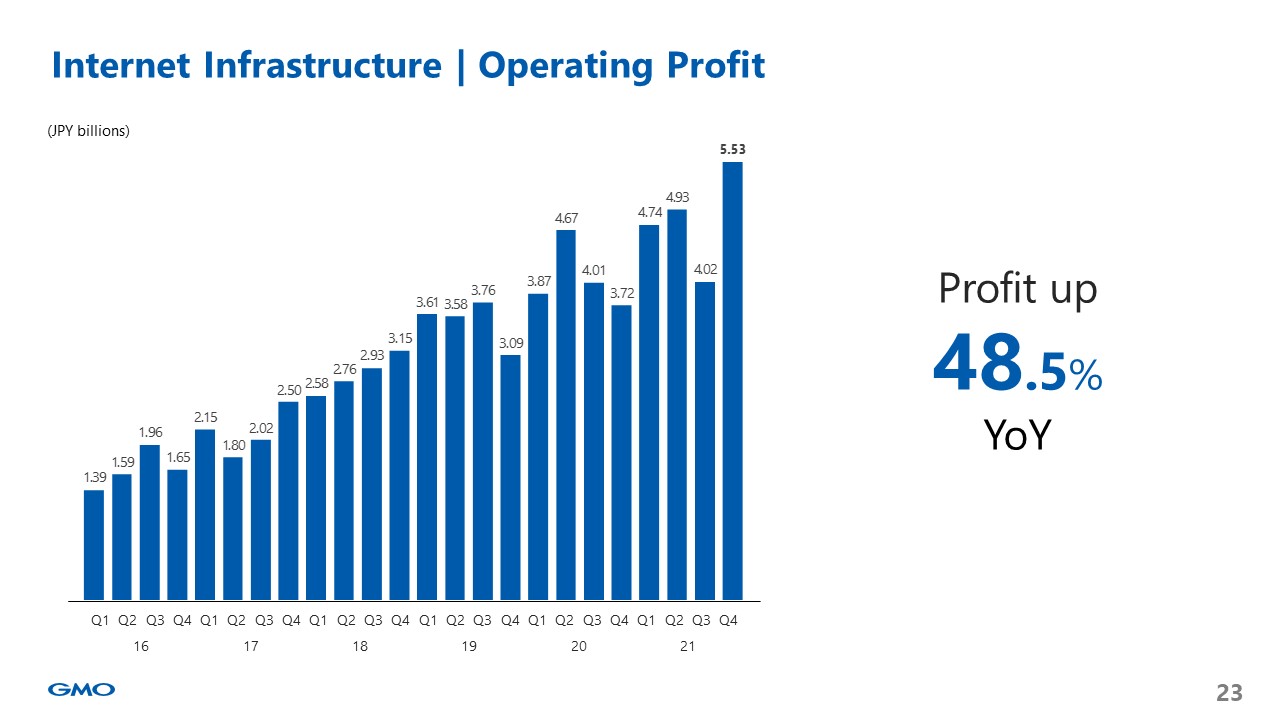

The growth trend of quarterly operating profit also continues. Profits increased steadily despite making an investment in GMO Sign.

=============================================

■Online Advertising & Media

=============================================

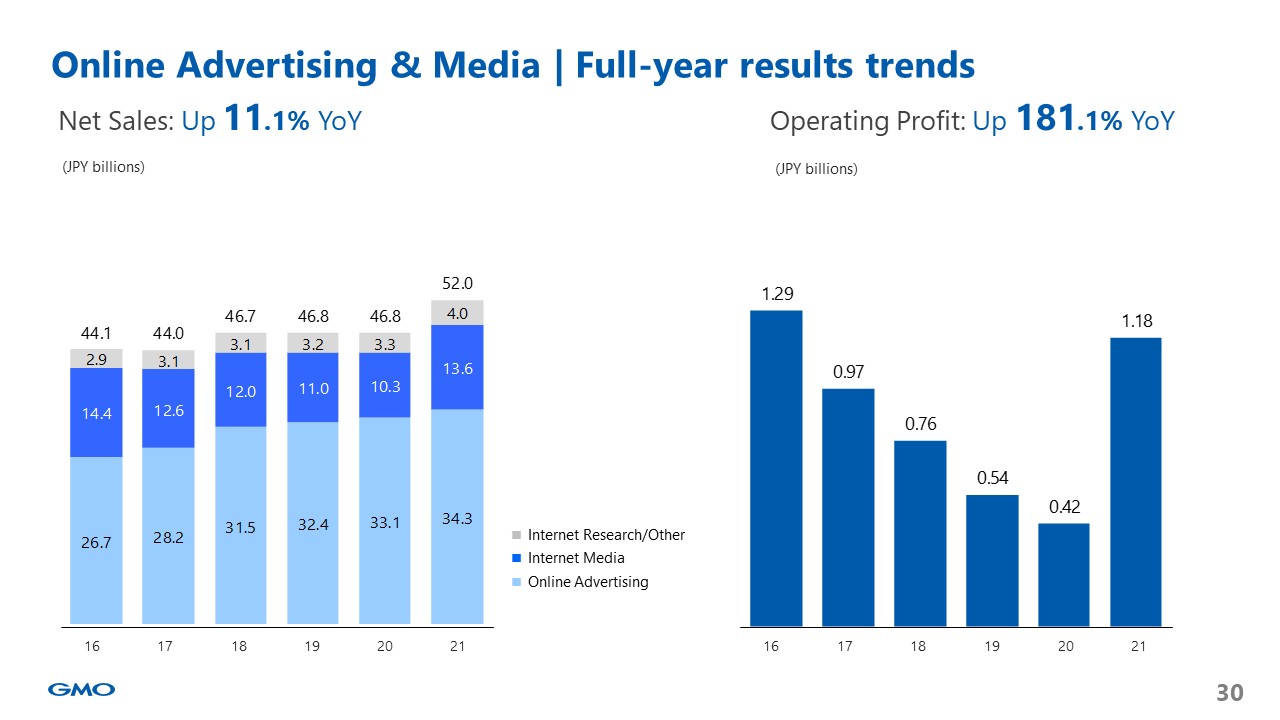

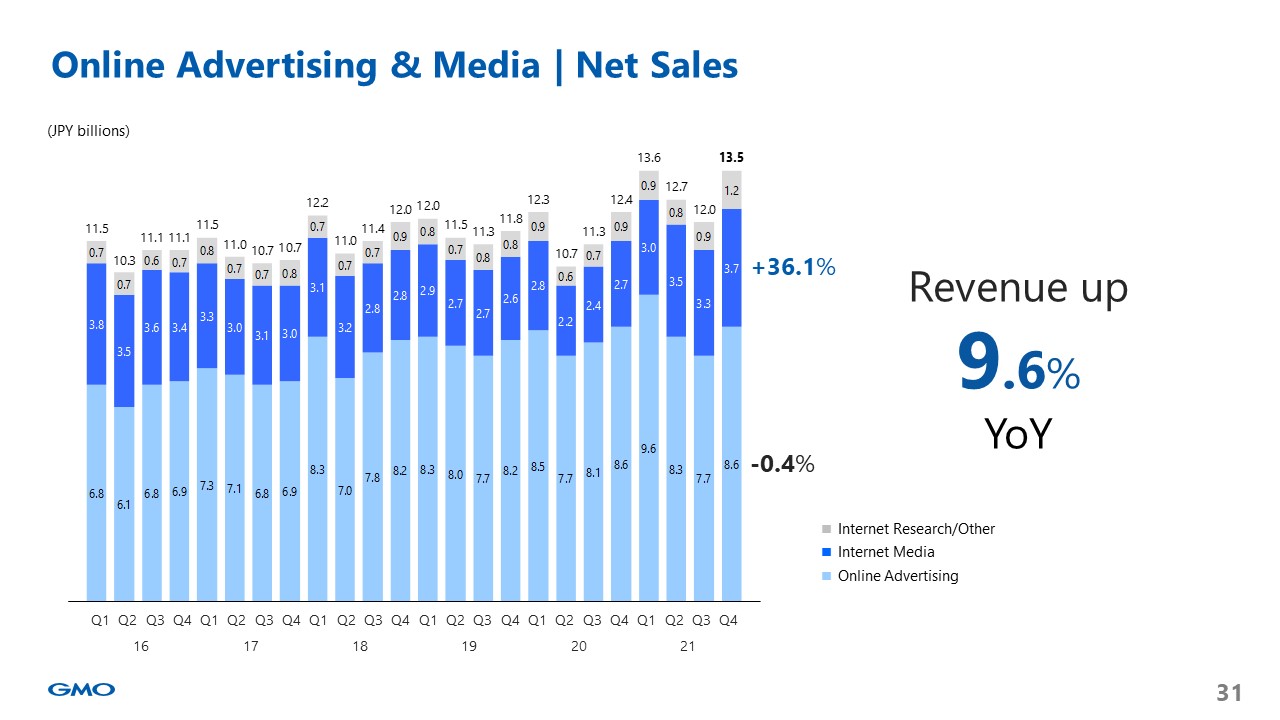

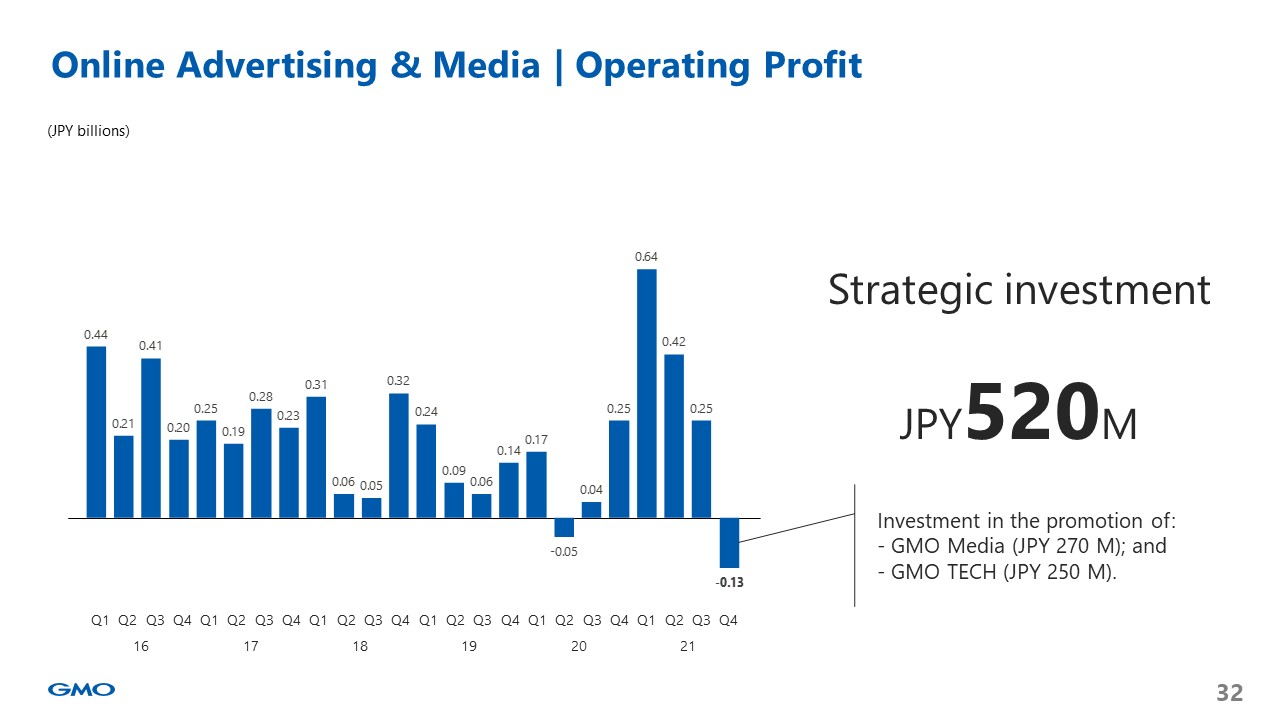

The next two graphs show the growth of Online Advertising and Media’s net sales and operating profit over the past six years. The segment is recovering despite making investments in Q4 due to the change in the external environment such as the initiatives to enhance in-house products and media and the recovery of the ad’s unit price of the media business.

For Online Advertising, while affiliate advertising grew, net sales were down compared to the same period last year when the demand of some customers increased due to stay-at-home orders, and standards of ad network advertisement distribution assessment were tightened in the third quarter and beyond, so the performance of this year was comparable to that of 2020. On the other hand, the net sales of Media have increased as the ad’s unit price is recovering its trend as opposed to the same period last year when Media has suffered due to the COVID-19.

Profit has bottomed out in the previous quarter and is now recovering. We have been expanding our Online Advertising & Media business by replacing products, through the overhaul of the business processes, and by reducing costs, which are delivering good results. Business conditions were good as a whole. GMO Media and GMO TECH invested approximately JPY 500 million in order to strengthen in-house products and media in Q4.

=============================================

■Internet Finance

=============================================

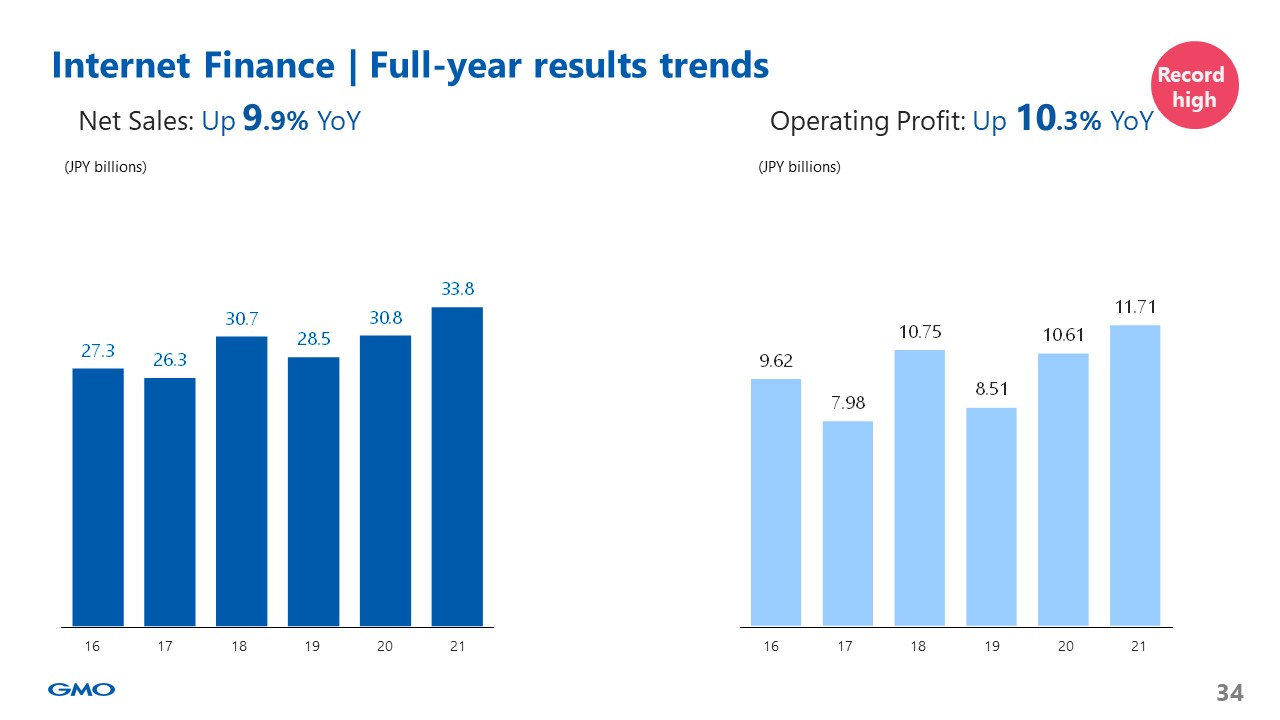

The next two graphs show the growth of Internet Finance’s net sales and operating profit over the past six years. We did better than expected compared to the same period last year, which saw the volatile market during the pandemic, and Internet Finance saw record-high earnings. In FX, a core product, both revenue and profit were up YoY as the profitability recovered due to the leveling of the competition in terms of spread, and also because Gaika ex byGMO joined the Group. Regarding organic growth, FX performed favorably because of the increased volatility of emerging countries’ currencies such as the Turkish lira.

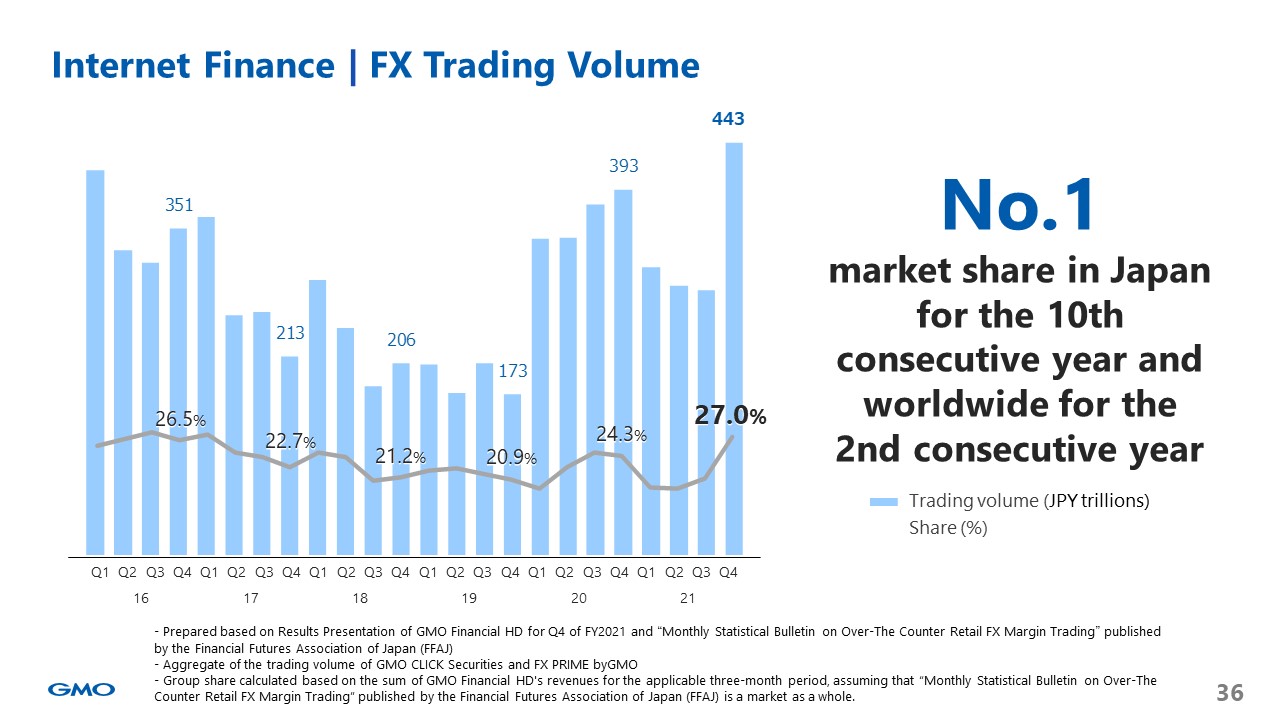

Trading volume grew quarter-on-quarter significantly due to the newly incorporated subsidiary, was No. 1 for the 10th consecutive year within Japan, and was also No. 1 in 2021 following 2020 in the world. We are aiming to expand the market share and improve the profitability as we continue to explore synergies to become No. 1.

=============================================

■Cryptoassets segment

=============================================

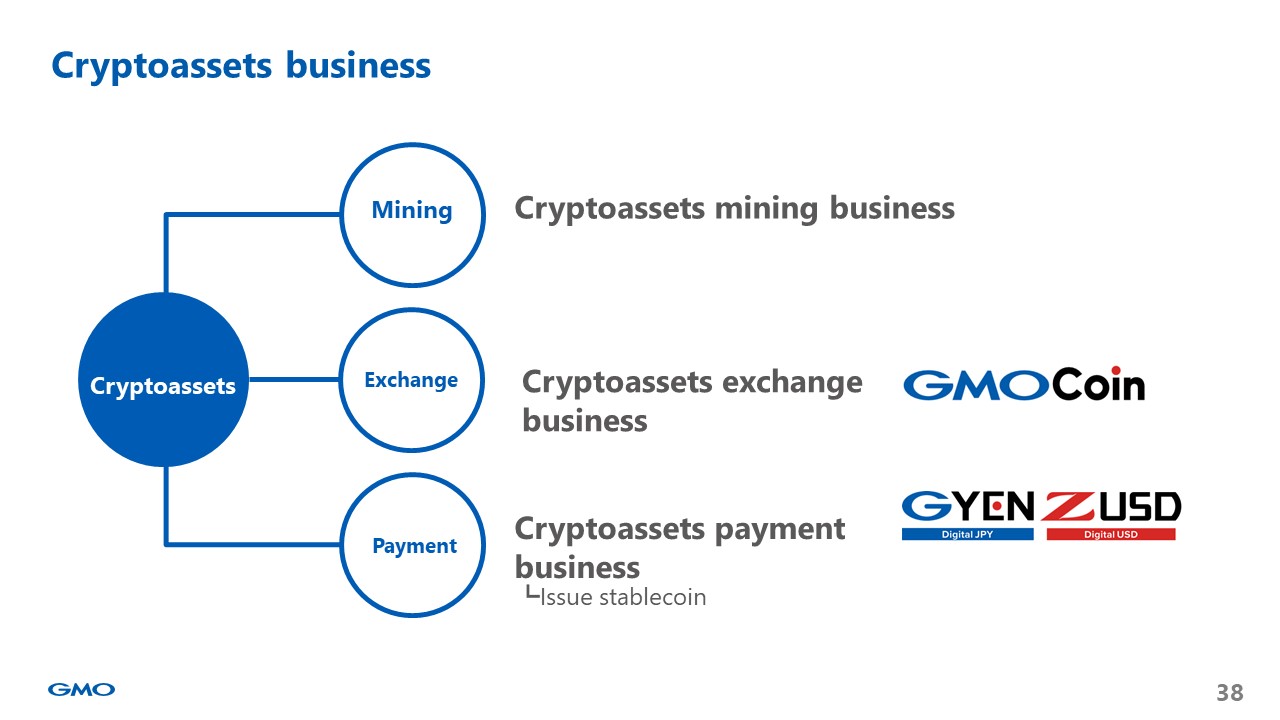

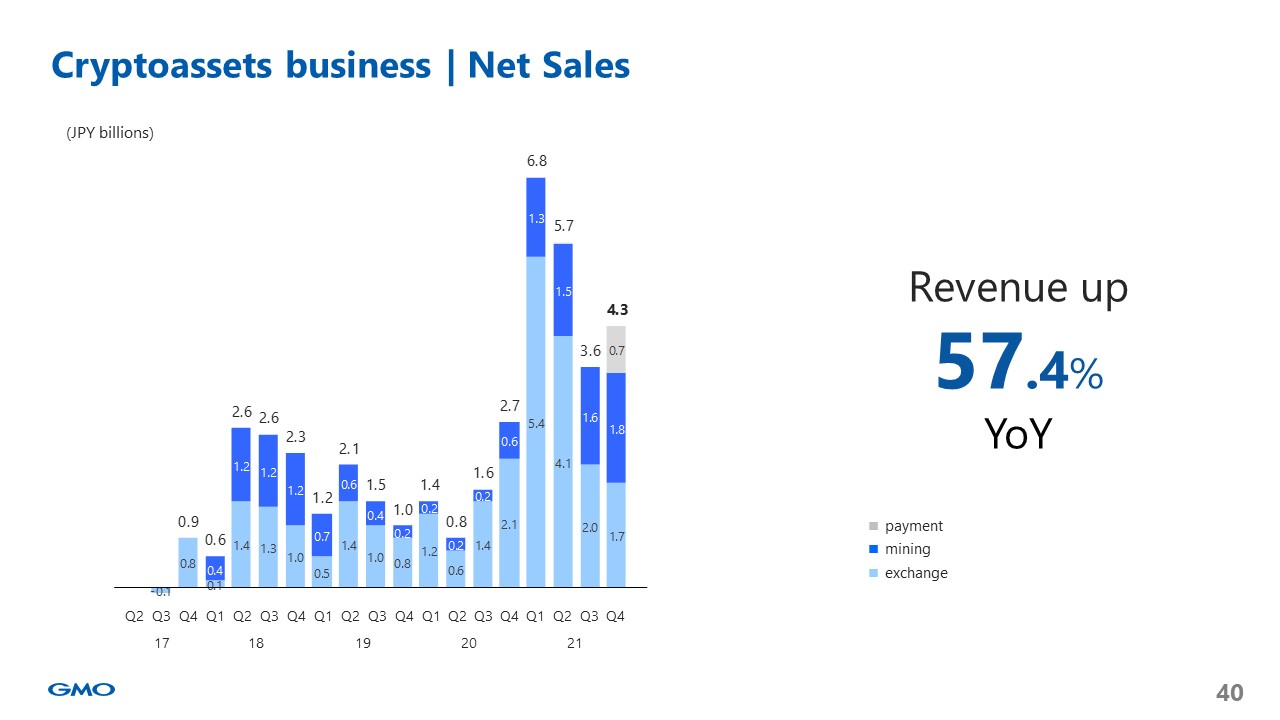

Cryptoassets business operates the following three services: cryptocurrency mining; cryptocurrency exchange, which mainly offers services under GMO Coin; and cryptocurrency payment that issues stablecoins.

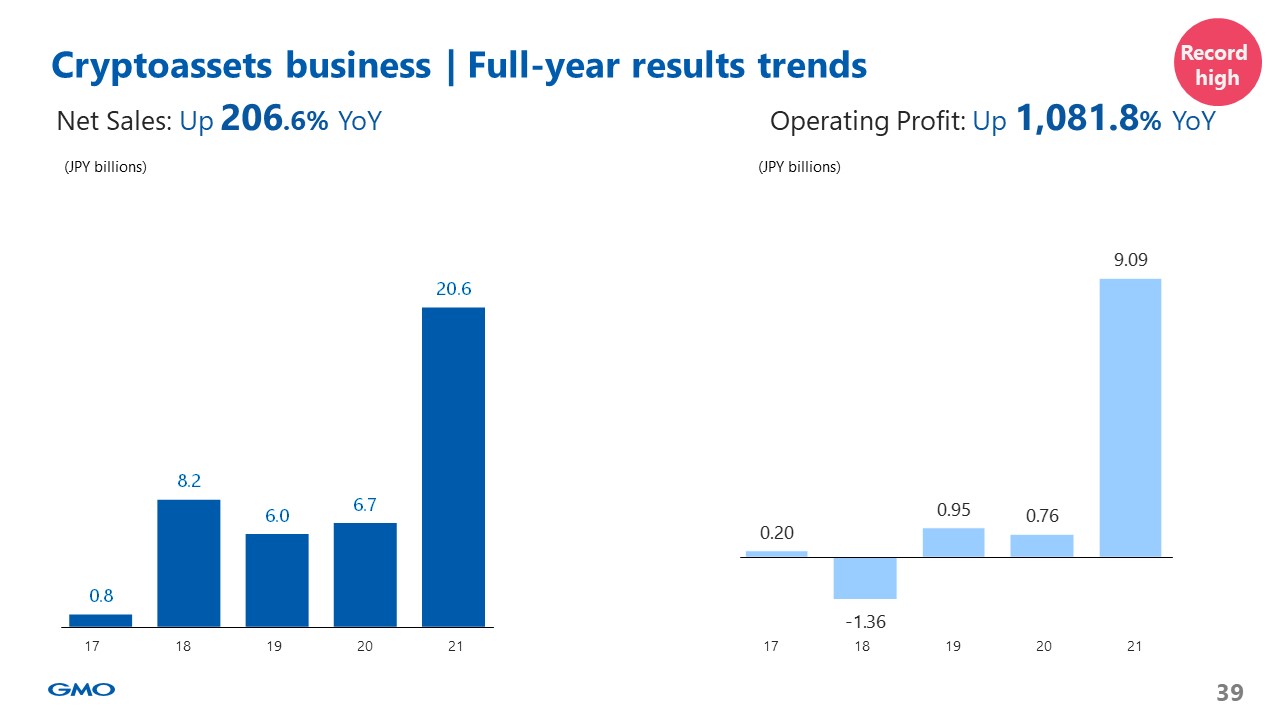

Both revenue and profit were up significantly YoY for the fiscal year 2021 as the transactions of cryptoassets grew rapidly in the first half of 2021 and also due to active marketing investment for the purpose of enhancement of awareness in the second half of 2021. We are running a highly profitable business utilizing financial technology, which is the strength of the Group, amid the significantly volatile cryptoassets market and we are aware that the third pillar of business has grown year on year.

The trading volume and revenue in the cryptoassets exchange business have been down compared to the volatile cryptoassets market in the first half of 2021. On the other hand, revenue in the mining business has remained stable despite changes in the external environment, such as cryptoasset price and the global hash rate. In the cryptoassets payment business, the trading volume of GYEN is growing rapidly as it is listed on the Coinbase, which has led to the posting of a temporary profit.

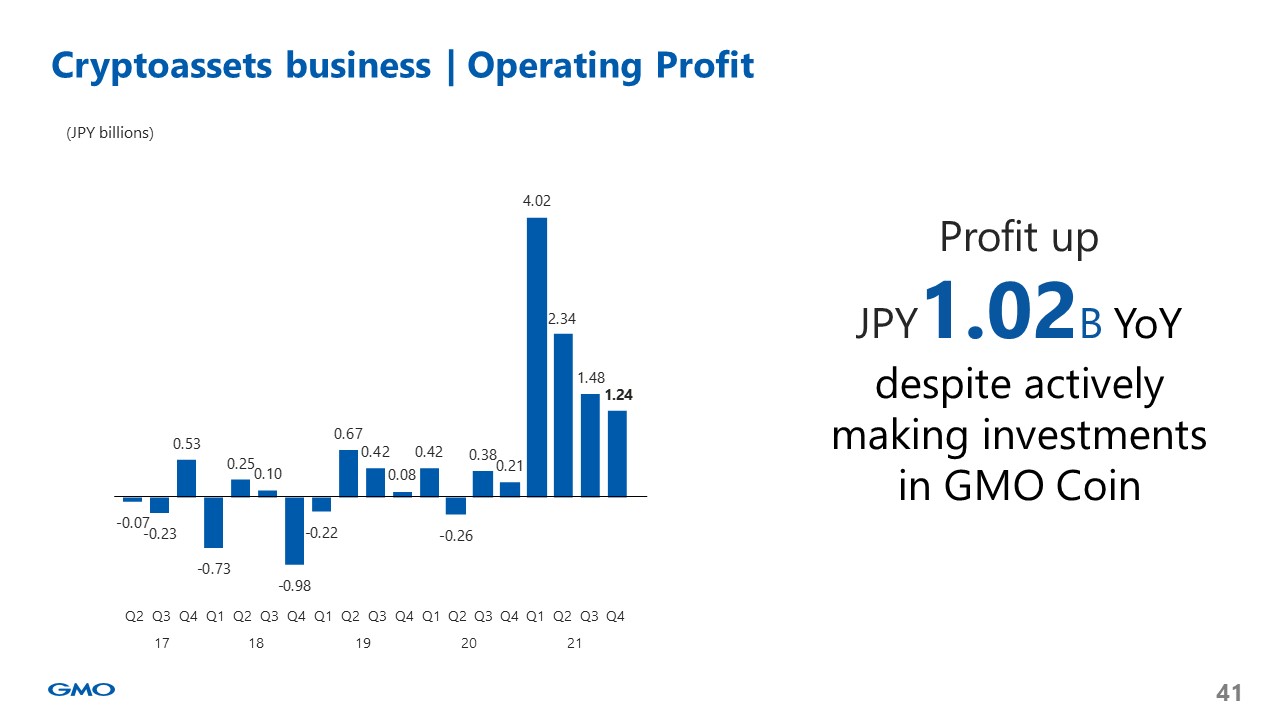

Operating profit increased by 1.02 billion yen year-on-year despite GMO Coin’s making investments in aggressive marketing. Advertising and promotion costs in 2022 are expected to be lower than in 2021 but GMO Internet will continue making efforts to expand its customer base in the future.

==============================

■TOPICS

==============================

『Shareholder Returns』

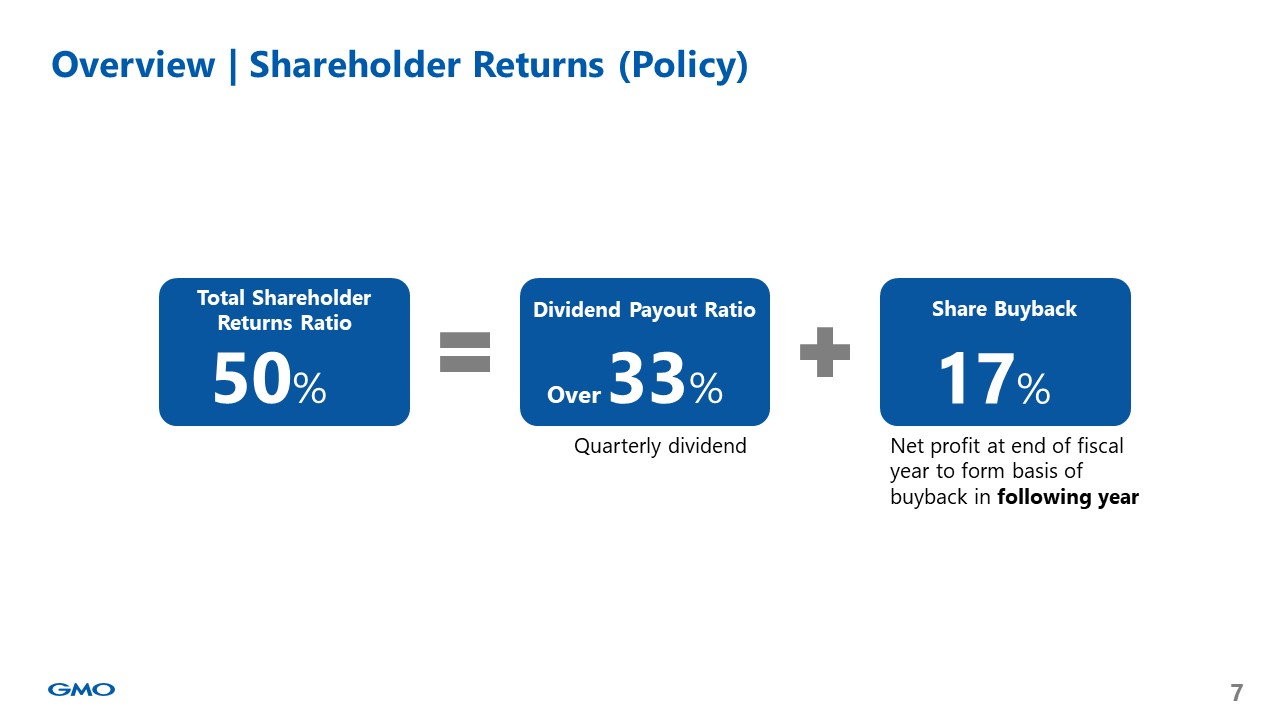

The company aims to return 50% of its profits to shareholders. The company’s target dividend payout ratio is at a minimum of 33% of consolidated net profit, while we will aim to allocate the remainder of the 50% of consolidated net profit to the acquisition of treasury stock.

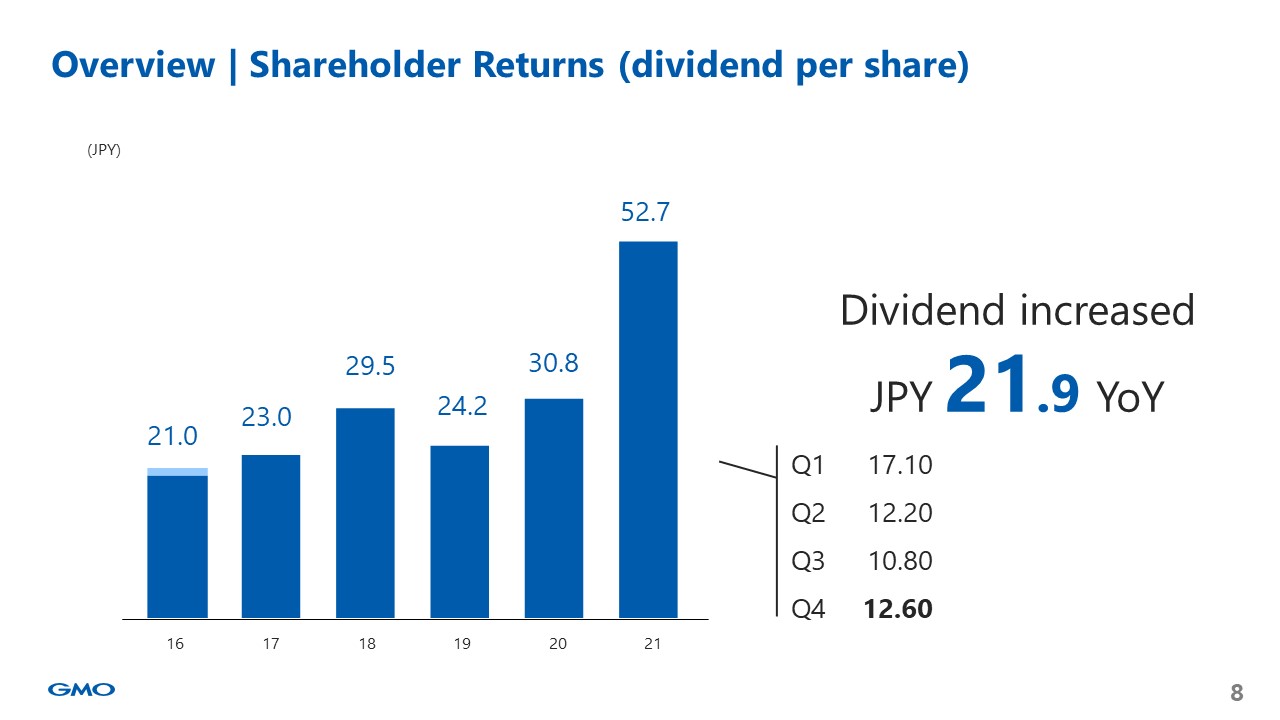

The next slide shows a dividend per share over the past six years. We have adopted a quarterly dividend system but since we will not disclose our guidance, we will also not disclose our dividend forecast, so we will announce the amount of dividend every quarter. The amount of dividend per share in Q4 is JPY12.6. The full-year dividend per share is increased by JPY21.9 to JPY52.7.

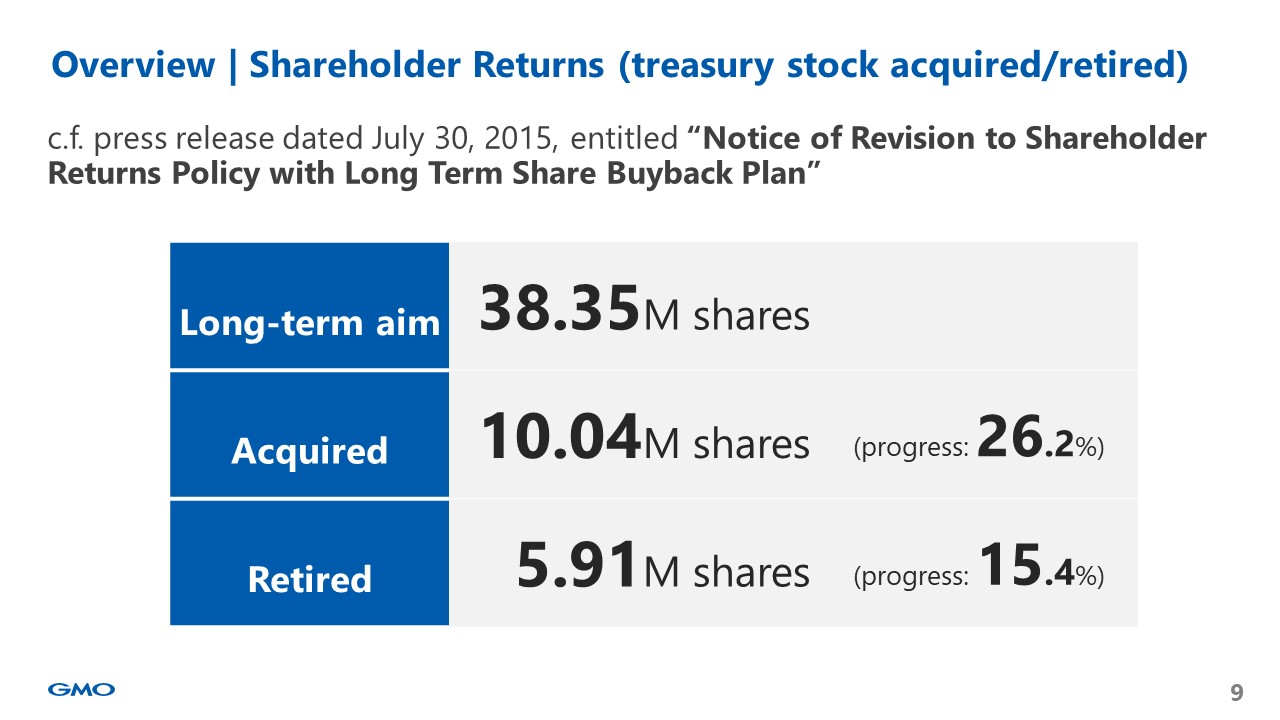

We will continue to carry out the acquisition of treasury stock, as announced in the press release “Notice of Revision to Shareholder Returns Policy with Long Term Share Buyback Plan” published on July 30, 2015, aiming to acquire approximately 38.35 million shares, which is the number of shares issued when the capital has been increased due to withdrawal from loan credit business from 2006 to 2007. The next slide shows the long-term aim and the actual number of treasury stock acquired/retired.

When setting the goal, we expected it to be a fairly long-term effort but thanks to you, we achieved more than a quarter of the target, and we felt that it proceeded considerably ahead of schedule. We would continuously disclose the progress.

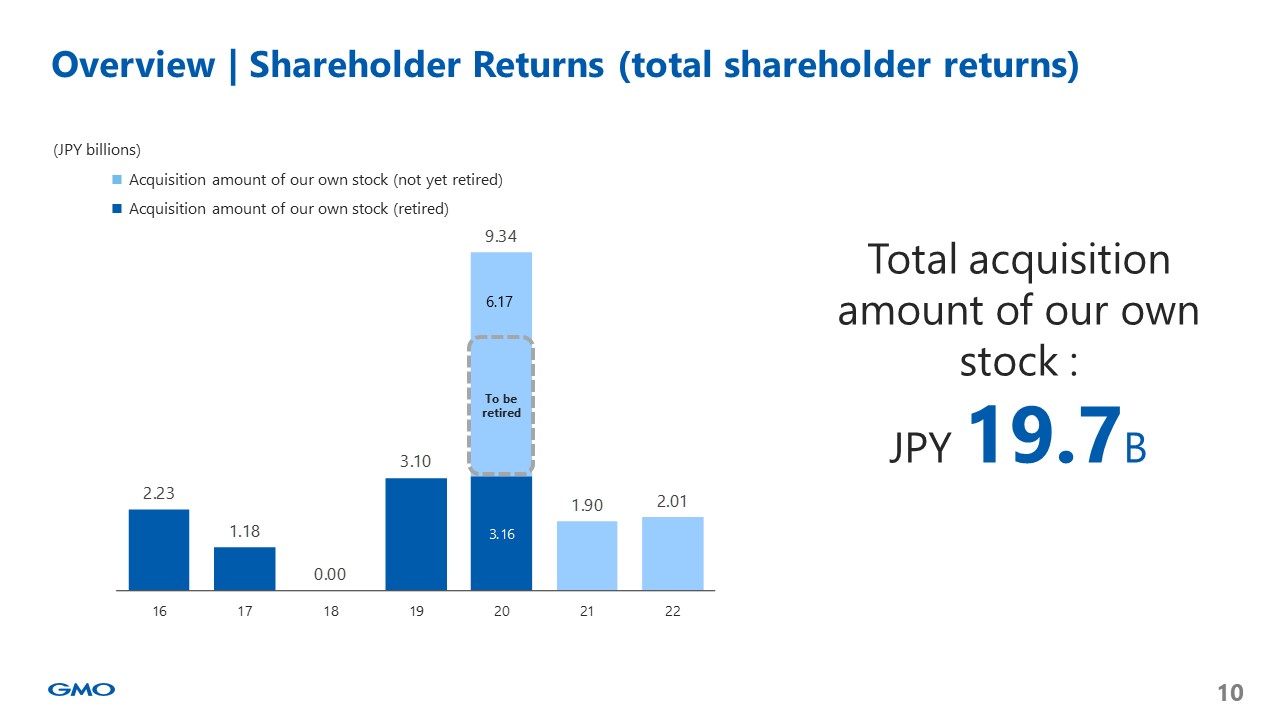

The next slide shows the acquisition amount of our own stock and the amount that has been retired over the past seven years.

Long term share buyback plan was announced in July 2015, and the total acquisition amount of our own stock since the share buyback began was JPY 19.7 billion. GMO Internet has been working on retiring treasury shares in stages and intends to retire treasury shares acquired by using the net profit of 2021 as the source.

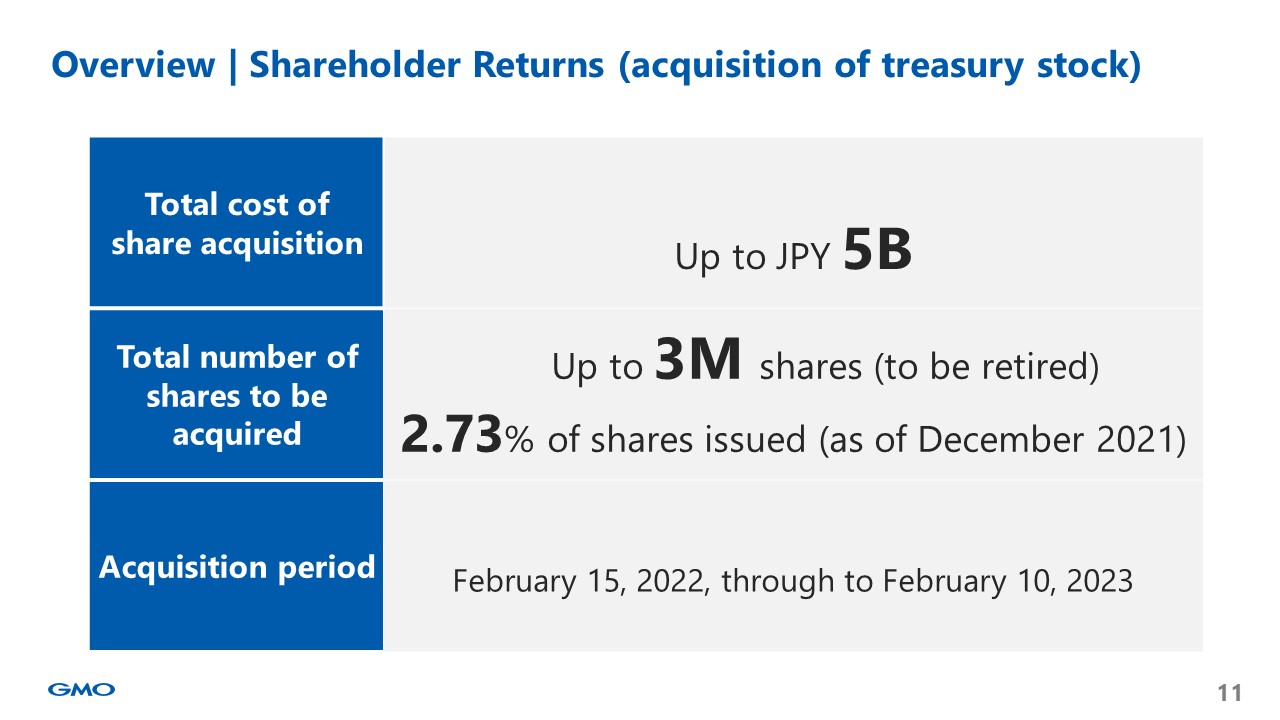

The company currently is acquiring treasury stock with February 14, 2022, as a time limit for the acquisition. However, the company is expected to fail to acquire treasury shares worth JPY 1 billion out of JPY 5.63 billion, which is the maximum cost of the share acquisition, within the scheduled acquisition period. In addition to the remaining amount (approximately JPY 1 billion), JPY 4 billion (therefore, up to JPY 5 billion) would be allocated to the acquisition of treasury stock. The Company will continue to improve its shareholder returns.

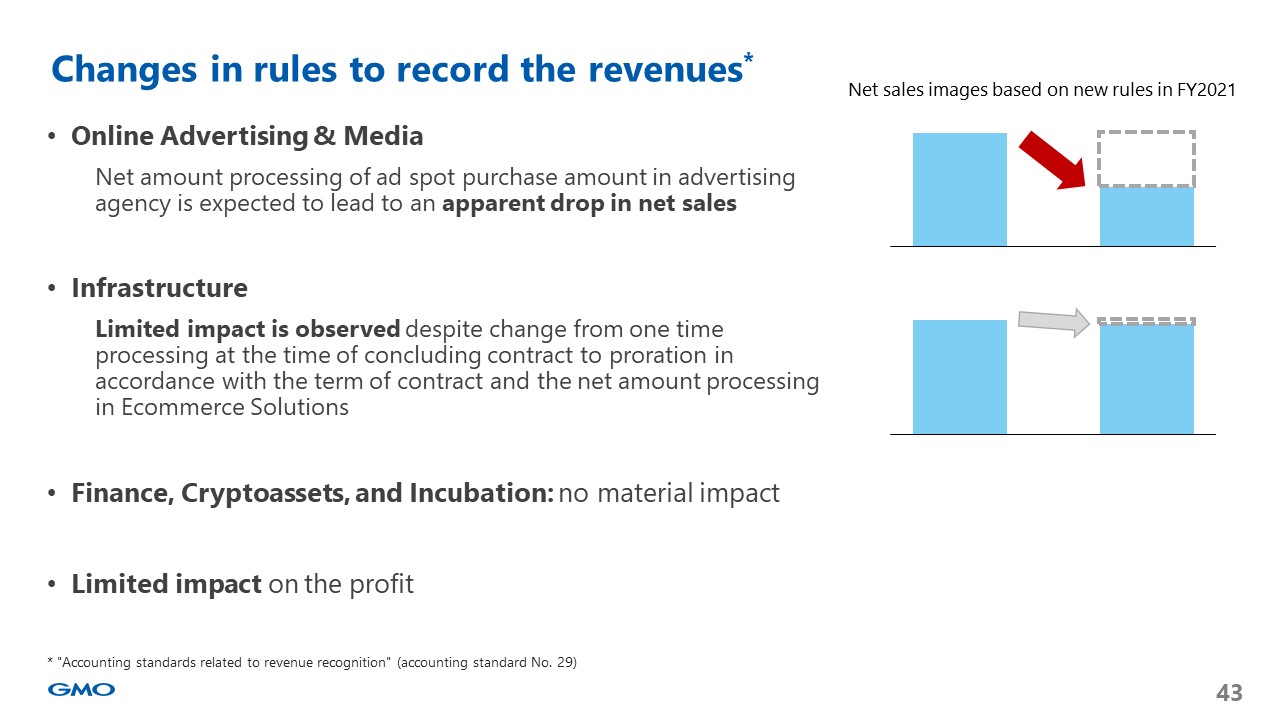

『Changes in rules to record the revenues』

“Accounting standards related to revenue recognition” would be applied in 2022, so we would like to tell you the impact of the changes in rules to record the revenues. The general idea of how the revenues will change before and after the new rules are applied is shown below. For Online Advertising & Media, we expect to see an apparent significant drop in net sales. As for Infrastructure, a limited impact will be observed. As for Finance, Cryptoassets, and Incubation, there will be no material impact. There will be a limited impact on the profit.

『Introduced group executive officer system』

We will adopt a group executive officer system to achieve the further enhancement of the managerial framework and improve the flexibility of business execution. In order to strengthen and separate business execution function and oversight function over management decisions, GMO Internet will adopt a group executive officer system, revise the composition of the Board, and improve the ratio of an External Director on the Board. GMO Internet is preparing to resolve the adoption of a group executive officer system in the Annual General Meeting of Shareholders in March and will disclose Board of Director candidate appointments, soon.

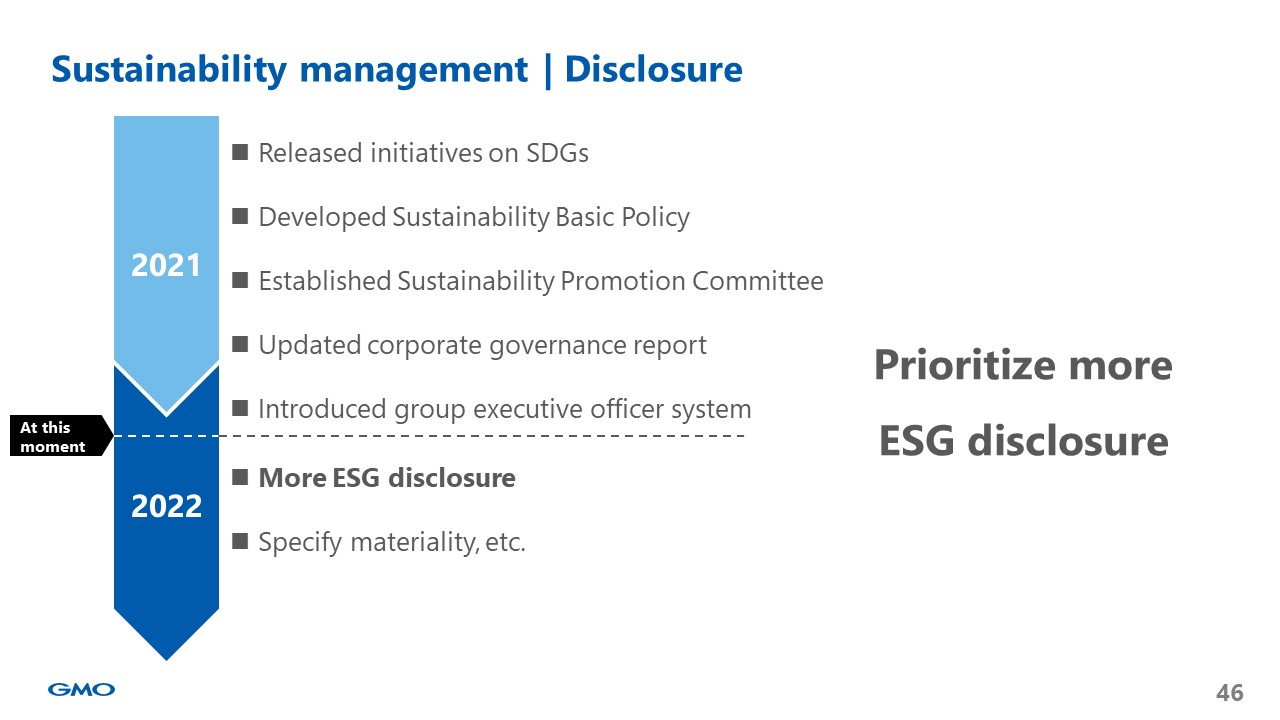

『Sustainability management』

Since its founding, GMO Internet Group has been running a business that provides infrastructure, and consistently focused its business resources on Internet infrastructure and service infrastructure, the “place” for the Internet. We believe our businesses, some of which are shown below, enable us to contribute to resolving social and environmental issues.

The Company has disclosed on its webpage the following three measures implemented in 2021: released initiatives on SDGs; developed Sustainability Basic Policy; and established Sustainability Promotion Committee. The Company filed in December the corporate governance report following the revision of the corporate governance code. We also announced in January the adoption of a group executive officer system, as discussed in detail earlier. We will prioritize more ESG disclosure through the Sustainability Promotion Committee’s activities in 2022.

* ESG is a word made with initial letters of environmental, social, and (corporate) governance. ESG disclosure means to provide the non-financial information that is associated with the ESG to investors.

==============================

■Strategic efforts

==============================

『Full-scale entry into cybersecurity business』

While the progress of the digital shift makes life more convenient, you may feel that cyberattacks are increasing. The Government of Japan has announced that it will require cyber defense for businesses handling critical infrastructure from 2022 onwards. There is also a warning that the private sector must promote the training and employment of white hat hackers in order to strengthen its cyber defense capabilities. In other words, cybersecurity has become a social issue in Japan. Against this background, the GMO Internet Group will make a full-scale entry into the “cybersecurity business,” which can be said to be the new infrastructure of the digital society.

This is the largest security operation center (SOC) in Japan scheduled to open on the top floor of our new office “GMO Internet Tower”. This is an image of the “GMO Cybersecurity Center”.

Japan’s leading white hat hacker organization Ierae Security, Inc. joined the Group

On January 24, 2022, we announced that Ierae Security joined the Group. Ierae is the largest group of white hat hackers in the country. When we asked the National Institute of Information and Communications Technology’s National Cyber Training Center about the number of white hat hackers in Japan, they said the Fermi estimate was “200-250”, which meant that about half of them belonged to our group.

The greatest strength of Ierae is its technological capabilities. “Vulnerability diagnosis” performed by white hat hackers who have an “attacker’s point of view” has a track record in a wide range of industries in Japan and overseas. In addition to the number of white hat hackers, Mr. Makita, the president, is also a white hacker, has a high track record in domestic and overseas hacking contests, and provides the No. 1 security service. The company name will be changed to GMO Cybersecurity by Ierae, Inc.

In the future, we will work to create synergies between this No. 1 security service and businesses in the Internet Infrastructure segment such as domain, hosting & cloud, ecommerce solutions, payment, and SSL (each holds top share in their respective markets in Japan). We will contribute to the realization of a safe nation and society by developing and providing the highest quality security services in Japan at low prices and developing high-value-added security solutions. Please look forward to it.

We promise further growth in 2022.

Internet for Everyone

▽back to presentation materials (here)

▽back to historical summery (here)