The following is an overview of the 3rd Quarter (July to September) FY12/2015.

For more details please refer to the following.

Results presentation materials (here)

Results presentation video (here)

◇(IR) Masatoshi Kumagai talks about GMO Internet Group Strategy

◇Q1 Summary(here)

◇Q2 Summary(here)

=============================================

■Financial Overview

=============================================

●Executive Summary: Q3 FY2015

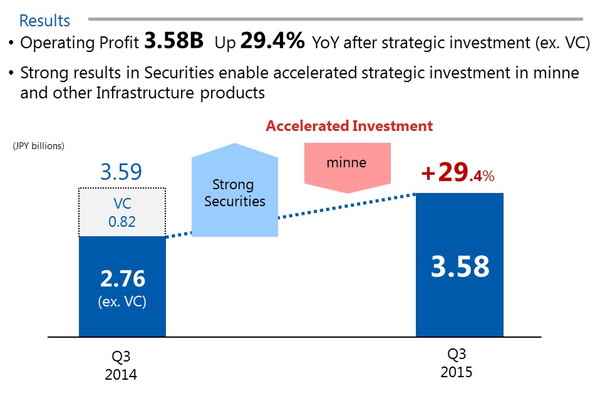

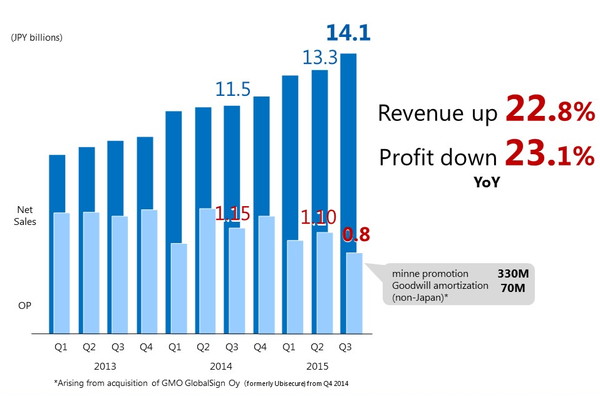

If operating profit in the Venture Capital business (Incubation)in the previous year is excluded, OP grew 29.4% year-on-year to JPY 3.58 billion. We are accelerating growth of the entire Group by actively investing profits from the strong securities segment into minne and other services.

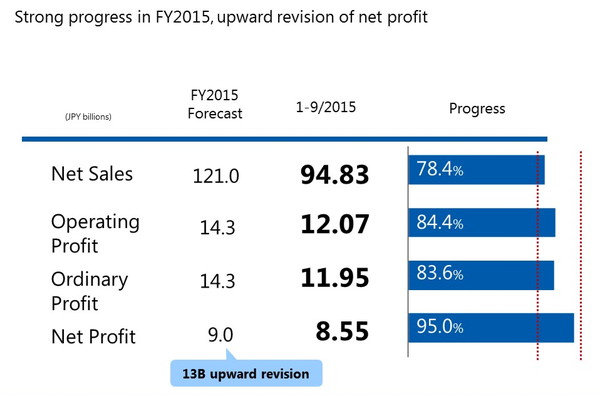

We are progressing steadily over 75% with full- year forecast in each segment. Full-year net profit forecast was revised upward to JPY 13 billion following sale of GMO CLICK Holdings share in business / capital alliance with Dawia Securities.

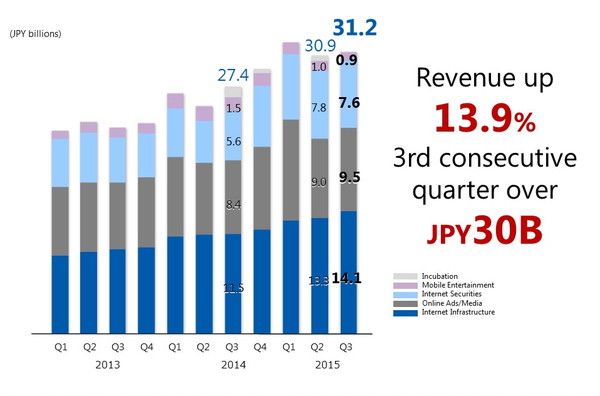

●This graph represents a breakdown of quarterly net sales by segment. For the past three consecutive quarters we have generated over JPY30 billion in stable revenue.

Most of these contracts are recurring-based contracts and contribute to a long-term stable earning base.

=============================================

■Group News

=============================================

◇GMO Media was publicity listed.

October 23, GMO Media(Stock Code:6180)was listed on the Tokyo Stock Exchange Mothers Market. GMO Media became the 9th company in the group to be publicly listed. GMO Media was established in 2000, and is the core of the Group’s Internet media business. The company has grown through the development and operation of services used by consumer on daily basis.

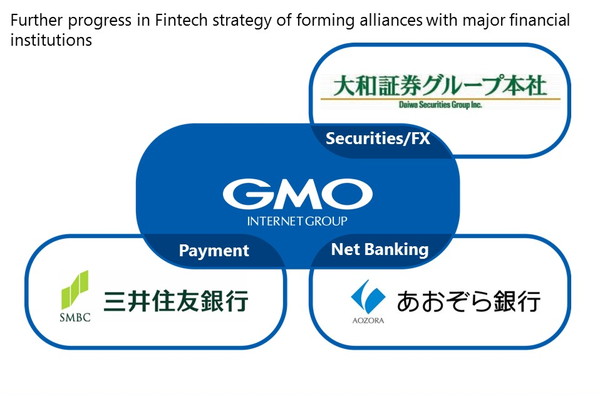

◇Financial and Payment – Alliance Strategy

Under the theme “Strengthening our strengths” and “Enhancing weakness with number one products” in the area of Fintech, the group has actively pursued an alliance strategy with major financial institutions.

We announced a partnership with Daiwa Securities Group. GMO CLICK HD and GMO CLICK Securities.

While we have a track record as the global number one FX provider and the technology strength to develop all of our own services, Daiwa Securities is a comprehensive securities group with a deep knowledge and understanding of the industry as well as strong management base.

We are considering collaborations in various fields including FX Securities and investment trust aim to provide a more user-friendly trading environment.

=============================================

■Internet Infrastructure

=============================================

In the third quarter costs included JPY330 million in promoting minne, and JPY70 million in goodwill. Quarterly operating profit is JPY880 million.

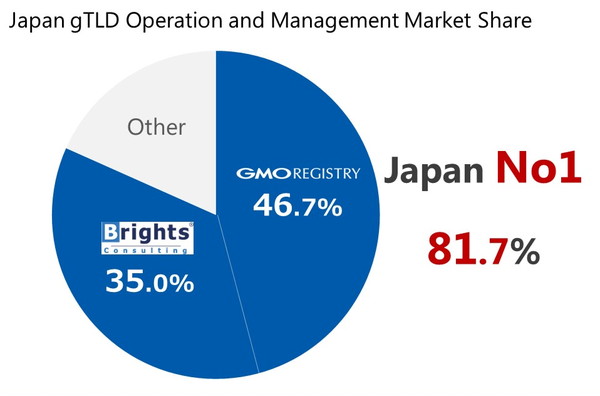

●Brights Consulting recently joined our group. The company provides domain services for enterprise. New gTLDs are top level domains like “.com” and “.net”, .

As a result, Group’s new gTLD market share in Japan including Geo domains operated by GMO Registry has grown to 81.7%. Our domain register brand, Onamae.com already has over 90 of the market. We are now overwhelmingly number one in both the domain registry and registrar fields.

●We are strategically investing in “minne” by GMO Pepabo.

By the end of this year, “minne” is targeting to reach 200,000 sellers, 2 million products and 5 million app downloads. We are on good trends.

You can see the monthly report on GMO Pepabo website. Please check the website.

=============================================

■Internet Securities

=============================================

While there was high volatility in the FX market, we also saw CFDs become a new pillar of earnings. After record results in previous quarter, we maintained high levels of profit in the current quarter. For three consecutive years since 2012, we have been the global number one in FX and we continue to grow. System, development, maintenance and operation is all done in-house. Our service is well-reputed among users.

=============================================

■Online Advertising & Media

=============================================

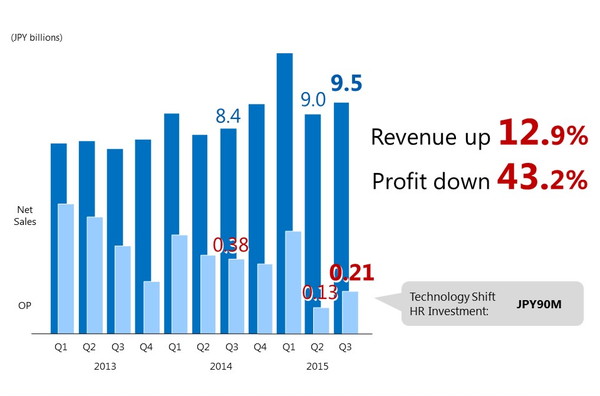

While we saw a positive trend in net sales, we continued to invest in a technology shift so that year on year revenue increased and profit decreased.

Under the theme of enhancing weakness with number one products, we continue to focus on in-house development with the objective of accelerating its shift toward technology.

=============================================

■Mobile Entertainment

=============================================

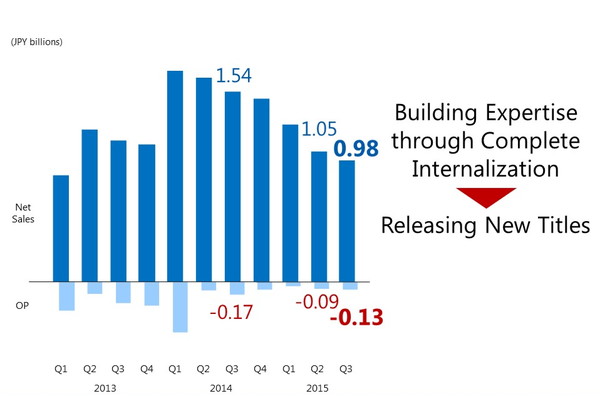

Under the theme of enhancing our weaknesses with number one products, we have streamlined game titles and brought operations in-house, building expertise and bringing costs under control. As a result, we are seeing a drop in revenue but an improvement in gross profit margins. At the end of July, we released “Chain-Heroes”, a game title developed completely in-house.

After completing test marketing, we decided to invest in their promotion in Q4.

Please refer to “Masatoshi Kumagai talks about GMO Internet Group in 2015 Overview of the group’s current position and outline of strategy going forward for shareholder returns ratio and important theme.

We appreciate your ongoing support of GMO Internet Group.

Internet for Everyone

◇(IR) Masatoshi Kumagai talks about GMO Internet Group Strategy

◇Please visit here for an overview of Q1 2015 business results

◇Please visit here for an overview of Q2 2015 business results