The following is an overview of the FY2020 Q4.

=============================================

■Financial Overview

=============================================

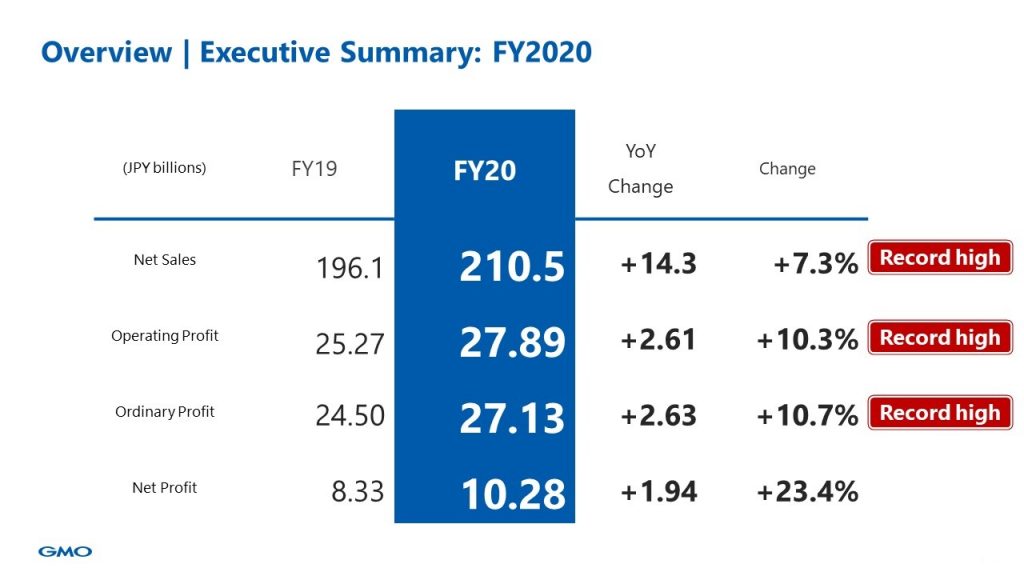

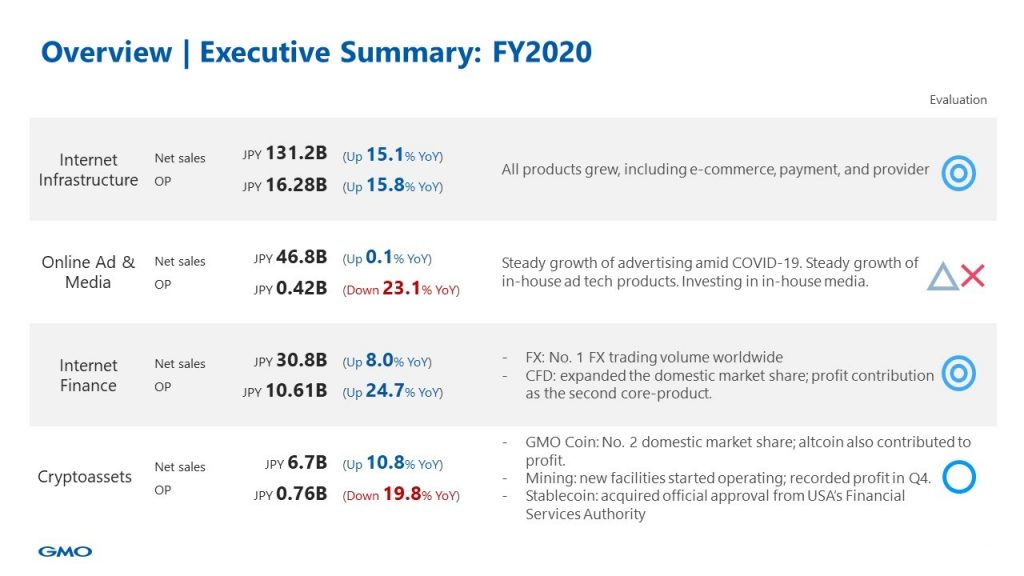

The following is a financial summary for 2020.

Net sales, operating profit, and ordinary profit achieved a record high, and net profit increased significantly.

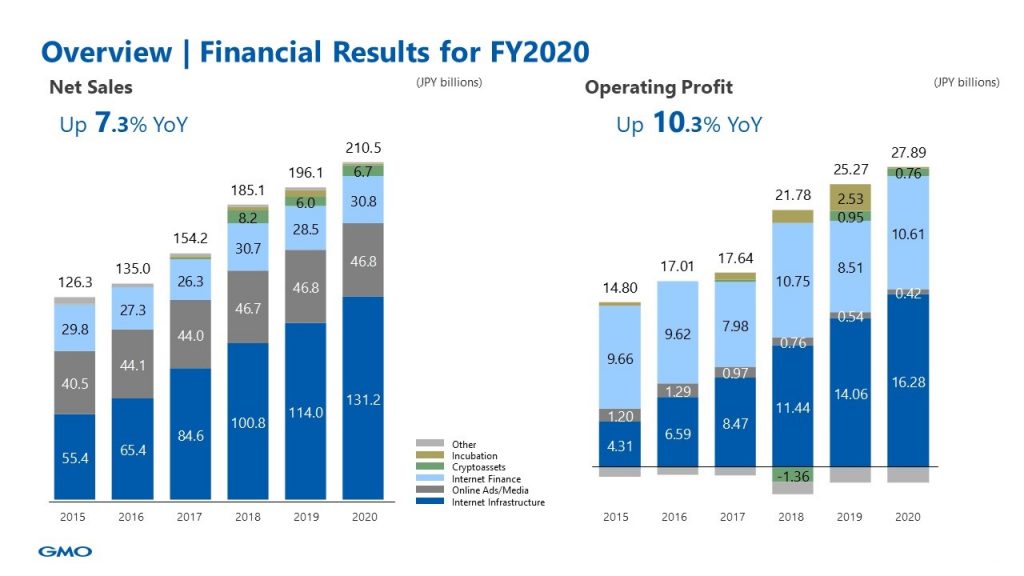

The next graph shows the growth of GMO Internet’s net sales and operating profit over the past six years. Both revenue and profit were up for the 12th consecutive year.

=============================================

■Internet Infrastructure

=============================================

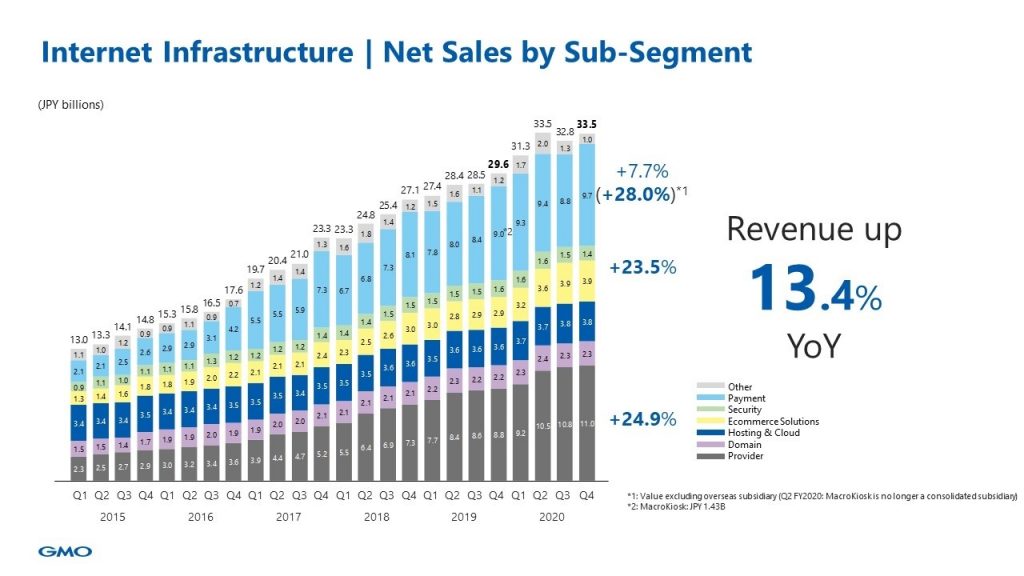

This is net sales in the Internet Infrastructure segment and its breakdown. Because the consumption increased due to stay-at-home orders and because of the increased demand for teleworking, Provider, Ecommerce Solutions, and Payment performed well. Net sales has decreased temporarily QoQ, as the Payment’s overseas subsidiary is no longer our consolidated subsidiary since Q3, but it has recovered and is now up again QoQ.

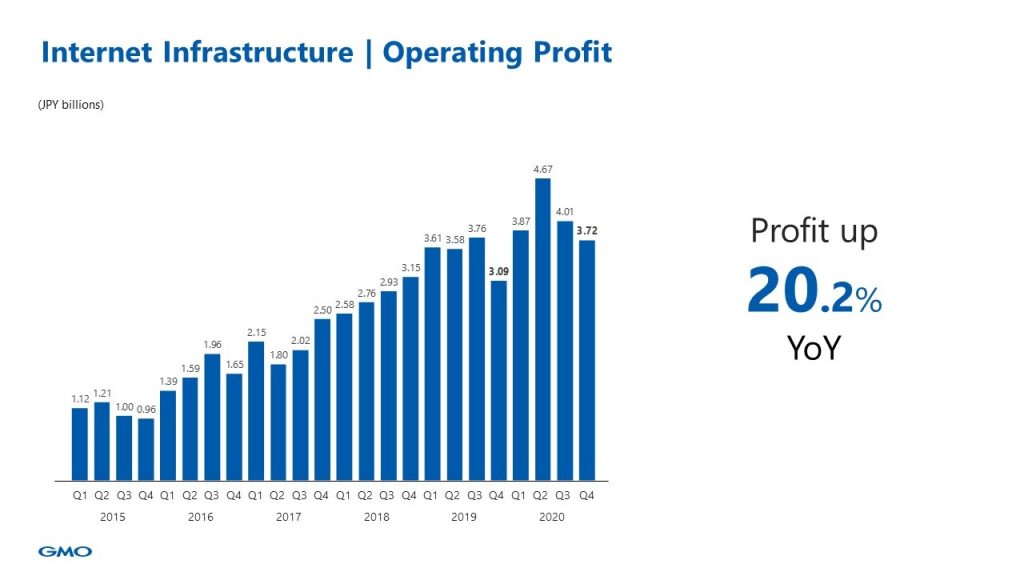

Shown here are Internet Infrastructure segment’s profit trends by quarter over the past 6 years. These are the numbers of the most recent quarter. While operating profit increased year-on-year, it decreased quarter-on-quarter.

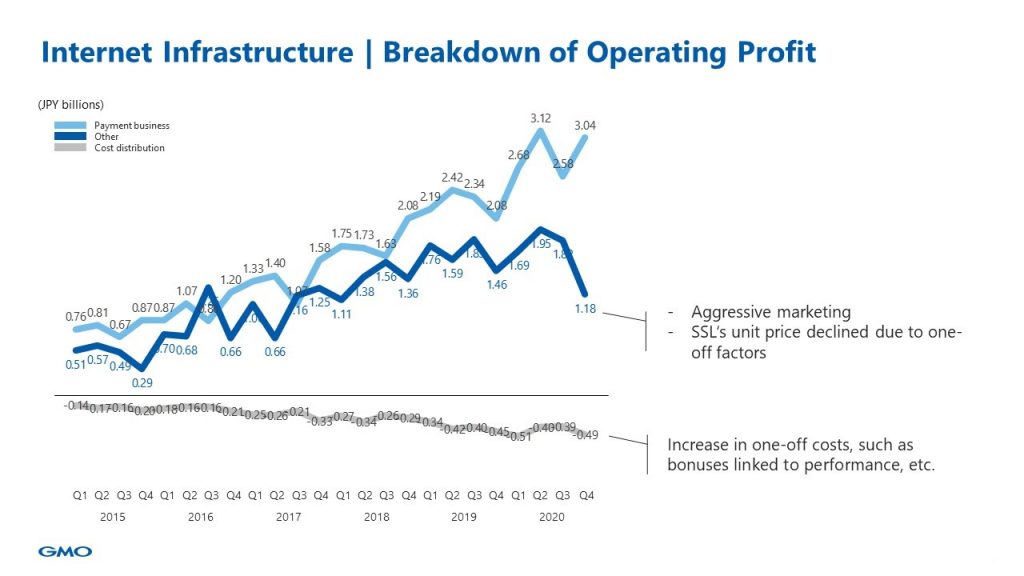

If you look at the under graph, the operating profit is divided into payment and non-payment, and cost distribution is shown. Payment, which offers services under the GMO-PG, has gone up significantly. However, profit in non-payment decreased YoY and QoQ as GMO Pepabo actively invested in marketing. Investment in marketing, which was scheduled in the first half of 2020, was shifted to the second half of the year. Ad‘s unit price declined as the effective period of the SSL was shortened to improve Internet security, which had a temporary impact. This is not related to actual demand, and the leveling of the effect of a change in the expiration date will occur in August 2021. Moreover, the cost distribution was temporarily affected by bonuses linked to performance, etc. Based on the revenue trends by quarter, we believe that the overall momentum of business is very good, and that both the payment and non-payment will achieve balanced growth in the future.

=============================================

■Online Advertising & Media

=============================================

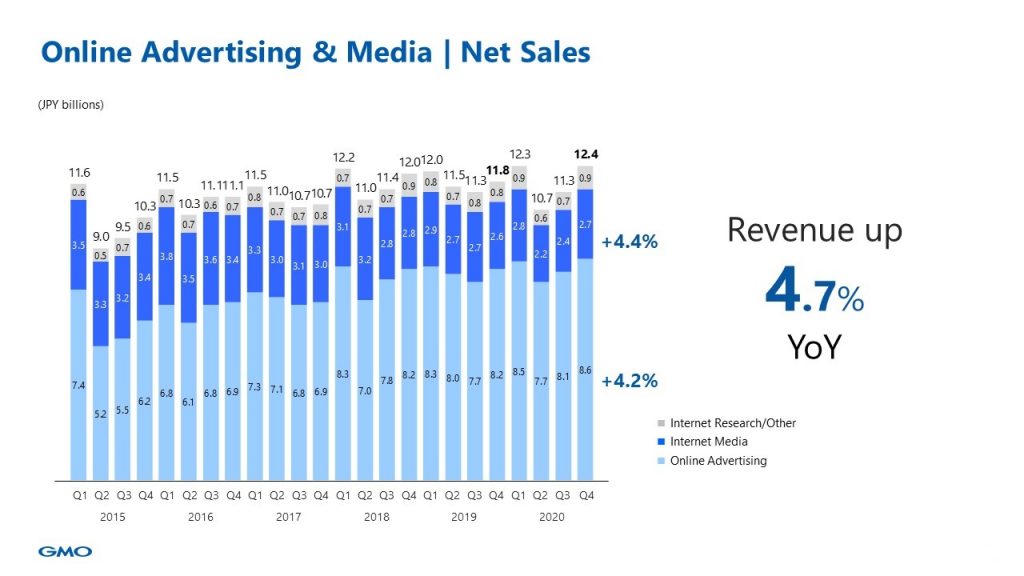

This is net sales in Online Advertising and Media and its breakdown. The net sales of internet advertising and media are up 4.7 percent year-on-year.

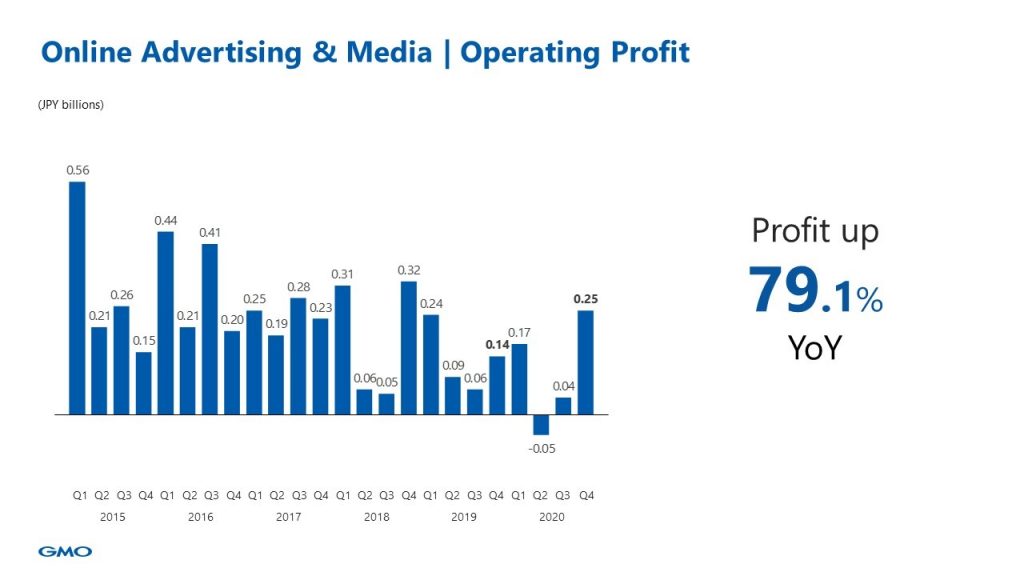

Shown here are Online Advertising and Media segment’s profit trends by quarter over the past 6 years. GMO Research performed favorably in the 4th quarter due to the market demand at the end of 2020.

=============================================

■Internet Finance

=============================================

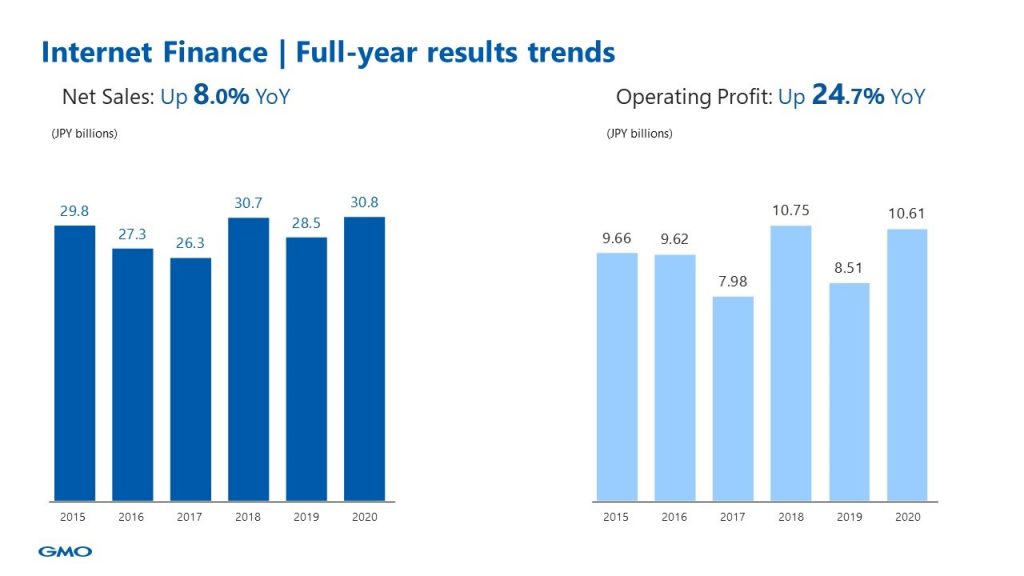

Next is the growth of Internet Finance’s net sales and operating profit over the past six years. Operating profit increased by 24.7% year-on-year, but earnings did not achieve a record high. FX, a core product, aimed to maintain the No. 1 market share and increase the trading volume by offering thin spreads, which led to YoY losses. However, trading value and revenue of CFD, which we had for some time been focusing on, expanded due to strong market conditions. Generating benefits of more than JPY 10 billion, while maintaining No. 1 FX trading volume and improving service line-up further, was a positive thing.

============================================

■Cryptoassets segment

============================================

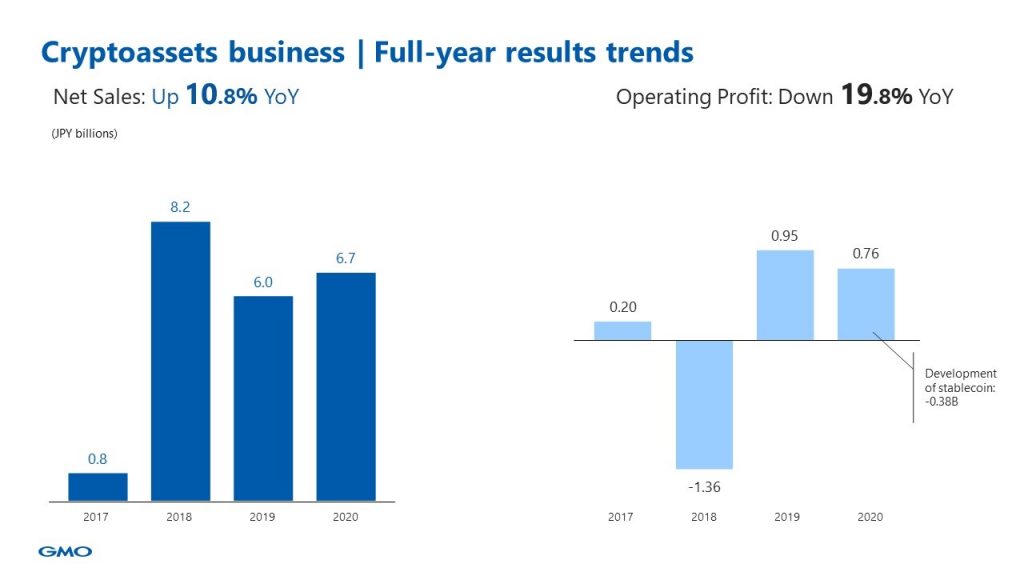

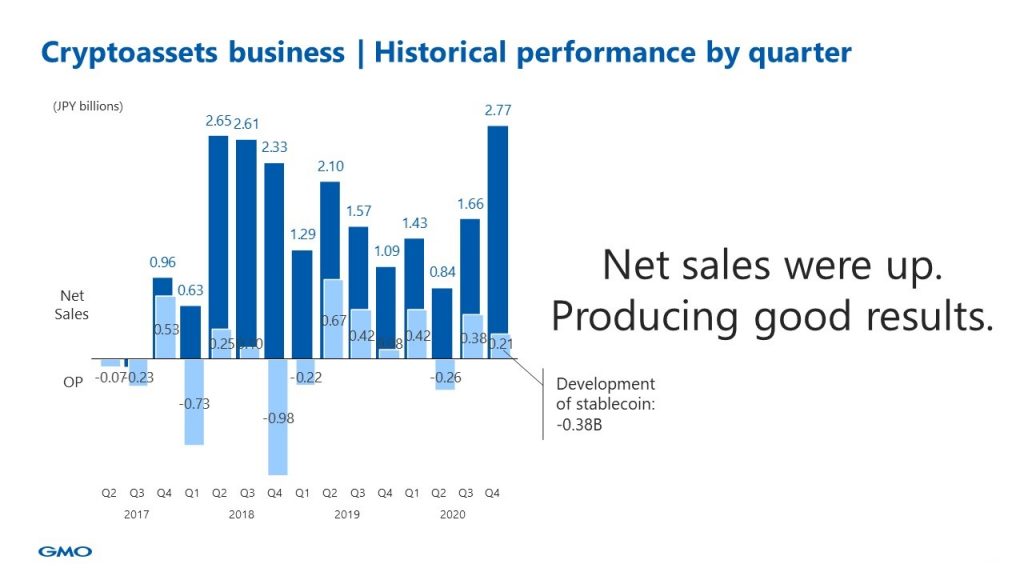

Next is the Cryptoassets business. The next two graphs show the growth of Cryptoassets’ net sales and operating profit over the past four years. We have already entered into the harvest season.

Although the net sales and profits in exchange and mining were up, the segment’s operating profit declined YoY due to the development of stablecoin GYEN. Regarding GYEN, GMO Internet has received official approval from the U.S. financial authority in December 2020.

===============================================

■Cryptoassets segment: Cryptoassets mining business

===============================================

Revenue was up QoQ, and the cryptoassets mining subsegment recorded profit. Old mining facilities have been closed on June 30, 2020, and we have been operating only at new mining facilities since July 2020. New mining facilities did not operate stably at first because the power supply stopped temporarily in Q3, but it started operating stably in Q4. The cryptoassets price also rose, which resulted in a rise in mining profitability. We have already entered into the harvest season.

===============================================

■Cryptoassets segment: Cryptoassets exchange business

===============================================

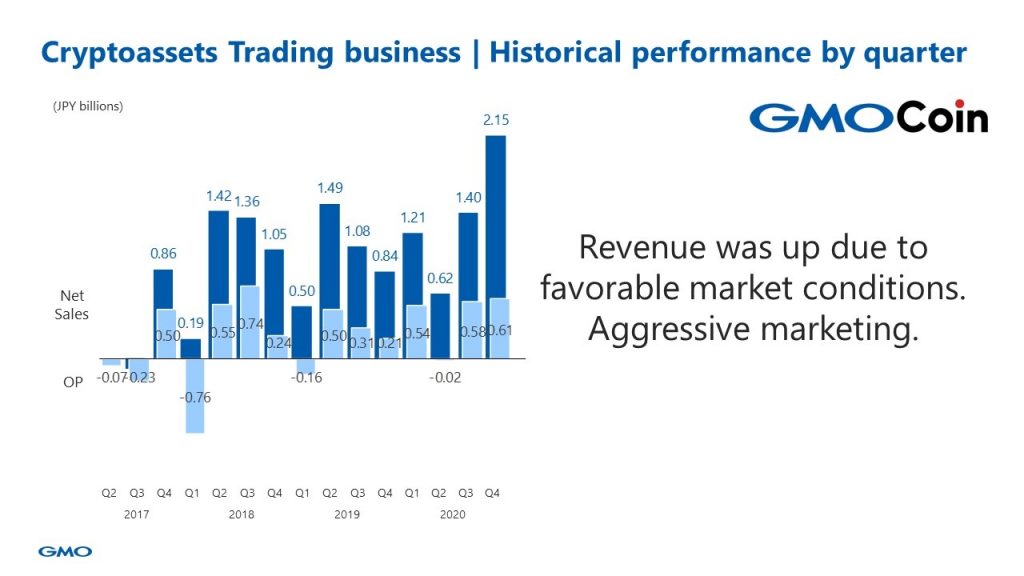

Regarding cryptoassets exchange business, both revenue and profit were up QoQ and YoY. The volatile market had favorable conditions, and revenue was up due to the increase in the altcoin trading volume. Our customer base as well as the domestic market share expanded as we actively invested in marketing.

■Future of seal impression: GMO Sign

GMO Global Sign HD revised the name of its e-contract service from Agree to GMO Sign on February 12, 2021.

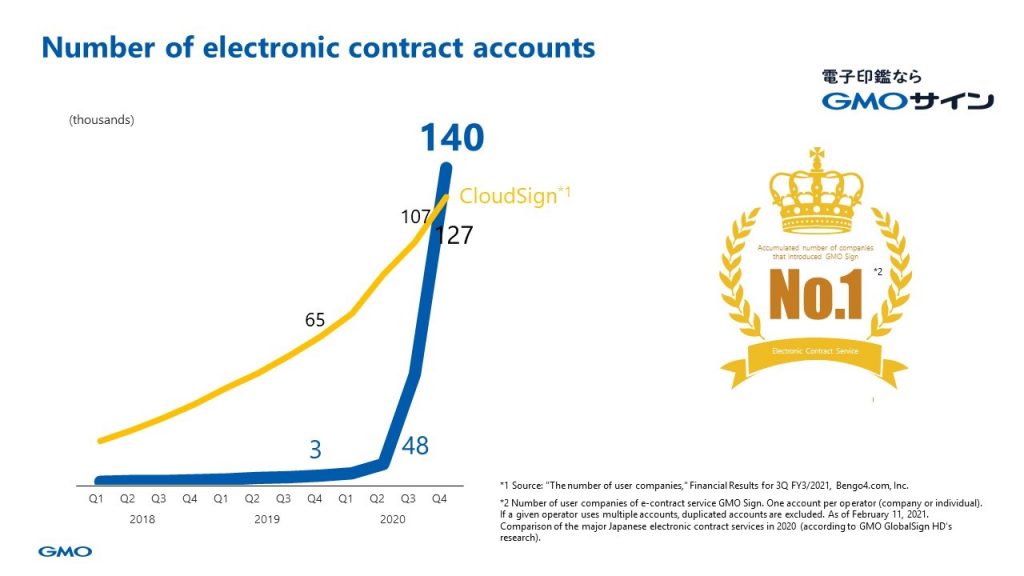

The next two slides show the KPIs of our e-contract service. This graph shows the number of accounts. GMO Sign reached 140,000 accounts as of the end of December 2020 (and 160,000 accounts as of today), overtaking Cloud Sign, and GMO Sign became No. 1 Japanese e-contract service in terms of the number of user companies. Because of the companies’ full-scale DX, we have received approximately 90,000 orders during the three-month period (from October to December).

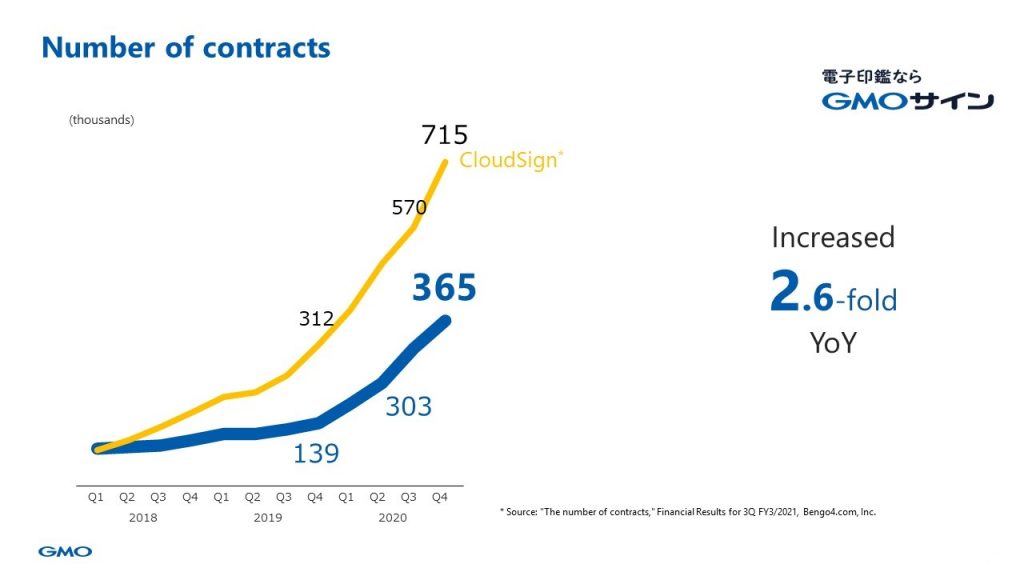

The next slide shows trend in the number of contracts. The number of contracts, which is the number of electronic contracts sent to the counterpart, has increased 2.6-fold YoY. The growth of the number of contracts will accelerate in the future, overtaking Cloud Sign.

E-contract service GMO Sign has No.1 market share because of the GMO Internet Group’s significant customer base (13 million customers). In the Group’s Internet Infrastructure and Internet Finance segments, the number of new contract per day is between 10,000 and 20,000. Cross-selling based on these new contracts could increase the number of customers of GMO Sign by approximately 1 million each year.

GMO in all will expand GMO Sign for everyone.

We ask for your cooperation.

Internet for everyone.

▽back to presentation materials (here)

▽back to historical summery (here)