The following is an overview of the 4th Quarter (Octber to December) FY12/2016.

For more details please refer to the following.

Results presentation materials (here)

(IR) Masatoshi Kumagai talks about GMO Internet Group Strategy

(IR) GMO Internet Group Strategy 2016 Q1 Summary(here)

(IR) GMO Internet Group Strategy 2016 Q2 Summary(here)

(IR) GMO Internet Group Strategy 2016 Q3 Summary(here)

=============================================

■Financial Overview

=============================================

●Executive Summary: FY2016

Forecasts were achieved for 7 consecutive years, and each area achieved record highs.

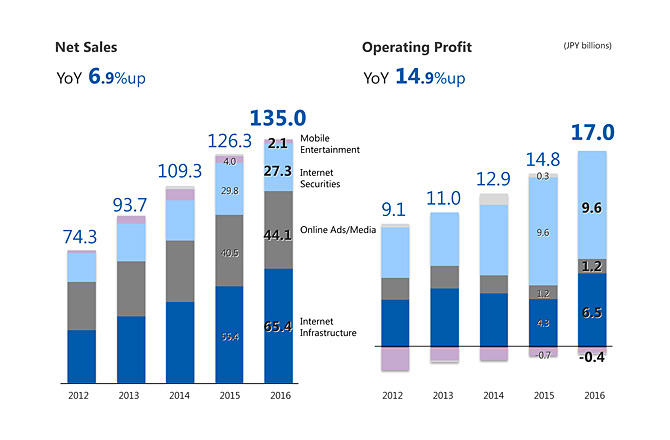

●Next shown are financial result trends for the past 5 years.

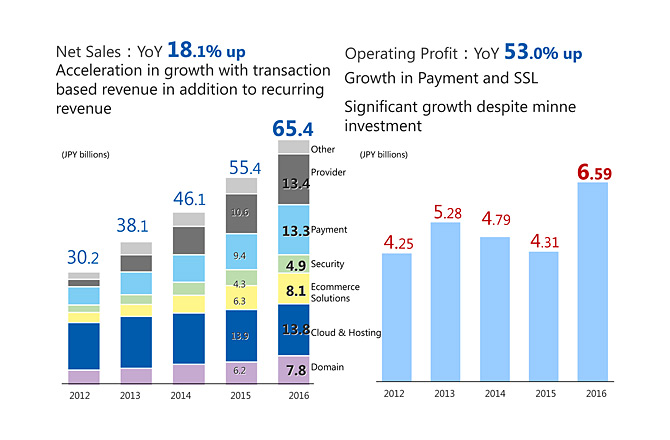

In addition to the current recurring products, high entry barrier products such as payment services, SSL and .shop drove Infrastructure business this year.Securities did not have as strong a momentum as in 2015, and although the market changes were volatile in 2016, profit amounted to almost the same as the previous year.

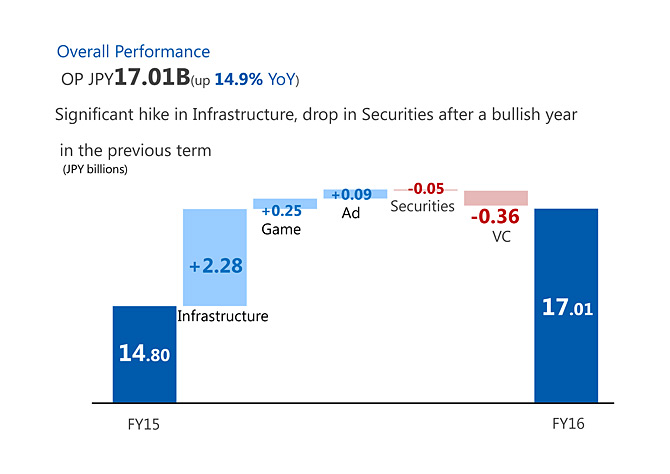

This next graph shows the increase and decrease in operating profit year-on-year.The significant growth in Infrastructure is a major reason for the spike.

=============================================

■ Financial summary for Q4 (October-December) of 2016.

=============================================

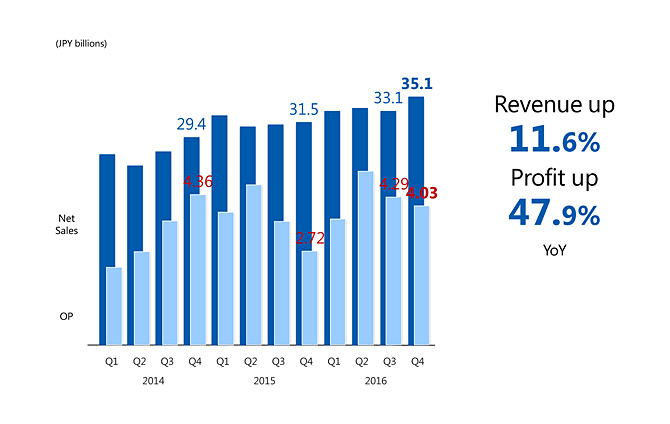

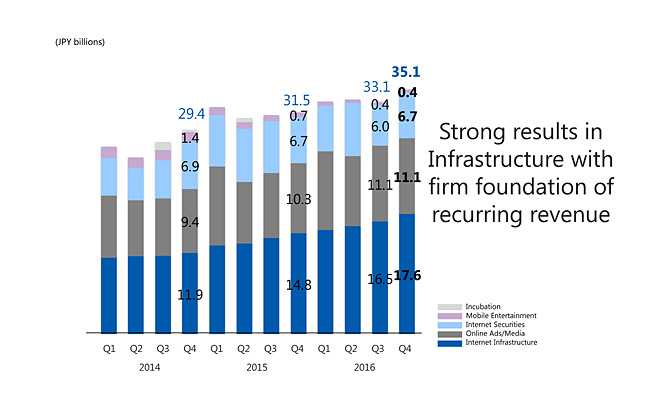

Net sales increased by 11.6% to JPY 35.1 billion YoY.

Operating profit was up 47.9% to JPY 4.03 billion YoY.

Net sales and profit were both up.

Because of the recurring revenue in Infrastructure, we had strong results.

=============================================

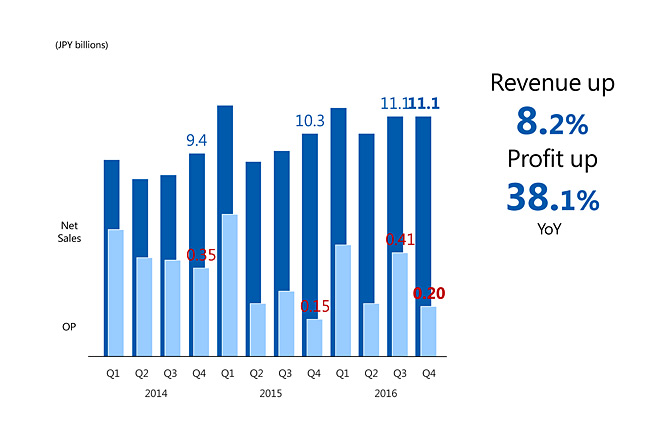

■Internet Infrastructure

=============================================

●This graph shows a breakdown of quarterly net sales by sub-segment for the past 5 years.With monthly based recurring revenue and transaction revenue from payment services and minne, the growth rate is accelerating.

As for profit, the profit margin for payment services and SSL also greatly increased.

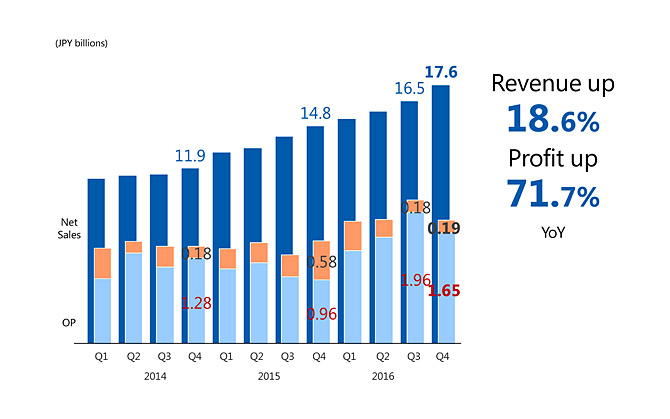

This is historical earnings by quarter. Orange shows strategic investment.Payment services drove the revenue during the busy season at the end of the year. Because of .shop’s initial sales and large scale security orders in Q3, revenue has decreased, but the momentum of existing businesses has stayed strong.

=============================================

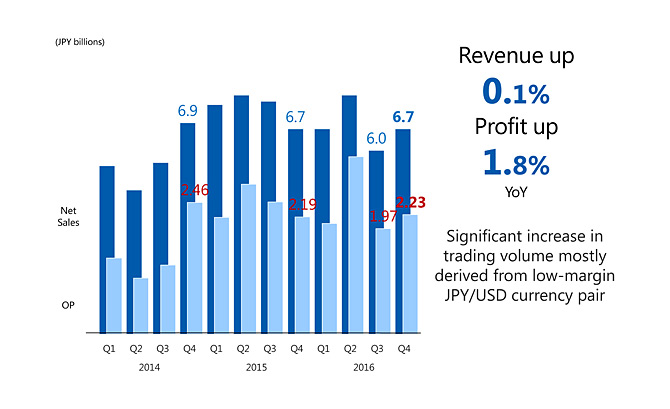

■Internet Securities segment.

=============================================

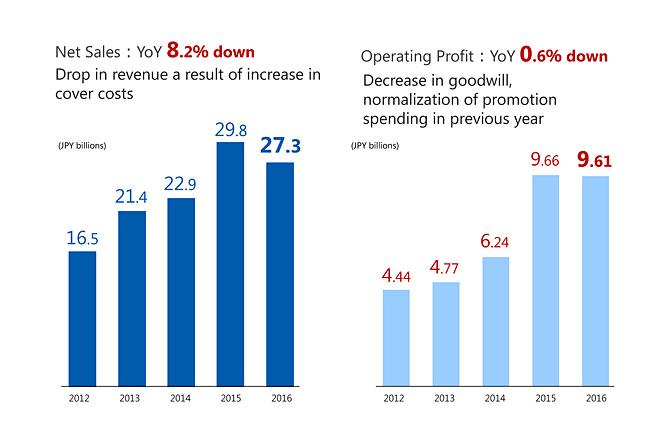

●With the expanding customer base and FX share, we improved profitability compared to 3 years ago.

Net sales were down and profit was also down slightly due to volatile market changes after Brexit and the US Presidential elections, and cover costs increased in the second half of the year.

Amortization of goodwill was down, and we optimized the cover rule resulting in profit staying at almost the same level as last year.

This graph shows performance by quarter, in which revenue and profit increased year-on-year.

=============================================

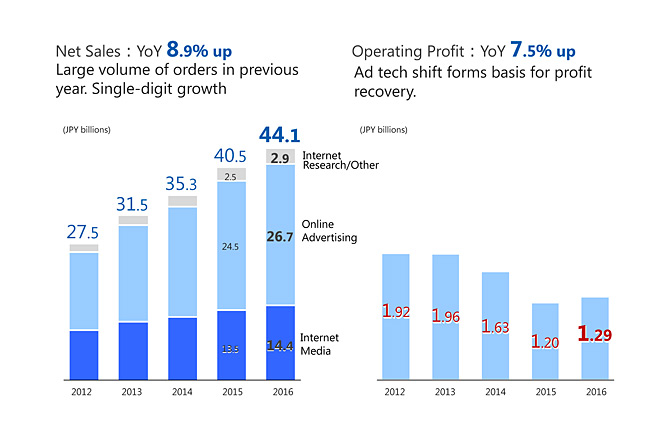

■Online Advertising & Media segment.

=============================================

●In the previous year, net sales grew by one digit because of large scale orders, and this past year both Online Advertising and Media have continued to grow.As for profit, we didn’t respond fast enough to changes in the online advertising market.

Over 2014 and 2015 we went through reorganization and restructuring and the results of pressing ahead in the ad technology shift and developing more in-house products has led to the beginning of profit recovery.

●The following slide shows quarterly earnings.

Both revenue and profit are up year-on-year, though profit is down quarter-on-quarter.As I explained earlier, we have new in-house products, but there was a negative influence from the decline of existing products, which have a relatively high level of profitability.

============================================

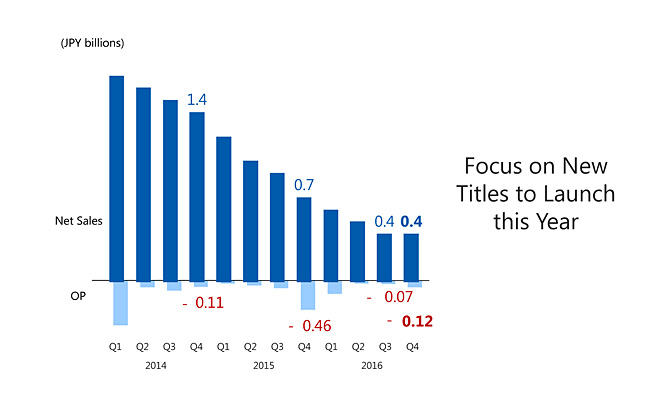

■Mobile entertainment segment.

=============================================

●We have been reorganizing internally and working on getting costs under control, but the increasingly negative figure trend for our current titles continues.

We are continuing to focus on developing hit new titles for next year.

Please refer to “Masatoshi Kumagai talks about the GMO Internet Group strategy” for the 2016 Overview of the group’s current position and an outline of our strategy going forward, particularly for “.shop” finance and other major themes.

We appreciate your ongoing support of the GMO Internet Group.

Internet for Everyone

Results presentation materials (here)

(IR) Masatoshi Kumagai talks about GMO Internet Group Strategy

(IR) GMO Internet Group Strategy 2016 Q1 Summary(here)

(IR) GMO Internet Group Strategy 2016 Q2 Summary(here)

(IR) GMO Internet Group Strategy 2016 Q3 Summary(here)