The following is an overview of our third quarter. For more details please refer to the following.

Results presentation materials here

Results presentation video here

◇(IR) Masatoshi Kumagai talks about GMO Internet Group Strategy in 2014

=============================================

■Group News

=============================================

● On October 21, GMO Research was listed on the Tokyo Stock Exchange MOTHERS market (Stock code:3695). Two days later, on October 23 GMO CLOUD (TSE:3788) received approval to move listing to the Tokyo Stock Exchange First Section.

● On October 31 we announced a reorganization in the Internet Securities segment.

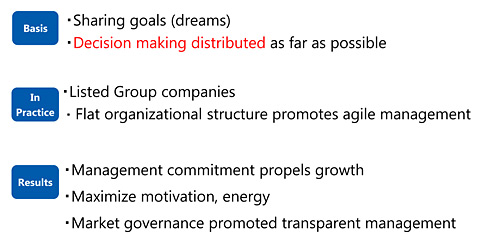

● The image below demonstrates group management culture. By distributing decision-making power, we have built a flat organizational structure that enables agile management. The most recent example of this management style is the public listing of Group companies. We believe that allowing Group companies to IPO contributes to business growth and generates synergies that boost corporate vaue for the Group as a whole.

=============================================

■Financial Overview

=============================================

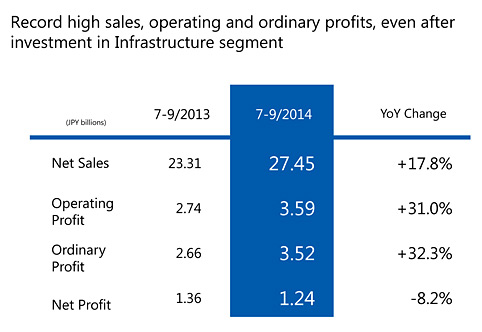

● In the July quarter, net sales, operating profit and ordinary profit were all at record record highs.

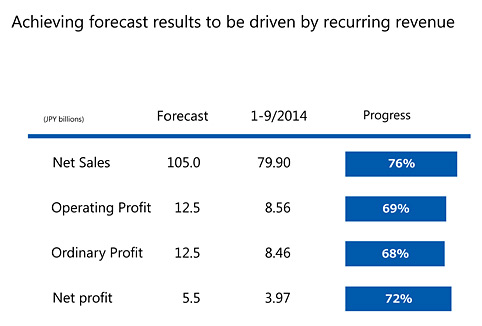

● The table below shows progress toward year-end forecasts. There is no revision to any forecast and operating profit forecast remains at JPY12.5 billion.

=============================================

■Internet Infrastructure

=============================================

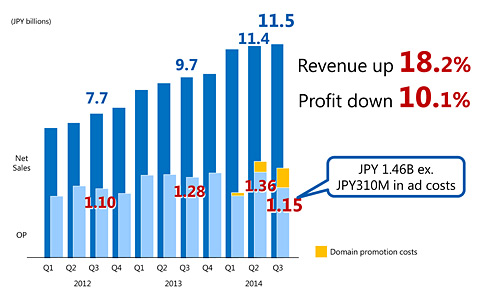

● In Internet Infrastructure, revenue rose 18.2% while profit fell 10.1%. Profit was impacted by spending on .tokyo television commercials (JPY310 million).

●Contracts in the Infrastructure segment reached 5.54 million. In addition, we have another 27,000 contracts in the provider business. That is a total of over 5.8 million, and is growing at around 600,000 contracts a year. The majority of contracts in this segment represent recurring revenue, the foundation for stable, long-term growth.

=============================================

■Online Advertising & Media

=============================================

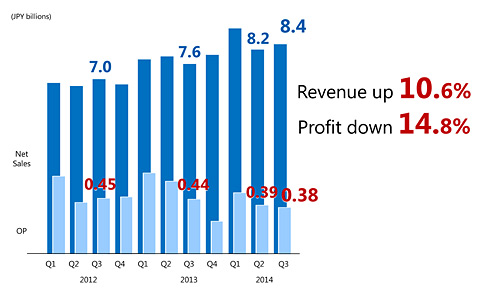

● In Online Advertising & Media, net sales grew 10.6% while profit fell 14.8%. The segment is focused on shifting to technology based products in response to changes in the market environment.

=============================================

■Internet Securities

=============================================

● In Internet Securities revenue increase 9.6% and profit increased 10.4%. Our transation volume share continued to grow as market activity picked up.

=============================================

■Mobile Entertainment

=============================================

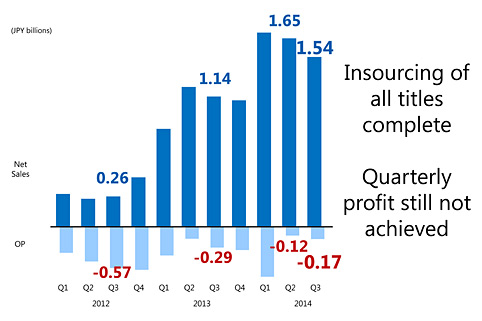

● We were unable to reach breakeven in this quarter, but in this segment we will continue to introduc new titles while maintaining a cost-controlled business.

We look forward to your ongoing support.

Internet for everyone.

◇(IR) Masatoshi Kumagai talks about GMO Internet Group Strategy in 2014