The following is a brief overview of GMO Internet Group business results in the fourth quarter of Fiscal Year 2013. For further details please visit our Investor Relations website.

Q4 FY2013 Results Presentation Materials

Q4 FY2013 Results Presentation (Video)

Return to Group Business Strategy 2014

Previous overviews:

Q1 2013 business results here.

Q2 2013 business results here.

Q3 2013 business results here.

=============================================

■Financial Results Overview

=============================================

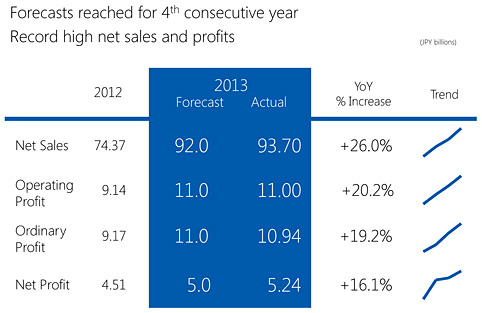

In fiscal year 2013, net sales, operating, ordinary, and net profits all increased over the previous year. Net sales and operating profit respectively grew 26.0% and 20.2% year-on-year.

On October 30, 2013 we revised earnings forecasts upward. Net sales and operating profit exceeded revised forecasts while operating and ordinary profits came in at approximately the revised levels.

=============================================

■Web Infrastructure & Ecommerce Segment

=============================================

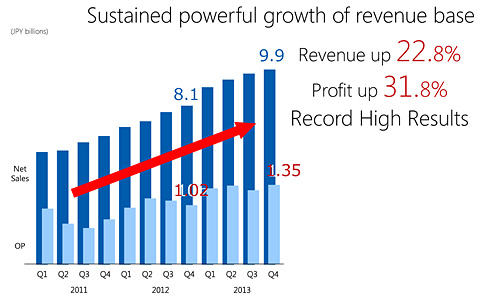

The Web Infrasrtucture & Ecommerce segments remains strong, and is a key driver of group performance. The fourth quarter was a record high quarter for the Group,

and a clear and sustained growth trend is evident in this segment.

Current Growth Drivers

In addition to the traditional growth drivers in this segment – hosting and payment processing, we are now seeing accelerated growth in ecommerce and security.

At the same time, an expanding ecommerce market and increasing smartphone penetration are driving segment-wide growth.

Web Infrastructure Strengths

We have spent many years building a business structure that ecourages a natural cross-sell between products. Further, these products are developed in-house and operated with the expertise and knowledge we have also built up over many years. We are the only group in the world to aggregate a SSL certificate authority and a domain registry business. These are marets with high entry barriers and a strong competitive edge for us.

2014 Infrastructure Initiatives

New city domain .nagoya will launch in February followed by .tokyo in April. We are planning high profile promitions of these two products. We already have the number one market share in Japan throughout all of our infrastructure products, but this year we are focused on further stengthening this position.

=============================================

■Internet Media Segment

=============================================

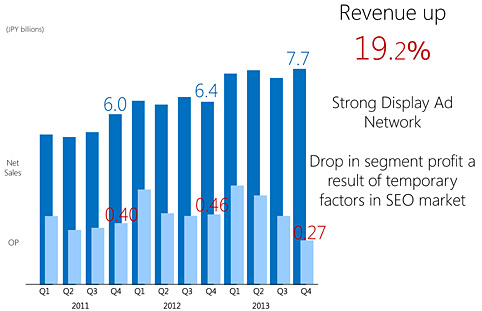

In the Internet media segment, net sales grew year-on-year, operating profit was down from both the previous quarter and the previous year. This was due to a change in Google search algorithims that temporarily impacted our SEO business. In 2011 we introduced a revised product for customers who were affected by this change, and we are now seeing a recovery in this segment.

ad network products as a percentage of over ad sales. We are actively working to improve sales mix in this segment.

=============================================

■Internet Securities Segment

=============================================

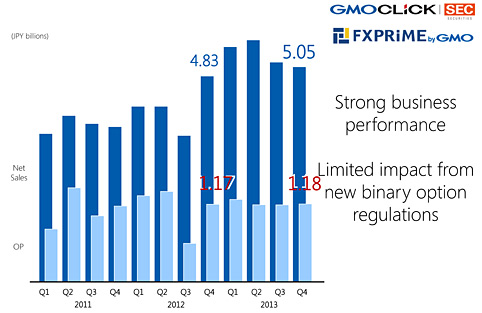

In Internet Securities, operating profit increased over the previous quarter while net sales fell slightly.

In mid-November, a revised binary options product was introduced in compliance with new regulations, and impact from this change was more limited than expected. I both FX and securities we continue to pursue a cost leadership strategy, and both sub-segments remain strong.

=============================================

■Smartphone Games

=============================================

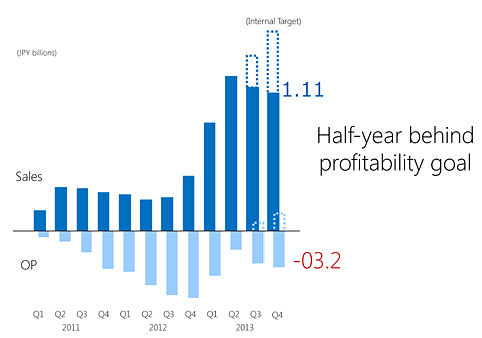

In the smartphone game segment we are now approximately 6 months behind our initial profit target.

I will talk a little bit about how we plan to catch up on that.

Over the past year we have seen rapid changes in the smartphone game market. However over the past three yars we have gained significant assets in operational, development and KPI tuning expertise, and we are confident this segmentis now on the brink of profitability.

For 2014, we have a totalof 14 titles in the pipeline, many of which are fully native apps. Last year, the Group acquired GMO GamePot, and this year G-Gee will develop a smartphone version of the popular GamePot title Wizadry.

We are committed to making this segment the fourth pillar of the Group’s earnings and are working hard to achieve profitability as early as possible.

Internet for Everyone

Return to Group Business Strategy 2014

Previous overviews: Q3 2013 business results here.