The following is an overview of our first quarter. For more details please refer to the following.

Results presentation materials here

Results presentation video here

◇(IR) Masatoshi Kumagai talks about GMO Internet Group Strategy in 2014

=============================================

■Financial Overview

=============================================

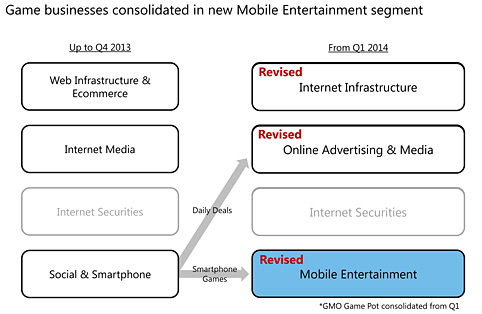

●Segment Names Revised

As of the first quarter of 2014, segment names have been revised as follows, and the daily deals business is now reported under

Online Advertising & Media.

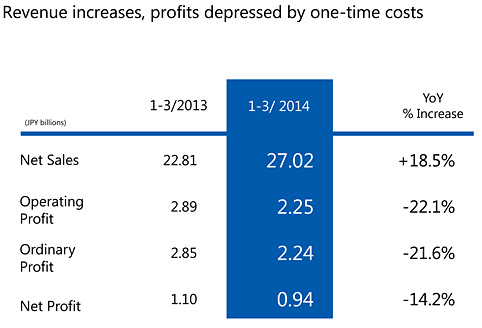

● In the first quarter, revenue grew while profit fell as a result of short term expenses. I will talk more

about factors contributing to this in the next section.

● We are still seeing strong momentum accross all segments and there is no revision to the year-end forecasts.

=============================================

■Factors Contributing to Profit Decrease

=============================================

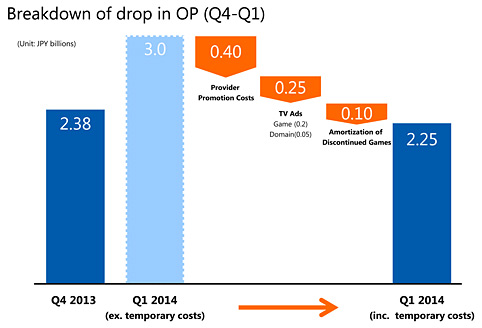

●There are three factors that caused profit to decrease in the current quarter.

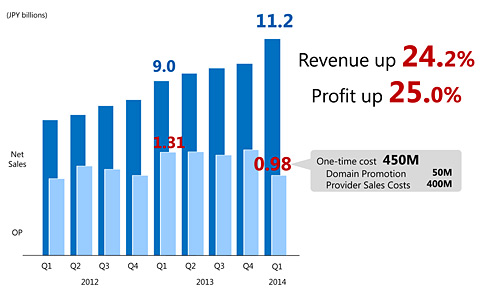

1) Sales promotion expenses in the Provider business: JPY400 million

2) Advertising expenses in the Game and Domain businesses: JPY250 million

3) One-time amortization of discontinued titles in the game business: JPY100 million

This is a total of JPY750 million in expenses.

Excluding these one-time expenses, you would see Q1 profit of JPY3 billion, and profit growth that remains above 20%.

=============================================

■Internet Infrastructure

=============================================

●Segment sales exceed JPY10 billion for the first time. No significant changes, strong performance accross all sub-segments.

●Excluding sales promotion costs in the Provider sub-segment, operating profit was at a record high level. In the current fiscal year we are investing aggressively in maintaining our industry-leading position in Internet Infrasrtucture.

●Internet Infrastructure (ex. Provider) contracts numbered 5.19 million. Including 250,000 contracts in the Provider business, contracts totalled 5.5 million. With daily growth of over 1,500 contracts, monthly growth of 50,000 contracts, and yearly growth og 600,000 contracts, this is a broad revenue base that will provide stable income over the long-term.

=============================================

■Online Advertising & Media

=============================================

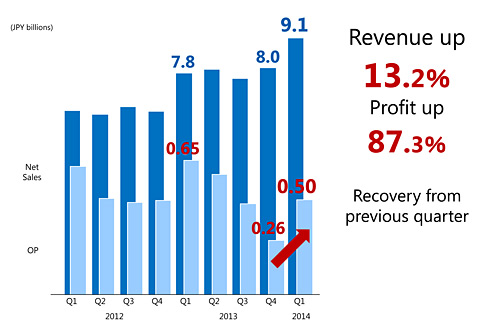

●In the first quarter, the segment reported revenue up 13.2% to JPY9.1 billion. Online advertising is chiefly comprised of ad network and smartphone related ad products.

●Operating profit grew 87.3% after recovering from the temporary decrease at the end of the previous year caused by a change in search algorithims in the SEO sub-segment.

● An increase in smartphone app downloads is notable, reward and affilliate advertising are driving segment growth. Going forward, we are working to expand margins by growing proprietary products.

=============================================

■Internet Securities

=============================================

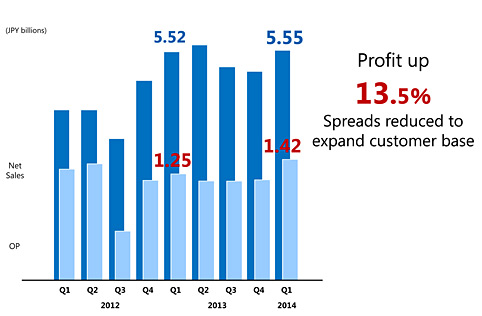

● FX and Securities both performed well in the curent quarter and both revenue and profits increased. FX trading volume was at around JPY70 trillion, and for the second consecutive year we were name the largest online FX operator by trading volume. Going forward we will continue to grow market share by maintaining a cost leadership strategy.

=============================================

■Mobile Entertainment

=============================================

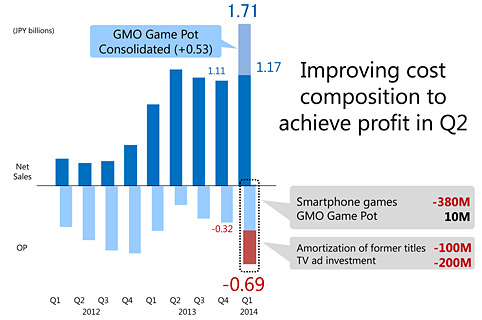

●GMO Game Pot was consolidated from the first quarter and results are reported in the Mobile Entertainment segment. Overall net sales reached JPY1.71 billion, and an operating loss of JPY 690 million was reported.

●During the first quarter we made fundamental improvements to cost composition in response to changes in the business environment. One of these measures was a one-time amortization of discontinued titles, and this was one of the factors that caused a higher than expected operating loss.

● We currently have 10 titles in the development pipeline scheduled for release this year. The entire team is working to ensure that we achieve profitability in the second quarter. Our strategy is as follows.

1)Current titles: Knowledge and expertise accumulated from titles generating revenue for over a year.

By continuing to fine tune these games we will maintain a stable revenue base.

2) Successful titles: Continue to improve games such as LINE Dream Garden that have already achieved a certain level of succes in Japan and expand to new platforms and markets including outside Japan.

3)New titles: Streamline development pipeline and focus on a smaller number of higher quality games to produce hit title.

In the short term we expect to see revenue contribution from items one and two, and increased efficiency as a result of item 3.

=============================================

■ New domain strategy

=============================================

● Internet infrastructure has been the core of our business ever since we were first established. 2014 is the year in which we reinforce our position in this industry.

● 2014 is the year we launch new domains.

● Until now there have only been 20 or so generic Top Level Domains (.com, .net etc.) that were open globally for registration. In the popular .com space there are over 100 million domain names registered and it is now almost impossible to acquire a short, memorable and relevant name in .com.

However, the Internet is now being expanded on an unprecedented scale and new domains including .tokyo and .nagoya have become available for registration.

New domains are gaining worldwide interest and we expect to see over 1,000 introduced over the coming years. GMO Registry applied to operate 7 new domains and we have already launched the first two.

・Open for registration:.tokyo .nagoya

・Upcoming launch: .yokohama

・To be determined by auction: .osaka, .shop, .mail, .inc

●.tokyo and .nagoya are already accepting registrations. We want the GMO Internet Group brand to be synonymous with domain registration and over the course of this year we plan to invest up to JPY1 billion in advertising for domains.

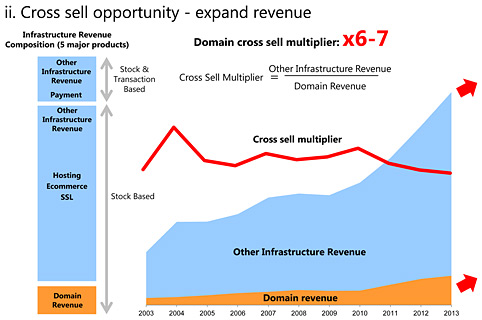

● In domain registration we already register and renew 2 million domains and 1.85 million domains respectively, and we are overwhelmingly the number one domain registrar in Japan. As well as generating domain registration fees, we see a direct link between domain registration revenue and “non-domain infrastructure revenue” (hosting, SSL, ecommerce, payment).

●This chart shows domain and non-domain revenue over the past ten years. Over this period, non-domain revenue has grown around 690%. In the most recent 5 years it has grown 650%. Non-domain revenue growth is driven by growth in the domain business and we have proved this link over the past 10 years. For further details, please see our Q1 results presentation.

Investing is .tokyo is without a doubt the right strategy. With new domains, we will contribute to new growth in the Japanese Internet market, and we are looking forward to seeing the results.

Internet for everyone.

◇(IR) Masatoshi Kumagai talks about GMO Internet Group Strategy in 2014