The following is an overview of the 2nd Quarter (April to June) FY12/2021.

=======================================

■Financial Overview

=======================================

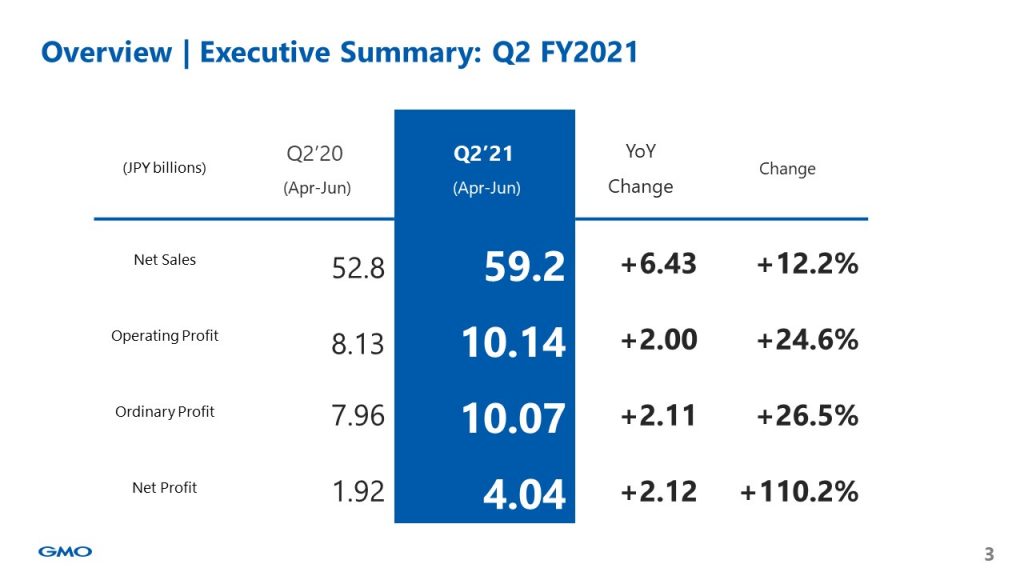

Here you can see an overview of Q2 FY2021 from April 1, 2021, to June 30, 2021.

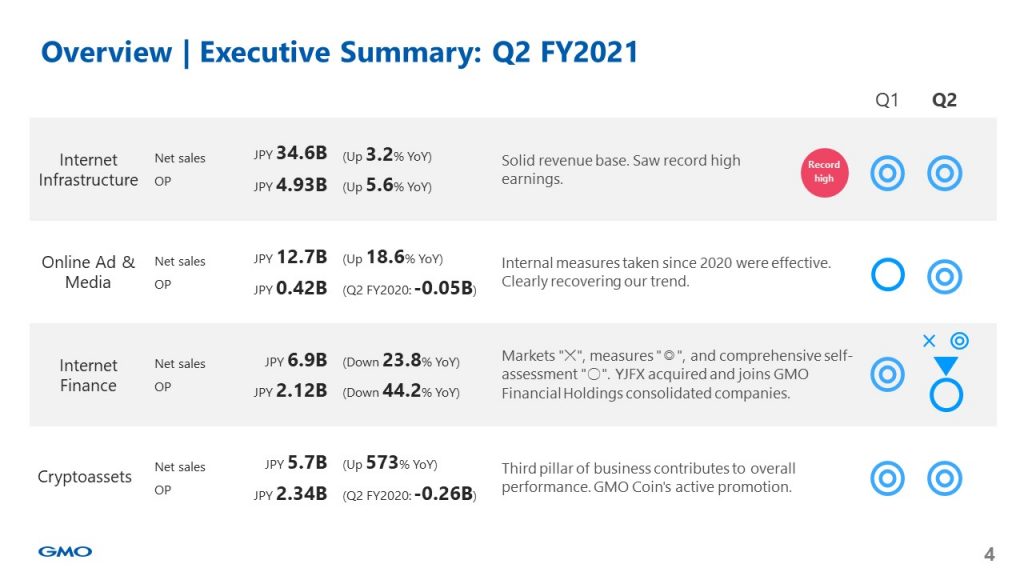

Both revenue and profit were up compared to the same period last year, which saw a volatile market. Operating profit, which achieved a record high in Q1 2021, exceeded 10 billion yen in Q2. Three factors were as follows: the Internet Infrastructure segment performed favorably; V-shaped improvement of Internet Media business; and cryptoassets business grew as the third pillar of business.

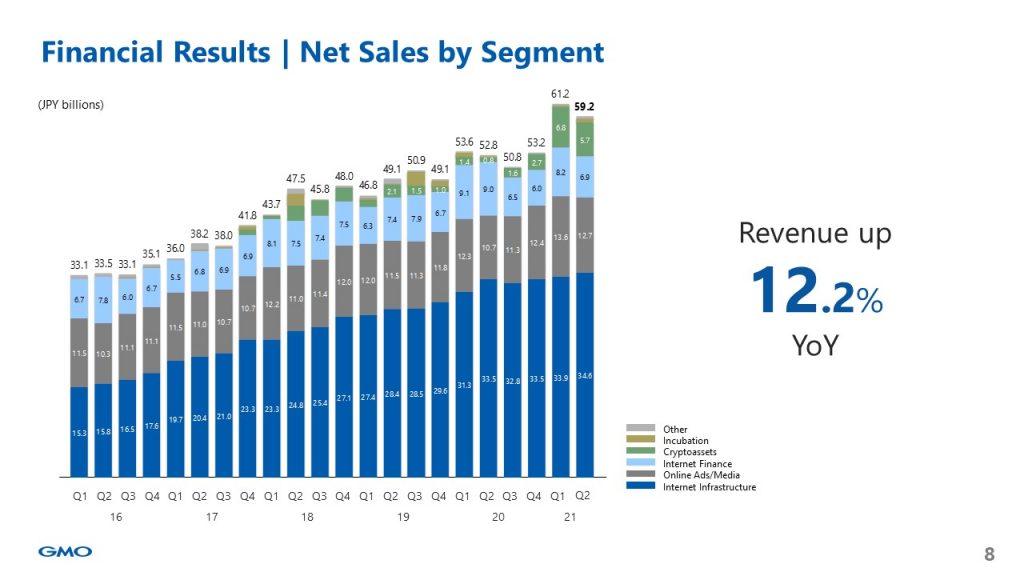

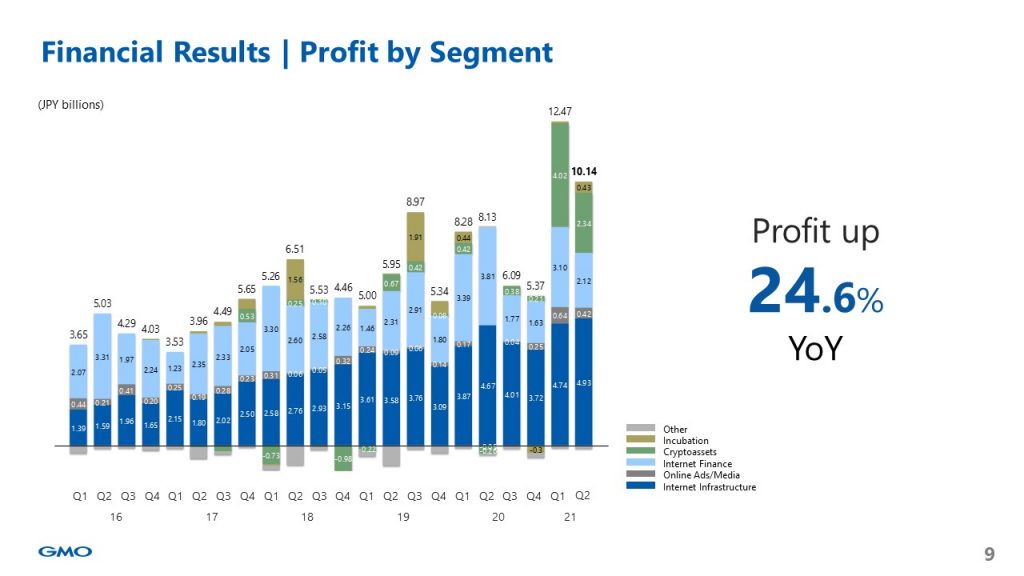

These are each segment’s quarterly net sales and operating profit trends. This graph shows the sustainable trend growth of the recurring revenue base of the Infrastructure segment and the impressive contribution made by the Cryptoassets segment.

OP of more than JPY 10 billion was reported for the 2nd consecutive quarter due to contribution made by the Cryptoassets segment, which grew and became the third pillar of business.

====================================

■Internet Infrastructure

====================================

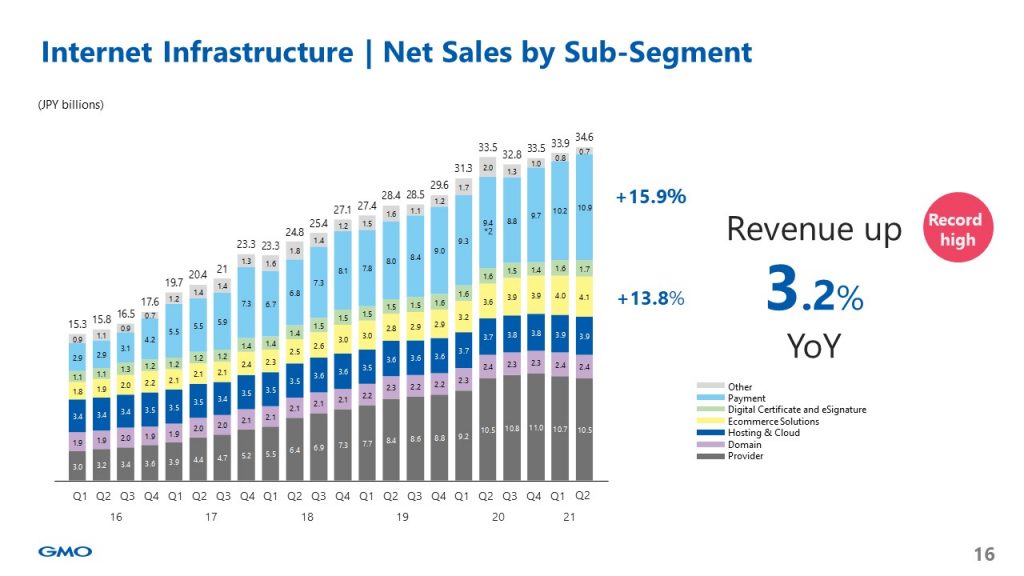

This is net sales in the Internet Infrastructure segment and its breakdown. The Internet Infrastructure segment has been growing on an ongoing basis since Q2 FY2020 as online consumption becomes a habit and as the segment utilizes the strengths of the No. 1 services. Sales of the terminal of stera, the next-generation payment platform offered by GMO Financial Gate, Inc., have increased.

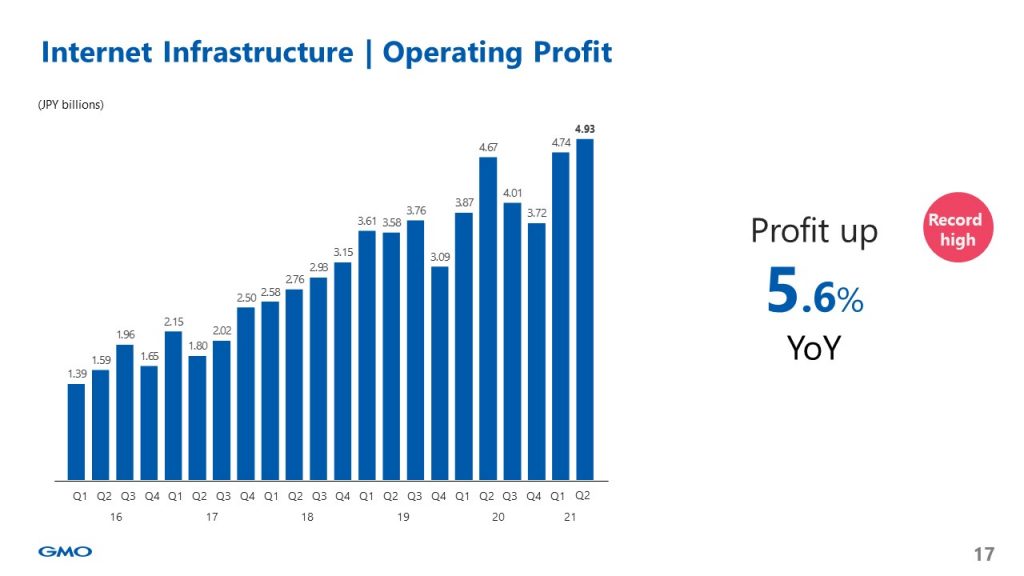

Operating profit has been growing on an ongoing basis as well and achieved a record high despite investing in GMO Sign, etc.

====================================

■Online Advertising & Media

====================================

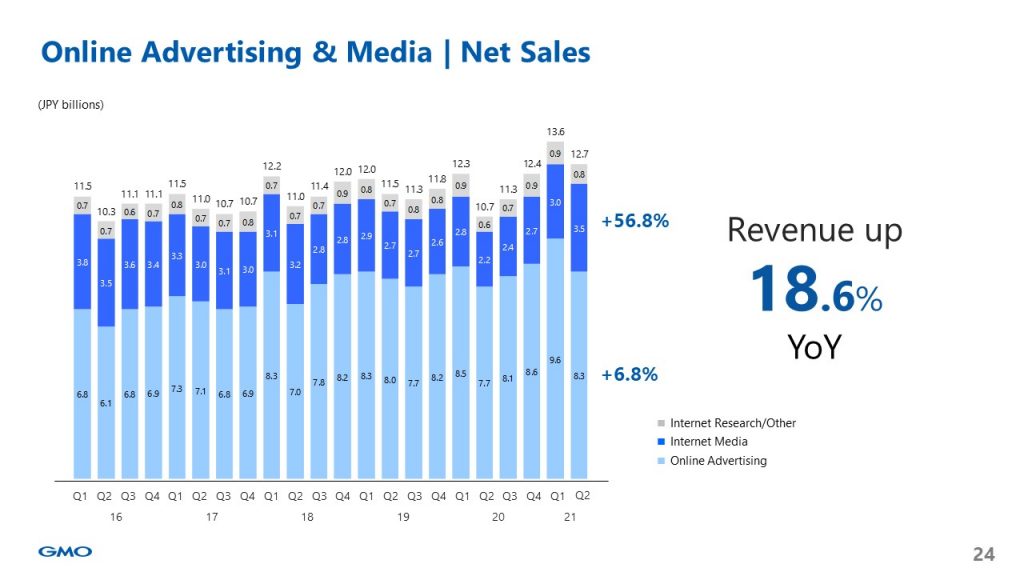

This is net sales in Online Advertising and Media and its breakdown. The net sales of internet advertising and media are up 18.6 percent year on year. Online Advertising and Media can meet strong client demand for advertisements.

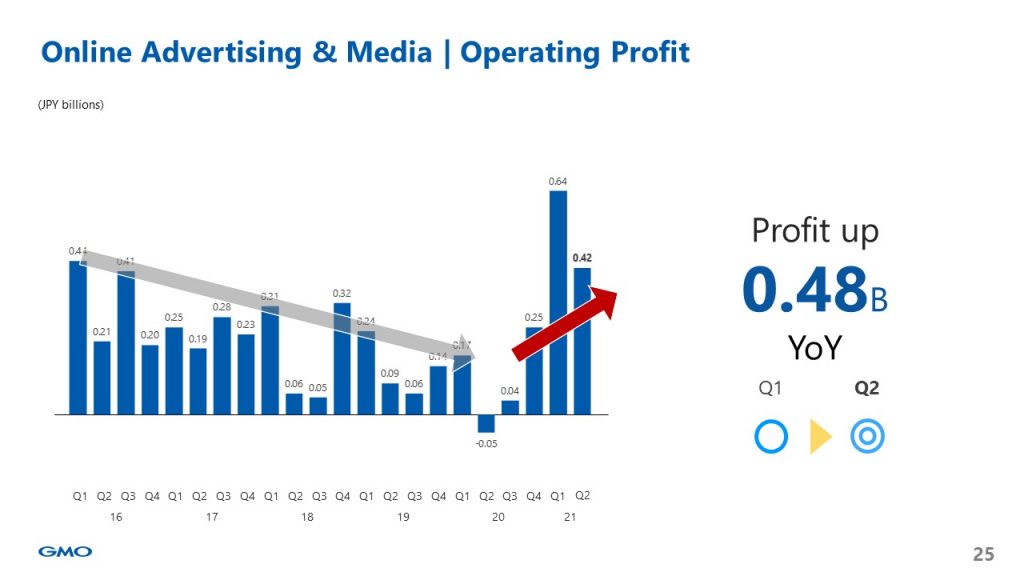

Shown here are Online Advertising and Media segment’s profit trends by quarter over the past 6 years. Profit has bottomed out in the same period last year and is now recovering in a V-shaped pattern. We had for some time been working on strengthening and developing our in-house media and in-house products to improve profitability. These investments have preceded profits, and the decline in ad placements, affected by the COVID-19, has resulted in the first quarterly loss in the same period last year. Accordingly, we have been expanding our Online Advertising and Media business by replacing products, through the overhaul of the business processes, and by reducing costs. We have been focusing on the customers unlikely to be affected by the COVID-19 since 2020 and, as of today, the external environment has recovered, such as increased demand for advertisements. Therefore, we have made an upward revision to the self-assessment concerning the Online Advertising and Media segment from ○ to ◎. We will enhance the investment, mainly in media, in the second half of the fiscal year 2021, as planned at the beginning of the period.

=================================

■Internet Finance

=================================

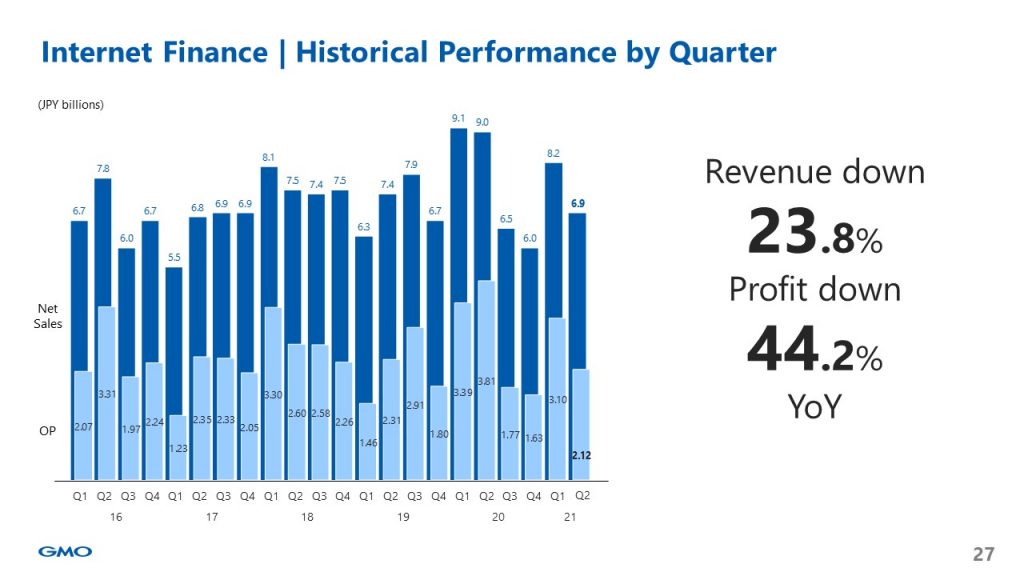

Revenue and profit dropped YoY because of the weak market environment as opposed to the volatile market last year (due to COVID-19) and due to a decline in volatility in Q2. We are putting effort into the entire Internet Finance business, which is progressing smoothly.

The lack of market volatility led to a decrease in FX trading volume. On the other hand, the market share of FX continues to be No. 1.

===================================

■Cryptoassets segment

===================================

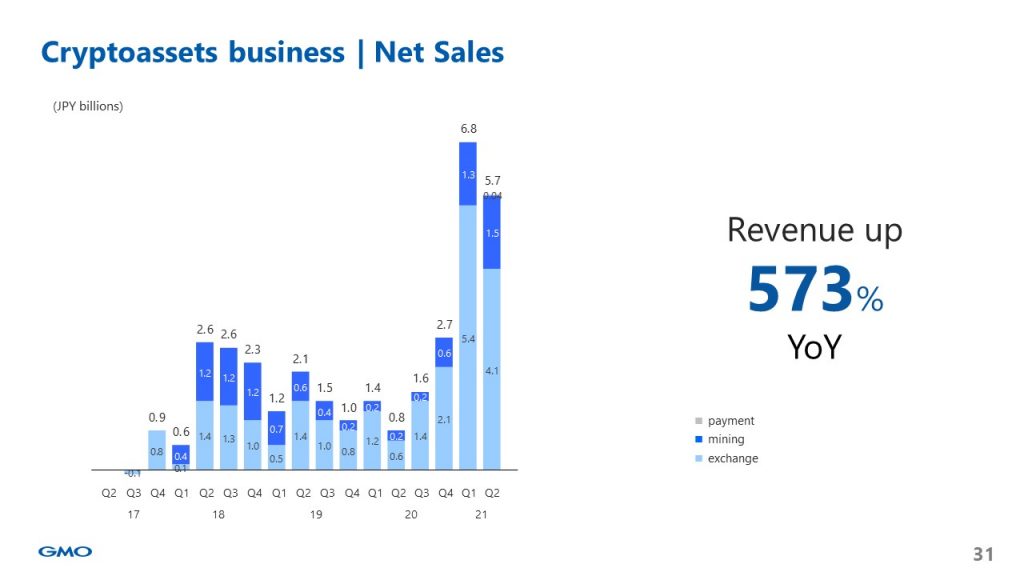

This is net sales in the Cryptoassets segment and its breakdown. Despite the decline in volatility compared to the volatile cryptoassets market in Q1, both the cryptoassets exchange business and the cryptoassets mining business hover at a high level, which has led to 573% growth in net sales year-on-year.

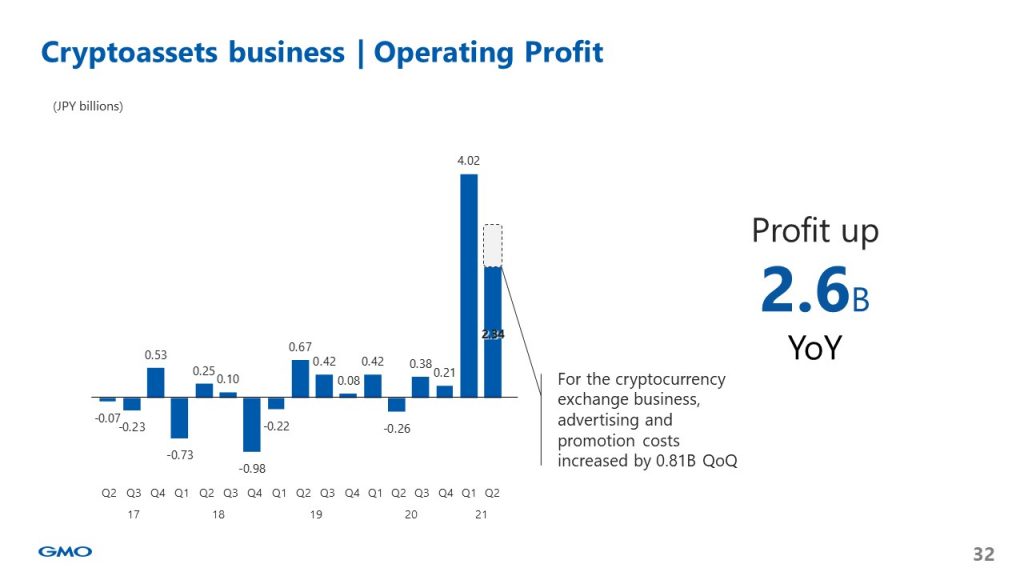

Shown here are the Cryptoassets segment’s profit trends by quarter over the past 5 years. In consideration of GMO Coin’s aggressive marketing activities, advertising and promotion cost increased compared to the previous quarter. Despite this, the Cryptoassets segment generated benefits. GMO Coin will invest in marketing on an ongoing basis with an aim to raise their social recognition even further, though they will invest less in Q3 than Q2.

■TOPICS

① Workplace vaccination against novel coronavirus at GMO Internet Group

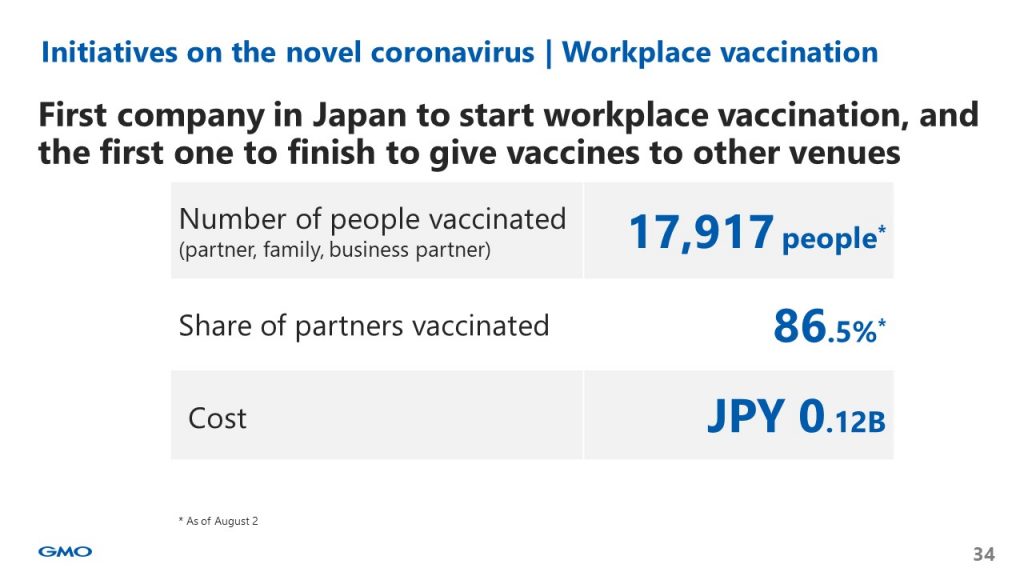

First, we would like to report on the workplace vaccination against novel coronavirus at GMO Internet Group. Our group has long been committed to protecting the lives and safety of our partners. We were the first company in Japan to start working from home starting from January 27, 2020. After the government announced a policy on workplace vaccination on June 1, 2021, we announced on June 2 the policy of workplace vaccination at GMO Internet Group and started vaccination on June 21. We stopped accepting applications on July 16 in order to give the vaccine to other people in Japan who applied for workplace vaccination and were waiting. We were able to inoculate approximately 18,000 people, including group partners, their families, and business partners. The vaccination rate of group partners was 86%, and the total cost was about 120 million yen.

This workplace vaccination demonstrated the strengths of the GMO Internet Group in terms of organizational strength, technical strength, and hospitality, conveying our gratitude to all those involved. We developed our own vaccination reservation system and reception system using QR code with our technical capabilities, and as a result, the waiting time for vaccination was almost zero. In addition, we prepared our novelty goods with Kumagai’s letter as souvenirs for business partners and partners’ families who came to the company. Above all, we hope that people will be able to return to normal life as soon as possible.

② GMO Aozora Net Bank

Next is GMO Aozora Net Bank. We announced our future outlook at the business strategy briefing held on July 6. Now that we are in the fourth year of business, we will further strengthen our services for corporations as No. 1 Technology Bank.

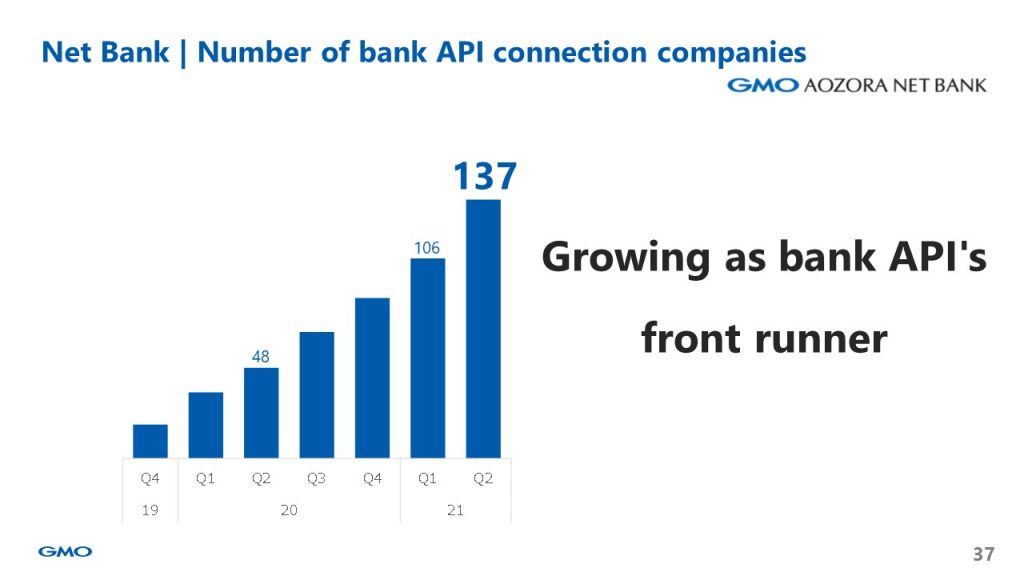

This slide shows the number of bank API connection companies. The bank API is a mechanism/specification for an external party to access banking functions such as balance inquiry and transfer. We provide this bank API free of charge but we regard it as an important KPI that will lead to future transfers. An operating company can incorporate the banking function into its services, contributing to the acceleration of DX. We will continue to grow as bank API’s front runner.

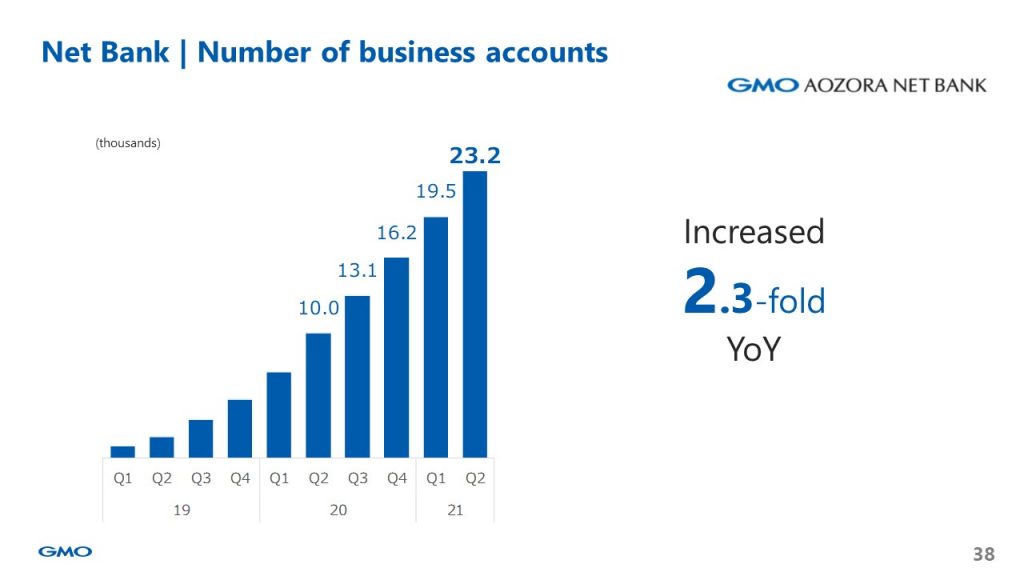

As a result of this initiative, the number of business accounts has increased 2.3-fold year-on-year, and the number of businesses, especially the small companies and startups, is increasing. This is because of a low commission rate due to cost advantage and a lot of assistance for companies that have just been founded. We will continue to grow to become the No. 1 bank for small companies and startups.

③ OMAKASE, a new business joined GMO group

Next is OMAKASE Co., Ltd. that has joined the Group as announced in May. OMAKASE provides the No. 1 reservation management service supported by the owners of restaurants that are difficult to make reservations at, and its ultimate aim is “Allowing chefs to concentrate more and more on cooking.” As a result, it has become the No. 1 media that captivates the gourmets. We will further strengthen OMAKASE through synergies with our Internet Infrastructure business going forward, especially Payment and Ecommerce Solutions.

④Adam by GMO

Last is the NFT marketplace Adam byGMO. Development is in the final stages to make Adam byGMO the No. 1 NFT marketplace that is easy to use. The service will begin at the end of August.

▽back to presentation materials (here)

▽back to historical summery (here)