(IR) Masatoshi Kumagai talks about GMO Internet Group Strategy in 2018 Overview of the group’s current position and outline of strategy going forward.

Results presentation materials(here)

Q2 2018 business results (latest quarter)

Older business results (here)

=============================================

Contents

=============================================

About GMO Internet

– Internet Infrastructure

– Online Advertising & Media

– Internet Finance

– Cryptocurrency (*1)

– Major focus in 2018

(1) Cryptocurrency

(2) Finance and payment segments

(3) GMO Aozora Net Bank launch

(4) Global Strategy

– Business Performance, Outlook & Return to Shareholders

– In Closing

– Disclaimer

(*1)We established the new Cryptocurrency segment in FY2018.

=============================================

About the GMO Internet Group

=============================================

– The GMO Internet Groupis a business group that is listed on the first section of the Tokyo Stock Exchange, leading 113 consolidated subsidiaries, nine of which are listed companies (including GMO Internet). At the end of March, the number of partners totaled 5,690 people.(as of September 2018)

– Internet for Everyone has been our corporate slogan for 22 years, ever since we launched Internet business operations in 1995.

– If you were to summarize in one sentence our business activities over the past 22 years you could say that we are the company who has most increased the number of websites in Japan, or the volume of information available over the Internet in Japan.

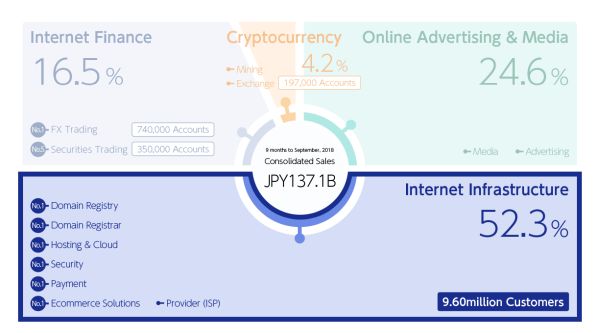

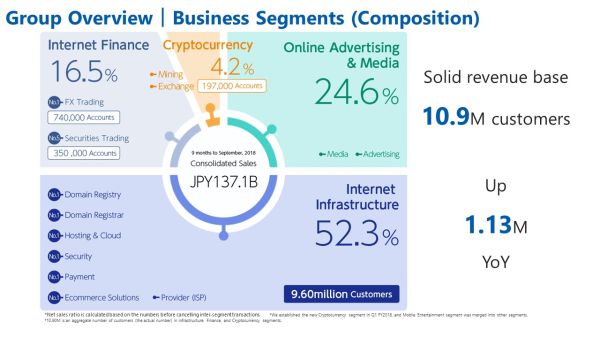

– The following diagram illustrates our four business segments. (as of September 2018)

(as of September 2018)

– Internet Infrastructure functions as a one-stop provider of everything required to communicate over the Internet for both businesses and individuals.

– Online Advertising & Media segment provides online marketing related services.

– GMO Internet Group offers financial services, such as online securities and FX trading services.

-Cryptocurrency segment consists of cryptocurrency exchange and cryptocurrency mining businesses. We are offering the areas where customers can mine and trade cryptocurrency as a new form of money.

– We have four major strengths.

(1)The technology that allow us to build almost all of our services from scratch.

(2)The sales and marketing power right throughout the group to sell the products and services we develop.

(3)A level of customer support recognized as an industry benchmark.

(4)The research strength that allows us to identify trends early phase.

– An analyst once said we were an organization made of steel. I would say that our greatest asset is the formidable organization that supports all of the above.

=============================================

Internet Infrastructure

=============================================

All four major products number one in Japan!

Overwhelmingly, the market leader.

– The entity that has most increased the volume of websites on the Internet is Internet Infrastructure segment shown at the bottom of the figure below.

– In this segment, six different businesses have captured leading shares of their respective markets in Japan.

(as of September 2018)

—————————————

(1)Domain registry business

—————————————

Unique strategic product “.shop”

– There are two types of domain business. One is domain registry business that wholesales domains. The other is domain registrar business that retails domains.

・[No. 1 potential value] Domain is an online address. The number of domains managed worldwide exceeds 300 million. The development of the Internet led to 6 million new registrations every month all over the world. For this reason, it became difficult to acquire domains with short and easy-to-remember character strings, so the new character strings, which are the substitutes of existing .com and .net, were made more flexible. This led to approximately 2,000 new domain applications. .shop has the highest potential value among them.

・[Acquisition of the rights to operate .shop domain] GMO Registry, Inc. acquired a right to provide .shop domain at USD 41.50 million, the highest price globally, on January 28, 2016, 9 years after a preparation began in 2009. (c.f. Consolidated Subsidiary Acquires Rights to Operate New Domain, .shop)

・[Strength] As summarized earlier, the strength of our unique product “.shop” is that it has a high potential for increasing profitability of the Internet Infrastructure segment.

・For “.shop,” since it was launched in September 2016, the number of customers exceeded 716,000. progressing smoothly. .shop is registered in 185 countries.

・[Overseas ratio of 85%] For .shop domain’s registration, the overseas ratio is 85%, which is the highest among all of our products. We strongly believe that .shop will drive the overseas sales ratio in the future.

・[Strategy] We will strengthen partnership with overseas domain registrar and help provide a lot of good-quality information.

—————————————

(2) Domain Registration

—————————————

– .com and .co.jp are examples of domains. Your domain name is your “address” on the Internet. We are the leading domain registrar in Japan.

– There are two types of domain business. One is domain registry business that wholesales domains. The other is domain registrar business that retails domains.

– Our cumulative market share in Japan is around87.4% (*2)

– We are overwhelmingly No.1 in Japan, and in the top 10 .com/.net registrars worldwide.

– Some of our Services and Service Providers:

GMO Registry, Inc. https://www.gmoregistry.com/

GMO Brights Consulting, Inc. https://brightsconsulting.com/

Onamae.com https://www.onamae.com/

MuuMuu Domain https://muumuu-domain.com/

VALUE-DOMAIN https://www.value-domain.com/

Z.com Domain https://domain.z.com/jp/

—————————————

(3) Hosting & Cloud

—————————————

– Our web hosting business remains focused on responding to growing sophistication and diversification of client needs, through shared, dedicated and increasingly cloud-based hosting solutions. We are the leading hosting provider in Japan.

– Our cumulative market share in Japan is around 56.3% (*2)

In this field, we are also overwhelmingly number No.1.

Some of our Services:

GMO AppsCloud https://cloud.gmo.jp/

Onamae.com Shared Server SD http://www.onamae.com/service/shared/sd/

Onamae.com VPS https://www.onamae.com/server/vps/

Z.com Web Hosting https://hosting.z.com/jp/

Z.com for WordPress https://wp.z.com/jp/

Z.com Cloud https://cloud.z.com/

ConoHa byGMO https://www.conoha.jp/

ConoHa WING https://www.conoha.jp/wing/

GMO Cloud (Rental Server) https://shared.gmocloud.com/

GMO Cloud VPS https://vps.gmocloud.com/

GMO Cloud Altus https://www.gmocloud.com/

GMO Cloud Private https://private-c.gmocloud.com/

Lolipop! Rental Server https://www.lolipop.jp/

heteml https://heteml.jp/

CORESERVER.JP https://www.coreserver.jp/

VALUE SERVER https://www.value-server.com

—————————————

(4) Ecommerce Solutions

—————————————

– We provide simple ecommerce site building tools. Unlike online shopping malls Yahoo! and Rakuten, we provide operational solutions for online stores.

– Our solutions are convenient and cost-effective, and with 75,000 paid stores, we have the most widely used ecommerce service offering in Japan.

Some of our services are:

Color Me: https://shop-pro.jp/

MakeShop: https://www.makeshop.jp/

A New type of ecommerce

-Let me explain about the C2C market.

-We provide ecommerce platforms.

Even if customers don’t have much knowledge about the web, they can easily begin using our services, because our system responds to customer’s various eccomerce needs

-Some of our services are:

minne https://minne.com/

SUZURI https://suzuri.jp/

—————————————

(5) Internet Security

—————————————

– The Secure Sockets Layer (SSL) is the most widely deployed security protocol today. It is essentially a protocol that provides a secure channel between two machines operating over the Internet or an internal network. In today’s Internet-focused world, we typically see SSL in use when a web browser needs to securely connect to a web server over the insecure Internet and therefore SSL is essential in ecommerce businesses.

– This is the domain of GMO Cloud K.K.(English) (Tokyo Stock Exchange, First Section: 3788) subsidiary, GlobalSign (English)

–In addition to operating our own Certificate Authority, we have a highly sophisticated technology that enables certificate management in a secure environment. This is one of the reasons we are able to grow so quickly. Google announced in Google Webmaster Central Blog that it moved to use HTTPS as a ranking signal in search ranking algorithms and would preferentially index HTTPS sites (https://webmasters.googleblog.com/2014/08/https-as-ranking-signal.html) for more secure website browsing (https://webmasters.googleblog.com/2015/12/indexing-https-pages-by-default.html), and has been promoting SSL since 2014. For Chrome 68 – to be released in July 2018 – or later, the warning “Not secure” will be shown on insecure websites (websites without SSL). Hence, we can expect demand for SSL – as a secure method to provide information – will further increase.

Google moved to use HTTPS as a ranking signal in search ranking algorithms and to crawl HTTPS sites. Hence, we can expect SSL demand will further increase. This is a current trend worldwide.

– GlobalSign offers the only site seal for government elections in Japan. The GlobalSign site seal can be seen on the website of Japanese Prime Minister Shinzo Abe, and other members of parliament.

–GMO GlobalSign is putting effort into offering “Managed PKI for IoT,” a new service that enables the industry’s fastest, automatic digital certificates installation in IC chips embedded in IoT devices. GMO GlobalSign and ARM, the world’s leading semiconductor IP company, have partnered to meet next-generation security needs in IoT market with GlobalSign’s service integrating with the “Arm Mbed Cloud.”

—————————————

(6) Payment

—————————————

Annual transaction volume approximately 3.2 trillion yen

– We provide payment processing services for the sale of products via the Internet. When users provide their credit card numbers to our customers we check the credit limit and process the payment.

– This is a Payment Gateway Inc. (Tokyo Stock Exchange, First Section: 3769) service.

– Japan’s leading payment business with 10,200 merchants and approximately 348 million payment processing (transaction volume approx. 860 billion yen) between July and September 2018. This sub-segment has a No.1 market share.

– As one of the leading payment companies in Japan, we aim to continue driving innovation and growing ecommerce participation in Japan.

– Going forward we will continue to identify new markets for credit card payment processing services while expanding existing solutions as a leading innovator in ecommerce payment gateway services.

Some of our Services:

GMO Payment Gateway http://www.gmo-pg.com/global/

GMO Epsilon http://www.epsilon.jp/

GMO Payment Service http://www.gmo-ps.com/

GMO PAYMENT GATEWAY PTE. LTD. https://www.gmo-pg.com.sg/

SMBC GMO PAYMENT https://www.smbc-gp.co.jp/

GMO FINANCIAL GATE https://gmo-fg.com/

Global Card System https://www.globalcard.co.jp/

—————————————

(7) Provider

—————————————

Provider service is an Internet connection service developed and offered by GMO TokuToku BB. This service has been continuing for approximately 20 years since the company was established. It is an entrance to the Internet and is our origin.

The usage of SNS, video, and other rich contents has recently expanded, and people’s contact time with the Internet through smartphone, tablet, and other devices has increased. The company will continue to meet the needs of the customers, offer plans perfect for them, and help them connect to the Internet.

Some of our Services:

GMO TokuToku BB https://gmobb.jp/

————————————————————————-

(8) Features and Strengths of the Internet Infrastructure Segment

————————————————————————-

– Overall the Internet Infrastructure segment is overwhelmingly No.1 in its field. Despite being in competition with major carrier businesses, our domain registration and web hosting businesses boast leading market share, customer satisfaction, revenue, and profit.

– Each of the Internet Infrastructure businesses has large customer bases. Building an economy of scale grows our operating profit margins.

– The Internet Infrastructure segment has five exceptional features.

(1) Solid revenue stream

Once a customer signs a contract we have a continuing source of income creating a solid revenue stream.

(2) An industry that will exist indefinitely

The Internet industry will continue to exist indefinitely. Take the example of the automobile industry. People get a new car about once every four years. However, even when cars change, the need for roads, traffic lights, parking lots, toll booths and other infrastructure remains. Imagine websites as the cars, ISP services as the roads, domains as the traffic signals, rental servers as the parking lots and payment processing as the toll booths. If the Internet continues to exist so will our business.

(3) People rarely change web service providers

Migrating to new web or mail servers is time-consuming and tedious.

(4) Customers don’t stop using our services

Customer URLs and e-mail addresses are printed on the business cards they hand out every day. These are services that they don’t stop using.

(5) Natural Cross Sell

The structure of this segment promotes a natural cross-sell among products and services. A customer who purchases a domain name cannot do anything with it unless they have a server.

Those that are using web hosting services for ecommerce will need payment processing, security (SSL) and shopping cart services as well.

– The infrastructure business is (1) stable (2) Solid revenue stream (i.e. stability)and (3) a high margin business with a large market share. It is a price leader that continues to grow.

=============================================

Online Advertising & Media

=============================================

– We advanced into a second business area directly after being listed on JASDAQ on August 27, 1999.

(as of September 2018)

(1) Why We are in this Industry

—————————————

– There are two reasons why we are in the Internet media business.

(1) Synergy with Internet Infrastructure

Customers who start up ecommerce businesses need advertising in order to increase sales. By providing search ranking services, SEO, SEM, SNS and other tools we achieve better customer satisfaction, capture more customers (cross sell) and achieve a higher profit ratio.

(2) Our Long term Plan (55-Year Plan)

We have a long term plan we call the 55-year plan. We plan to create an Internet group that by 2051 consists of 207 companies that are valuable to society and its people. In the Internet industry, companies that succeed are companies that can attract customers. Having our own media that attracts customers gives us an advantage over our competitors in virtually any market we enter.

– These companies “create” media:

GMO Media Inc. (TSE:6180)

GMO Insight Inc.

GMO ADMARKETING Inc

GMO TECH, Inc. (TSE:6026)

GMO KUMAPON, Inc.

– These companies “sell” media:

GMO AD Partners Inc.(JASDAQ Growth: 4784)

GMO NIKKO,Inc.

GMO Solution Partner,Inc.

– These companies “online research”:

GMO Research, Inc. (TSE:3695)

—————————————

(2) Online Advertising & Media Segment – Strengths

—————————————

– We have the advanced technology to develop services used by millions of people, the marketing force to attract large numbers of Internet users and the stable operational capability to give tens of millions of users an enjoyable Internet experience. These are our three strengths.

=============================================

Internet Finance

=============================================

The Internet Finance segment complements our existing Web Infrastructure & Ecommerce and Internet Media businesses and helps to further generate synergy throughout the group. We aim to build a group that will succeed for hundreds of years and this is part of the reason why we brought this business into the group.

(as of September 2018)

—————————————

(1) Internet Securities Segment – Objectives

—————————————

Pioneer in next-generation online financial trading services

– With the growth of the Internet and the expansion of broadband usage during the late 1990s, as well as the 1999 relaxation of regulations on trading fees in Japan, online securities services became an essential tool for retails investors.

– Providing new technologies, added value, and innovative concepts through solutions that are universally user-friendly is core to the group’s fundamental mission.

– Our ultimate aim in this segment is to provide an easy to use online securities trading service to all of our customers.

—————————————

(2) Users & Market Share

—————————————

Market leader in FX

– Our Internet securities business has grown rapidly to become one of the major players, driving growth in the industry.

– For the past six consecutive years we achieved the highest transaction volume in the domestic FX market, and in comparison with global companies, we have the highest transaction volumes in the world. (*3)

(*3) The Company’s FX trading volume (trading value/in dollar volume) was No.1 in 2017 according to Finance Magnates’ report.

——————————————————–

(3) Internet Securities Segment Strengths

——————————————————–

Innovative technology and speed

– All of our backend systems are developed, operated and serviced in-house. Most other securities companies outsource technology functions. A large percentage of GMO CLICK Securities partners are engineers, and the company boasts industry-leading technology.

– This enables us to provide an agile service with a highly cost-effective operation and management. In other words, technology gives us our competitive edge.

–GMO CLICK Holdings, Inc. (currently, GMO Financial Holdings, Inc.; JASDAQ 7177) was listed on the JASDAQ (Tokyo Stock Exchange) on April 1, 2015. It launched its cryptocurrency exchange business GMO Coin in May 2017. For a new Internet bank “GMO Aozora Net Bank,” the company plans to launch its service in July 2018 and provide technical support in the area of FinTech. It is a holding company that heads the Group’s Internet Finance segment.

As a finance group with an edge in technology, we aim to accelerate growth further by expanding into global markets.

Some of our Services:

GMO Financial Holdings(JASDAQ 7177)

GMO CLICK Securities

FX PRIME by GMO

=============================================

Cryptocurrency

=============================================

Aiming to become the No.1 company worldwide in the field of cryptocurrency

・GMO Internet Group has been comprehensively developing Internet businesses, focusing on the Internet infrastructure business. The Internet has eliminated the boundary related to information and changed the way the world is.

・Although a certain amount of information has been controlled before the Internet has grown, information is now instantaneously transmitted worldwide once it is provided. Information is now transmitted properly and compared easily, and a product is selected based more on price or performance than on sales, which has encouraged us to engage in fair business practices.

・Similarly, cryptocurrency eliminates the boundary related to money, and the result is that it is likely to change the way currency, financial services, and the world are.

=============================================

The strengths of cryptocurrency business

=============================================

Volume production commenced rapidly and smoothly – so-called “vertical start-up”

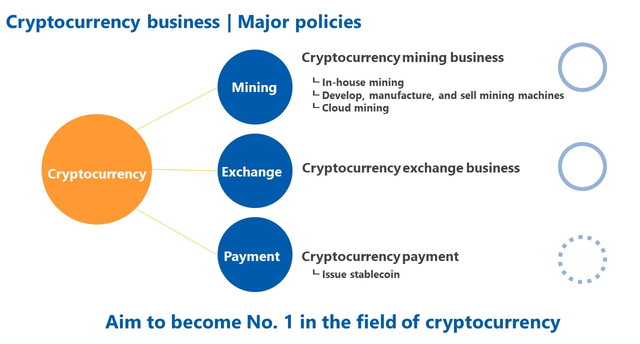

・Cryptocurrency related startups can be divided into 3 categories: mining, exchange, and payment. GMO Internet Group focuses on the cryptocurrency mining operation, which mines cryptocurrencies on our own, and crypto exchange operation, which provides an environment to trade mined cryptocurrencies.

・We launched our cryptocurrency exchange business in May 2017, begun to consider entering the cryptocurrency mining business in July 2017, and launched our mining business at the end of December 2017. Just several months after launch both businesses achieved positive figures, succeeding in commencing volume production rapidly and smoothly – so-called “vertical start-up.” By fully leveraging our experience and expertise cultivated through Internet Infrastructure and Internet Finance businesses and our web hosting, utilizing our engineers who support a cutting-edge technology, and unleashing synergies between existing businesses such as, volume production can commence rapidly and smoothly – so-called “vertical start-up.”

・There are various crypto payment methods within Japan, so we will need to consider more carefully the investment towards spreading crypto payment.

=============================================

(1)Cryptocurrency mining business

=============================================

・Community on the network operates the cryptocurrency mining business, utilizing the computational power enabling intensive arithmetic processing to build a system through which data fraud is prevented, and using the state-of-the-art technologies. As a business operating the large-scale server, our cryptocurrency mining business will use the expertise cultivated through Internet infrastructure and network infrastructure businesses and the state-of-the-art technologies.

・Pre-war “zaibatsu” established the current parent organizations through diversified operations, which were based on funding that was raised through mining gold and silver. The winner during the gold rush was Levi’s, which offered working clothes to workers, rather than those who were mining gold. We’ll expand into the business of cryptocurrency mining by adopting both Levi’s and pre-war “zaibatsu” strategies to challenge ourselves in new ways.

・For the cryptocurrency mining business, GMO Internet puts effort into: its own mining operations; development, manufacturing, and the sale of mining machines; and cloud mining that offers the mining environment to the customer (similar to hosting & cloud business).

・Cryptocurrency mining business: https://mining.gmo.jp/en

・Develop, produce and sell mining machines: https://gmominer.z.com/en

・Cloud mining service: https://cloudmining.z.com/en/

=============================================

(1)-1 Cryptocurrency mining business | In-house mining

=============================================

・The revenue structure of cryptocurrency mining business is based on the newly issued amount, Bitcoin’s market value (at the time of mining), and our mining share, as shown above. Cost is mainly comprised of electricity cost and the cost of mining machines and mining equipment. As we mine at massive data centers at multiple locations in 2 countries in northern Europe and our facilities are built in cold region the power consumption is low and we are using renewable energy and have been able to secure inexpensive power supply, so it is a very profitable business.

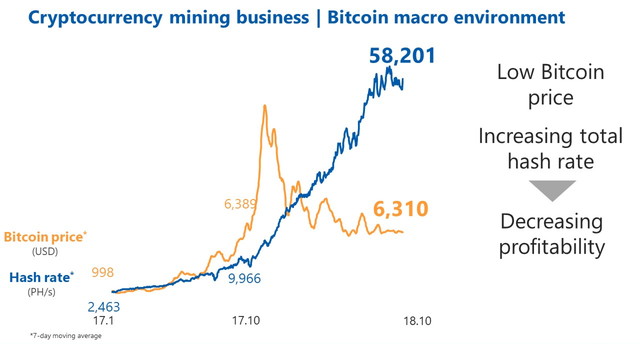

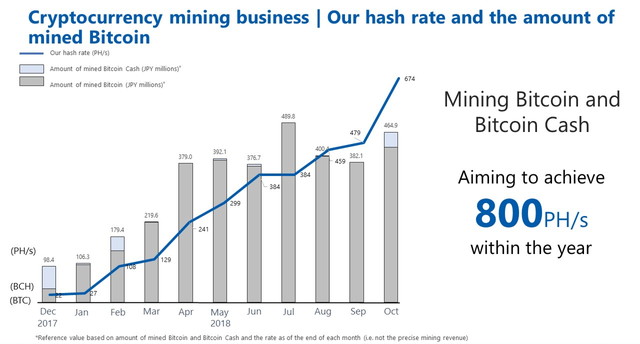

Bitcoin macro environment is shown below. The market is competitive. The blue line graph shows global hash rate, which is a computing power. Orange is the Bitcoin price. Profitability is declining due to increasing global hash rate and falling Bitcoin price.

・We set up next-generation mining centers in Northern Europe. Our hash rate continued to grow until June as disclosed, and the amount of mined Bitcoin increased as planned.

However, our hash rate increase flattened out in July as we have changed our policy in accordance with the profitability.

・We initially planned to offer our services in the following order of priority: in-house mining; cloud mining; and the sales of mining machines. Our top priority now is to sell our mining machines. If our mining machines are not sold out, we will mine on our own. If there is a demand, we will offer a cloud mining service, and we will adjust the order of priority accordingly.

・As in-house mining business is affected by the market to a certain extent, we will allocate more resources to the sales of mining machines than the in-house mining. Our aim is to focus more on ensuring profitability quickly and achieving the stabilization of revenue by selling mining machines than the mid-term investment recovery through in-house mining.

・By responding flexibly to the ever-changing market environment and through speedy decision making and execution, which are our strengths, we aim to be the number one in the field of cryptocurrency.

=============================================

(1)-2 Cryptocurrency mining business |

Develop, produce, and sell mining machines

=============================================

The biggest reason for the decision to enter the cryptocurrency mining business

・Now that the development of next-generation 7nm bitcoin mining chip – the world’s first cutting-edge technology – is within reach, we have decided to enter the cryptocurrency mining business.

・We use existing technology for mining, and also develop, design, and manufacture our own mining machines using cutting-edge technology.

・“GMO miner B2,” a mining machine equipped with the world’s first cutting-edge mining ASIC of 7nm process “GMO 72b,” was released on June 6, 2018, and sold out.

・GMO Internet Group launched “GMO miner B3” on July 2, 2018. The maximum hash power of one unit of “GMO miner B3” is 33 TH/s. “GMO miner B3” is packed with features that allow customers to set the optimal hash power and power consumption in their environment, improving the performance of each mining hardware unit compared to “GMO miner B2” that has a performance of 24 TH/s. While we were selling “GMO miner B2,” several customers have requested a function to adjust the hash power. The global hash rate is increasing every day as well. Therefore, we accelerated the planned development of “hash power optimization function.”GMO Internet Group’s 7 nm mining machine will be shipped starting at the end of October 2018.

・There are lots of new entrants worldwide in the cryptocurrency mining service, but our goal as a group is to actively continue to develop new next-generation mining chips and manufacture mining machines that are number-one globally in terms of their performance, despite the harsh competitive environment.

=============================================

(1)-3 Cryptocurrency mining business | Cloud mining

=============================================

Z.com Cloud Mining made available for immediate use

・GMO Internet will offer a cloud service with the Group’s global brand “Z.com,” renting out part of our mining facilities. We plan to deliver a significant hash rate of 25 PH/s per rental contract, and customers can mine in their environment, so our business model is simple.

・Z.com Cloud Mining

・The following is required to start mining: purchasing machines; data center contracts; machine setup; maintenance; and technicians who will monitor the data center 24 hours a day. These incur costs and require preparation, but with our cloud mining service, customers who have completed the contract will not have to worry about all of this.

=============================================

(2) Cryptocurrency exchange business

=============================================

Aiming to become No. 1 cryptocurrency trading business globally

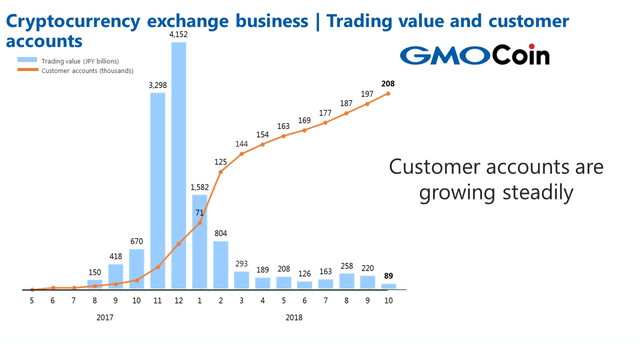

・GMO Coin, a group company of GMO Financial Holdings, launched cryptocurrency exchange business in May 2017. It provides a cryptocurrency spot trading service, enables trading with leverage, and offers a secure cryptocurrency transaction environment for major cryptocurrencies, such as Bitcoin, Bitcoin Cash, and Ethereum.

・Just a year after launch the number of accounts came to a total of 200,000, which is equivalent to approximately half of securities accounts of GMO CLICK Securities, a service that we have been providing for about 10 years, and approximately 20% of FX accounts, which is the global number one, allowing the company to target new customers.

=============================================

A major focus in 2018

=============================================

(1) Volume production commenced rapidly and smoothly – so-called “vertical start-up”

・We will aim to be number-one by unleashing our strength as a group in the cryptocurrency market as explained above. We have been working in the Internet industry for 22 years. Cryptocurrency may change the world, similar to the way the Internet enriches our lives. We will provide cheap and easy-to-use crypto related services to everyone to challenge ourselves in new ways, environment.

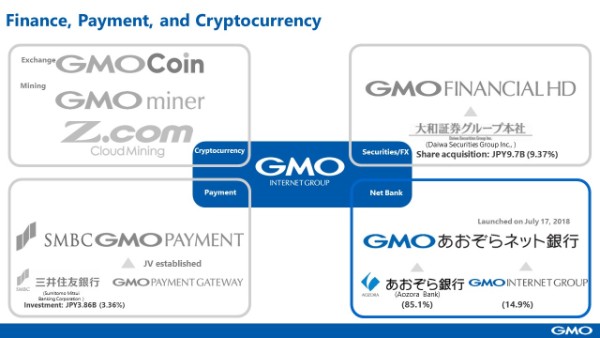

(2) Strengthening Internet Finance segment

Finance, payment, and cryptocurrency services

・GMO Internet Group has been actively forming an alliance with major financial institutions in the FinTech service under our policy of “Enhancing our strengths.”

(3) GMO Aozora Net Bank launch

GMO Aozora Net Bank launched a next-generation Internet banking service on July 17, 2018.

・We have been considering a joint Internet bank operation with Aozora Bank since June 29, 2015. Under the corporate philosophy of “Customer first at any time to become the number-one technology bank,” by utilizing the cutting-edge technology of GMO Internet Group and with the risk management expertise of Aozora Bank Group, the company aims to realize unique and smart next-generation services at a low price.

・This year, we celebrated the 23rd launch anniversary of GMO Internet Group, which was established as the Internet Infrastructure business during the early stages of the development of the Internet in Japan. It is our company’s privilege to offer financial services that are vital to our lives.

・A bank is an indispensable service to our lives. So is the Internet. GMO Internet Group will continue to meet the needs of each customer by utilizing IT without being bound by time and places and through API collaboration, partnering with various easy-to-use web services. Our services, above all, ・have strong safety and we will continue to create smiles.

—————————————

(4) Global Strategy

—————————————

Becoming a global Internet company.

・GMO Internet Group has already expanded to 64 locations in 23 countries and includes 1,298 partners.

・The overseas sales ratio is not yet high but Internet Infrastructure segment and Internet Finance segment, which are No. 1 within Japan, are expanding mainly to Asia.

・However, we will step up global expansion in both the Infrastructure and Securities segments, and unify global marketing efforts under the Z.com brand.

・GMO Internet Group is providing revolutionary global No.1 Internet Infrastructure and Internet Finance services under the world’s most memorable domain with the Z.com brand further driving global sales ratio and making direct sales.

=============================================

Business Performance, Outlook & Return to Shareholders

=============================================

————————————–

(1)Business Performance & Outlook

—————————————

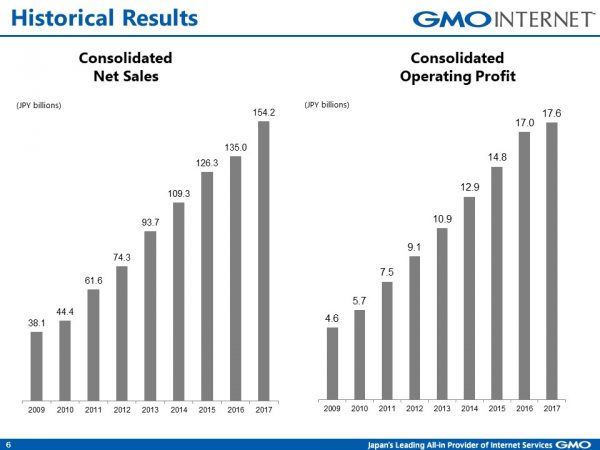

Contributing to the growth of the Internet under the corporate motto “Internet for Everyone”

・This graph shows the growth in quarterly earnings since 2009. We achieved our guidance for the 9th consecutive year, Z.com will continue to grow along with the development of Internet industry.

・We will not disclose our guidance for 2018 as we are putting effort into cryptocurrency business, but we will disclose the significant KPIs of our cryptocurrency mining and cryptocurrency exchange businesses on a monthly basis.

—————————————

(2) Return to Shareholders

—————————————

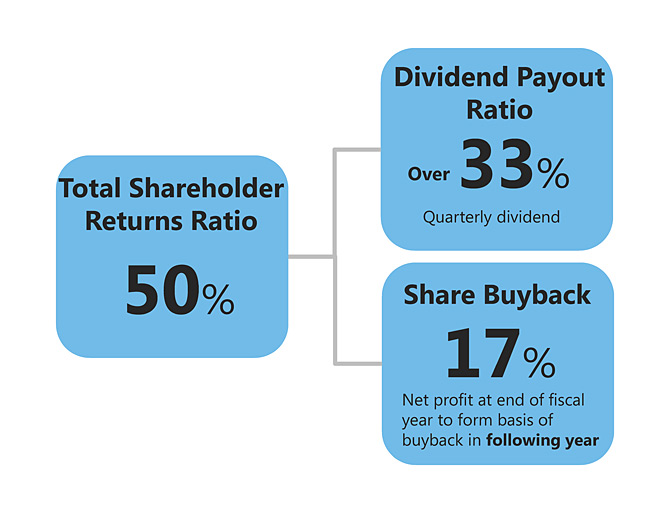

1. Total Shareholder Return Ratio

-The company will continue to invest in corporate growth as needed, but with the objective of returning greater value to shareholders, we have a dividend payout ratio objective stated in our articles of incorporation that aims to payout 33% of consolidated net profit in dividends.

-In addition to the current payout of 33% the remainder of the 50% total shareholder return ratio will be put toward share buybacks.

In June 2005, we entered the loans and credit business when we acquired a consumer loans business. Shortly after the supreme court reached a decision in regard to the overcharging of interest and the Japanese Institute of certified public accountants implemented changes to accounting standards related to provisioning allowances. This caused significant damage to our balance sheet. In order to compensate for the losses incurred by shareholders at this time, total shareholder return ratio has been raised to 50%, part of which is being put toward share buybacks.

. We believe that a share buyback of the shares issued during this time is an appropriate means to return profits to shareholders. In order to achieve this, the company will implement this new total shareholder returns policy that includes share buyback plans over the long term.

The company will take a flexible approach and any share buyback decision will take into account company performance, financial condition and current share price.

2.DividendsWe will not disclose our guidance for 2018 but will disclose the dividends at the quarterly earnings announcement.

2.DividendsWe will not disclose our guidance for 2018 but will disclose the dividends at the quarterly earnings announcement.

=============================================

In Closing

=============================================

We aim to be a comprehensive Internet services group that provides industry-leading services in four business segments Internet Infrastructure, Online Advertising & Media, Internet Finance and Cryptocurrency. – We will continue to build an Internet group that contributes to the growth of the Internet based on the concept “Internet for Everyone”

=============================================

Disclaimer

=============================================

This presentation document includes predictions based on expectations, premises, and plans for the future that are accurate as of November 12, 2018. These predictions may differ from actual results due to factors including changes in the global economy, competition and exchange rates or unforeseen events such as natural disasters. Some of the figures given such as market share are based on our own calculations. These figures may differ from research agency figures.

Information published on this site is provided for information purposes only and does not constitute a solicitation of investors. Further, the results forecasts and other forward-looking statements contain factors that are uncertain. Please understand that actual results may differ significantly as a result of forces including economic conditions and market environment. No responsibility is accepted for any damage sustained as a result of actions taken based on this information regardless of the reason.

*1 According to on our own research

*2 ForexMagnate

Q2 2018 business results (latest quarter)

Older business results (here)